On November 1, BNB Chain introduced the completion of its twenty ninth quarterly burn, successfully reducing the cryptocurrency’s complete provide. Following this occasion, Binance Coin (BNB) bulls are desperate to capitalize on the diminished provide to drive the token’s worth upward.

However will they succeed? This evaluation seems on the risk by using some on-chain and technical indicators.

Token Burn Drives Change in Binance Coin Sentiment

In a current weblog put up, BNB Chain, Binance’s blockchain for decentralized purposes, introduced the burn of 1.77 million BNB. This complete contains two elements: 1.71 million BNB for the Auto-Burn, and 62,569 BNB as an extra burn for BTokens. BNB Chain started its token burn after transferring from Ethereum to its native blockchain, aiming to cut back the availability to 100 million.

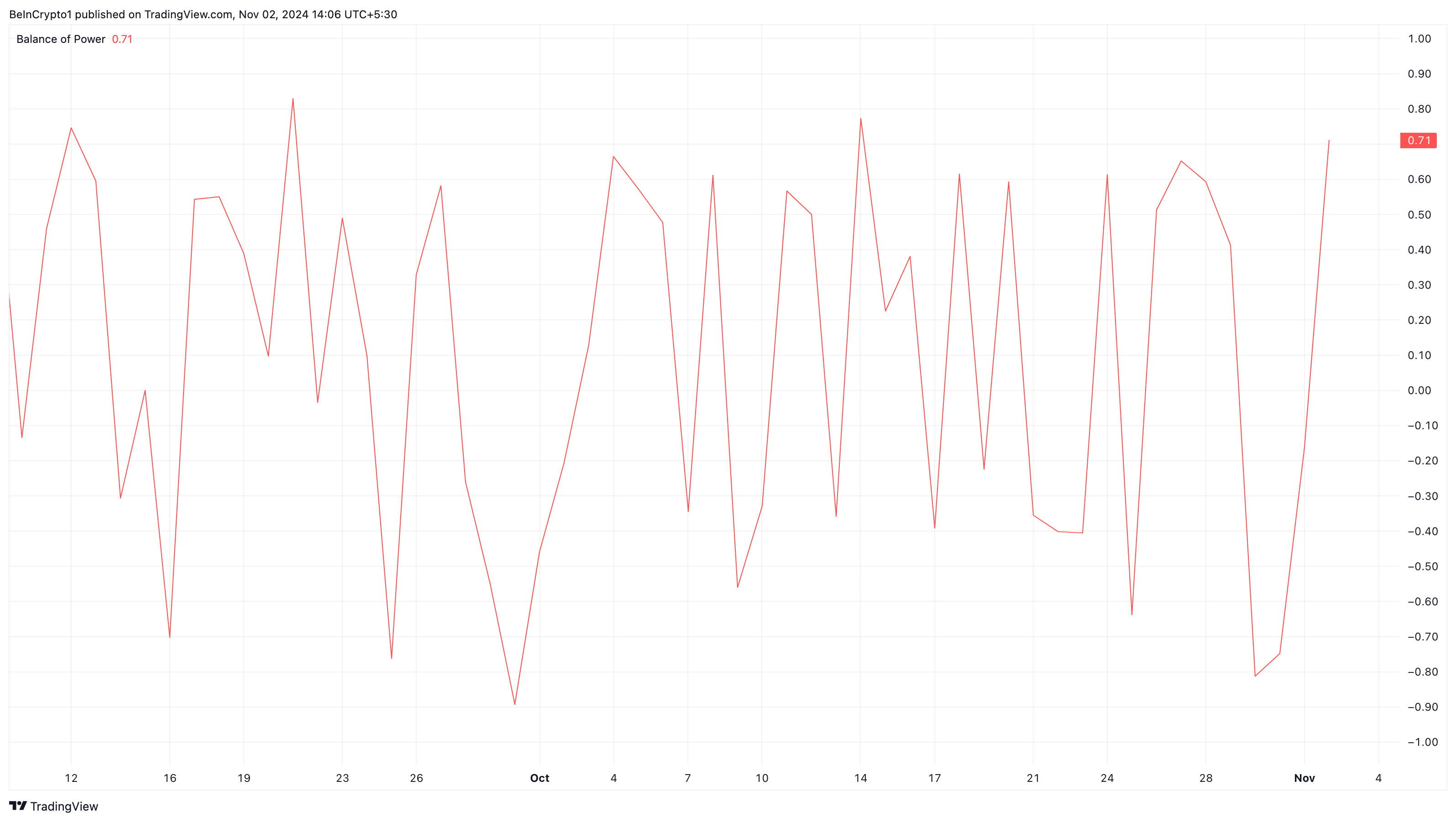

This twenty ninth quarterly burn, valued at over $1 billion, contributes to decreasing BNB’s general provide, doubtlessly fueling bullish sentiment as holders anticipate worth beneficial properties. Notably, the Stability of Energy (BoP) studying on the each day chart rose post-burn, suggesting elevated bullish momentum. Sometimes, a declining BoP signifies bearish management, typically signaling worth drops.

Learn extra: How you can Purchase BNB and All the things You Want To Know

Nevertheless, within the present situation, BNB bulls seem like in management. With the cryptocurrency’s worth hovering round $576, there’s a potential for additional upward motion.

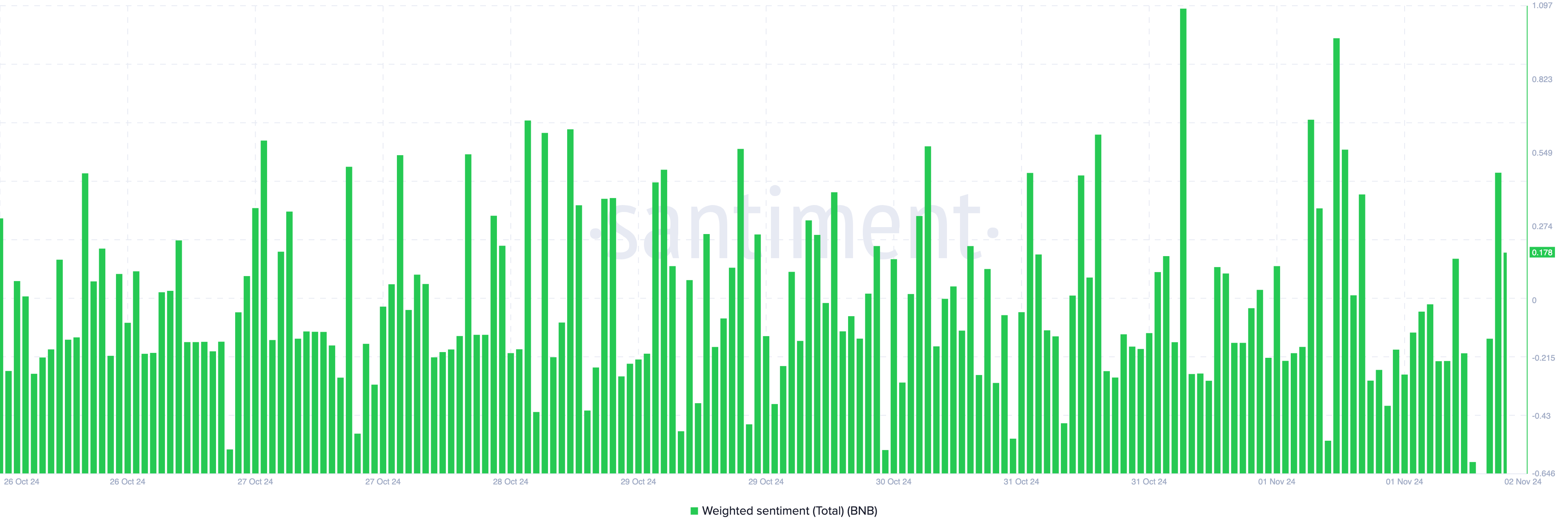

From an on-chain perspective, knowledge from Santiment exhibits a notable improve within the Weighted Sentiment, a metric that gauges the broader market’s notion of a cryptocurrency.

When the studying is adverse, the common comment tracked through social quantity is bearish. Since it’s optimistic on this case, it signifies that most buyers are optimistic about BNB’s worth potential, which may drive elevated demand.

BNB Value Prediction: $606 Is Inside Attain

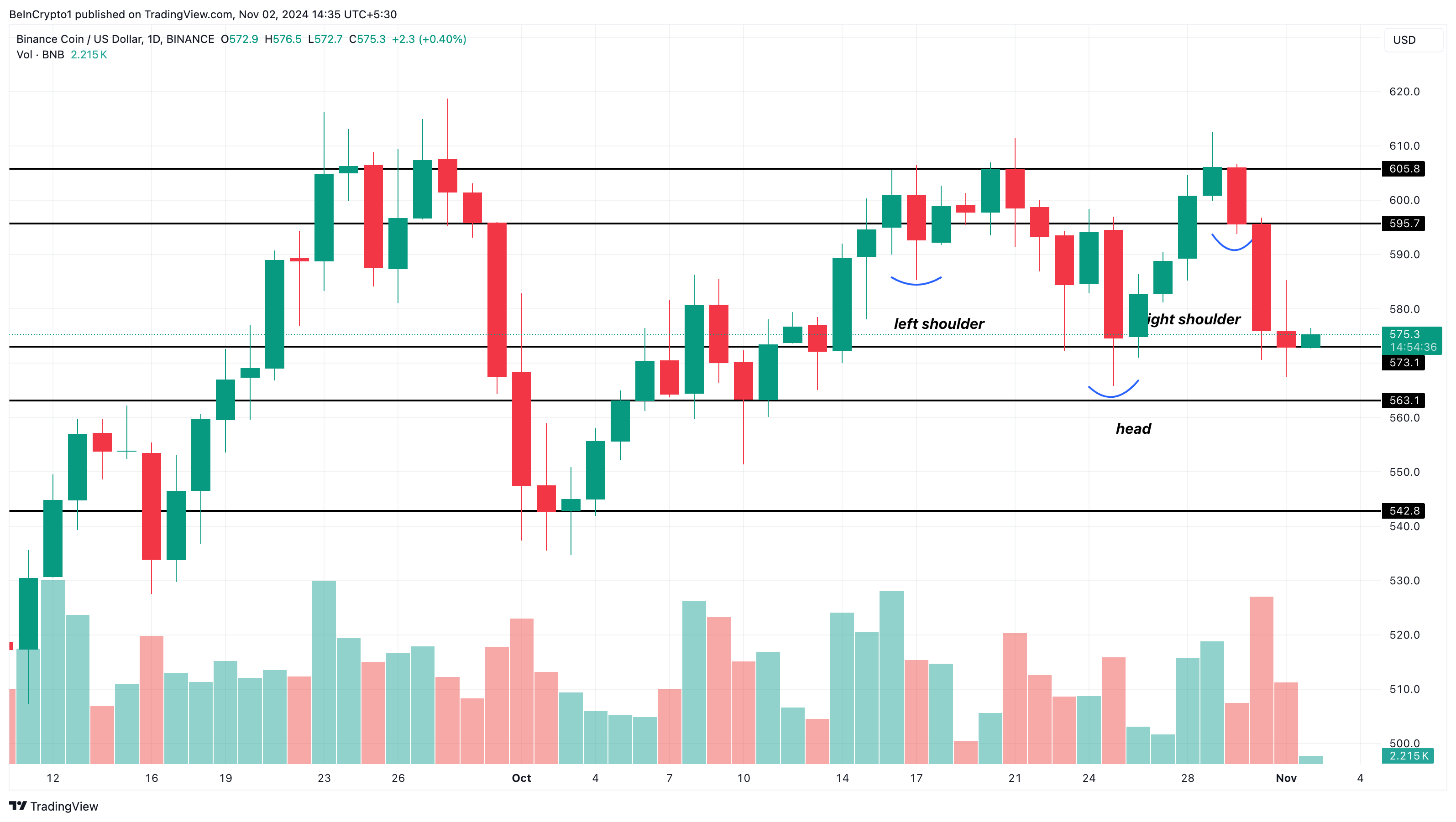

On the each day chart, BNB has barely bounced after bulls efficiently defended the assist degree at $573. If this assist hadn’t held, the cryptocurrency may have fallen to $563, the subsequent vital assist degree.

Moreover, BNB’s worth has shaped an inverse head and shoulders sample, signaling a possible reversal from bearish to bullish momentum. Contemplating this technical construction, BNB’s worth would possibly climb above the $596 resistance and rally to $606.

Learn extra: Binance Coin (BNB) Value Prediction 2024/2025/2030

Nevertheless, if bears are in a position to overpower bulls this time, the prediction might be invalidated. In that situation, BNB would possibly fall under the $5673 assist and decline to $543.

Disclaimer

In step with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.