With years of historic knowledge, we will observe the patterns from previous bull cycles to change into more and more able to making predictions about our present cycle. On this evaluation, we take a deep dive into when the subsequent Bitcoin peak might happen and at what value stage.

The Pi Cycle

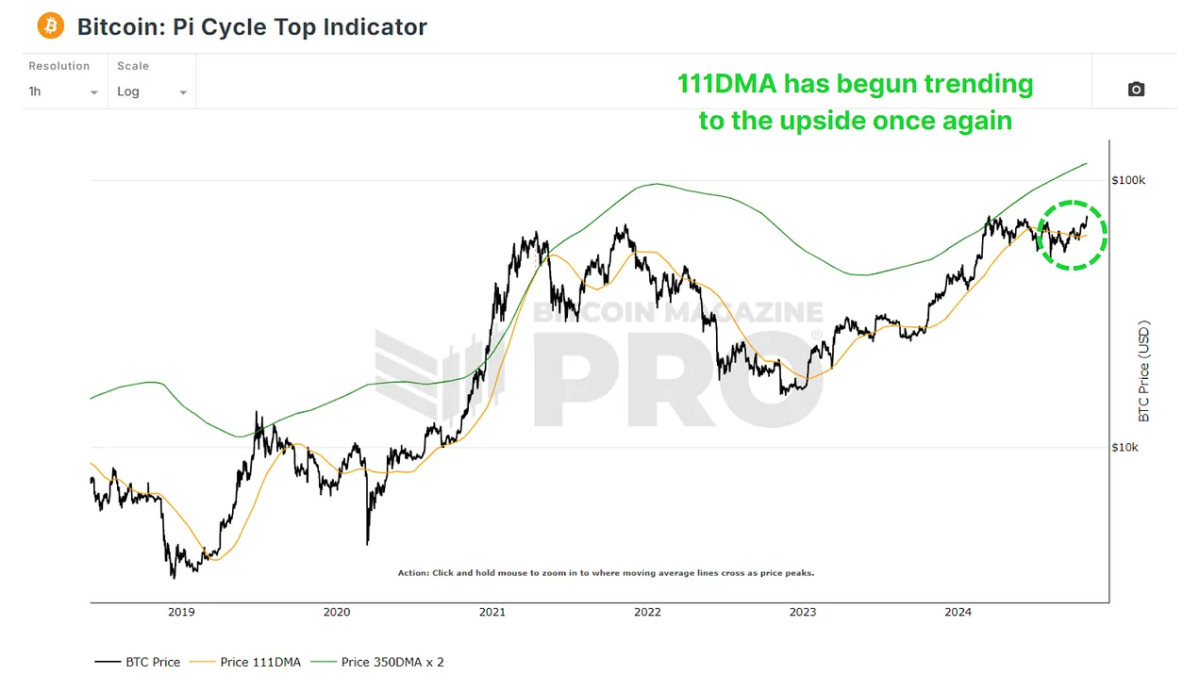

The Pi Cycle Prime Indicator is certainly one of our hottest instruments for analyzing Bitcoin’s cycles. This indicator displays the 111-day and 350-day (multiplied by 2) transferring averages, and when these two traces cross, it has traditionally been a dependable signal of Bitcoin reaching a cycle peak, sometimes inside only a few days. After a number of months of those two ranges drifting aside because of the sideways value motion, we’ve simply begun to see the 111-day trending again up once more to start closing the hole.

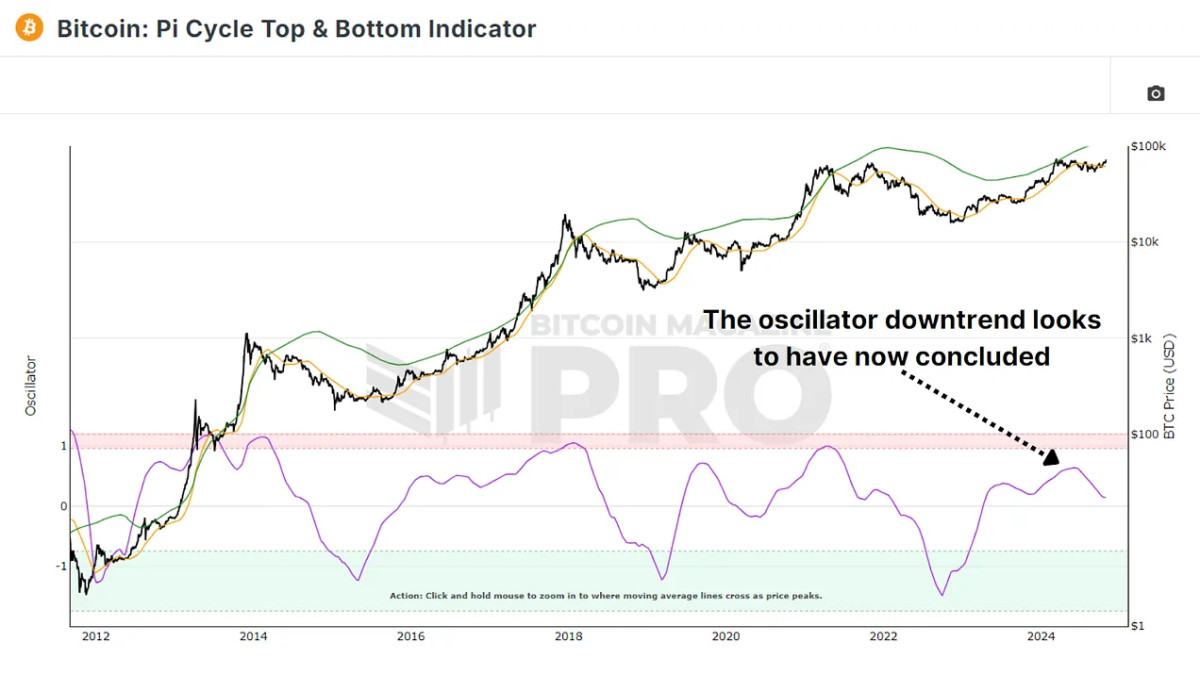

We will measure the distinction between the 2 averages to raised outline Bitcoin’s place inside bull and bear cycles with the Pi Cycle Prime & Backside Indicator. This oscillator trending up once more hints that Bitcoin’s subsequent bull run could also be simply across the nook, with parallels to earlier cycles seen in 2016 and 2020.

Earlier Bitcoin Cycles

Traditionally, Bitcoin’s bull cycles exhibit related phases: preliminary speedy progress, a cooling-off interval, a second peak, and eventually, a major retracement adopted by a brand new surge.

2016 Cycle: This cycle noticed a primary peak, a dip, a second peak, after which a full-blown bull market. It is similar to the development we’re at the moment seeing. Bitcoin’s value reached new highs after these two retracements.

2020-2021 Cycle: The sample was barely much less pronounced, however an identical trajectory was noticed. Bitcoin’s value peaked twice, as soon as through the preliminary surge and once more on the peak of the bull run as BTC was reaching an all-time.

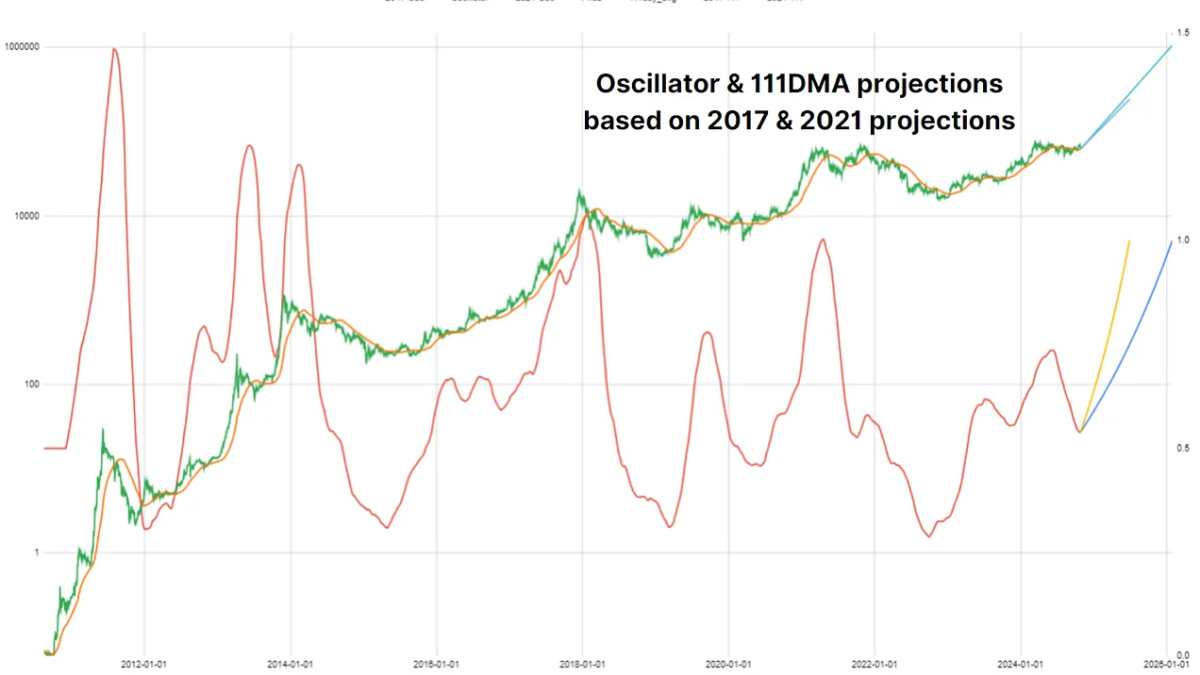

Utilizing the Bitcoin Journal Professional API, we will simulate completely different progress eventualities based mostly on previous cycles. Because the Pi Cycle Prime and Backside oscillator not too long ago turned upward we will overlay the speed of change within the oscillator from the earlier cycles to see potential route this cycle.

If the 2021 cycle repeats, the 111-day and 350-day transferring averages might cross round June 29, 2025, signaling a possible Bitcoin peak. If the 2017 cycle is mirrored, the transferring averages may not cross till January 28, 2026, suggesting a later peak.

Value Projections

Utilizing these dates, we will additionally try and estimate potential value ranges. Traditionally, Bitcoin’s value exceeded the transferring averages considerably at its peak. Through the 2017 bull run, Bitcoin’s value was thrice the worth of those transferring averages on the peak. Nonetheless, because the market matures, we’ve seen diminishing returns in every cycle, which means Bitcoin’s value may not enhance as dramatically in comparison with its transferring averages because it has traditionally.

If Bitcoin follows a sample much like the 2021 cycle, with a rise of about 40% above its transferring averages, this is able to place Bitcoin’s peak at roughly $339,000. Assuming diminishing returns, Bitcoin’s value would possibly solely rise about 20% above the transferring averages. On this case, the height value can be nearer to $200,000 by mid-2025.

Equally, if the 2017 prolonged cycle repeats with diminishing returns, Bitcoin might peak at $466,000 in early 2026, whereas a extra average enhance would possibly lead to a peak value of round $388,000. Though it’s unlikely Bitcoin will hit a million {dollars} on this cycle, these extra tempered projections might nonetheless characterize substantial features.

Conclusion

Whereas these projections use well-established knowledge, they’re not ensures. Each cycle has its distinctive dynamics influenced by financial circumstances, investor sentiment, and regulatory modifications. Diminishing returns and doubtlessly even lengthening cycles are probably, reflecting the maturation of Bitcoin’s market.

As Bitcoin’s bull cycle continues to develop, these predictive instruments might present more and more correct insights, notably as the information evolves. Nonetheless, evaluation corresponding to this supplies potential outcomes to help in your threat administration and put together for each end result.

For a extra in-depth look into this subject, try a latest YouTube video right here: Mathematically Predicting The Subsequent Bitcoin All Time Excessive