Bitcoin’s value cycles have lengthy been a supply of intrigue for traders and analysts alike. We are able to achieve insights into potential value actions by evaluating present developments to earlier cycles, particularly with Bitcoin seemingly coming to an finish of its consolidation interval, many surprise if the following leg up is across the nook.

Evaluating Bitcoin Cycles

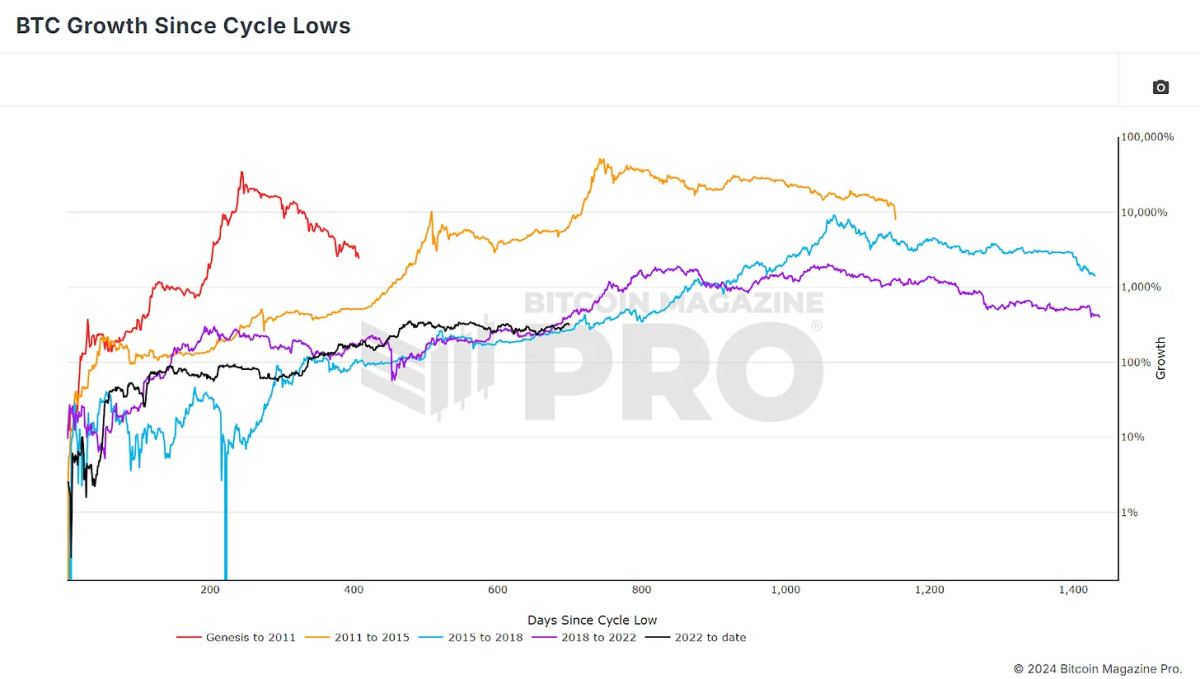

To start, it’s essential to take a look at how Bitcoin has carried out since hitting its latest cycle low. As we study the information, a transparent image begins to type: Bitcoin’s present value motion (black line) is displaying patterns just like earlier bull cycles. Though it has been a uneven consolidation interval, the place the value has been comparatively stagnant, there are key similarities after we evaluate this cycle to these in 2015-2018 (purple line) and 2018-2022 (blue line).

The place we’re in the present day, by way of proportion positive aspects, is similar to each the 2018 and 2015 cycles. Nevertheless, this comparability solely scratches the floor. Worth motion alone does not inform the complete story, so we have to dive deeper into investor conduct and different metrics that form the Bitcoin market.

Investor Habits

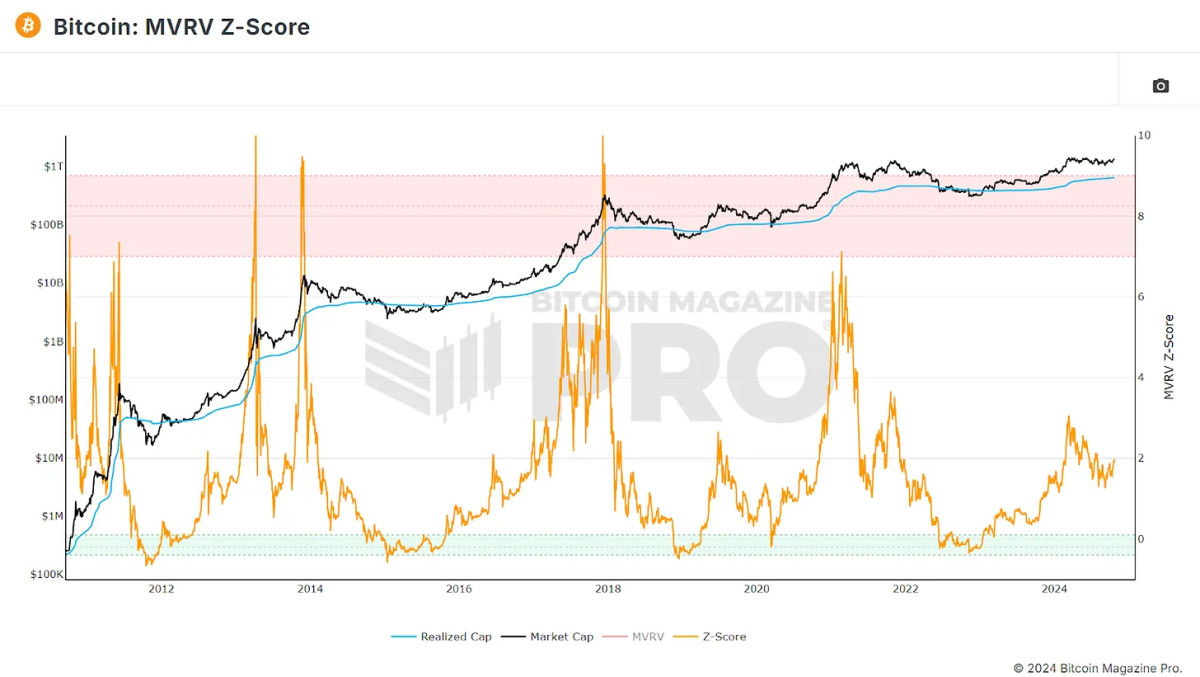

One key metric that offers us perception into investor conduct is the MVRV Z-Rating. This ratio compares Bitcoin’s present market value to its “realized value” (or value foundation), which represents the typical value at which all Bitcoin on the community was accrued. The Z-Rating then simply standardizes the uncooked MVRV knowledge for BTC volatility to exclude excessive outliers.

Analyzing metrics reminiscent of this one, versus purely specializing in value actions, will permit us to see patterns and similarities in our present cycle to earlier ones, not simply in greenback actions but additionally in investor habits and sentiment.

Correlating Actions

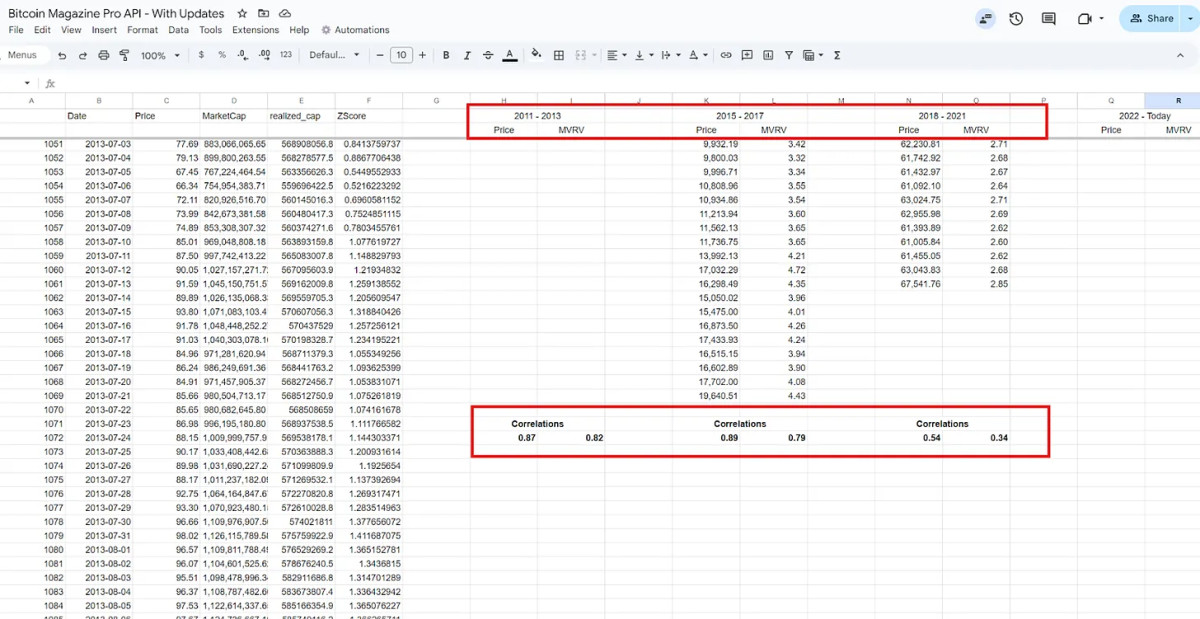

To higher perceive how the present cycle aligns with earlier ones, we flip to the information from Bitcoin Journal Professional, which presents in-depth insights via its API. Excluding our Genesis cycle, as there’s little correlation and isolating the value and MVRV knowledge from Bitcoin’s lowest closing costs to its highest factors in our present and former three cycles, we will see clear correlations.

2011 to 2013 Cycle: This cycle, characterised by its double peak, reveals a powerful 87% correlation with the present value motion. The MVRV ratio additionally reveals a excessive 82% correlation, that means that not solely is Bitcoin’s value behaving equally, however so is investor conduct by way of shopping for and promoting.

2015 to 2017 Cycle: This cycle is definitely the closest by way of value motion, boasting an 89% correlation with our present cycle. Nevertheless, the MVRV ratio is barely decrease, suggesting that whereas costs are following comparable paths, investor conduct may be barely completely different.

2018 to 2021 Cycle: This most up-to-date cycle, whereas optimistic, has the bottom correlation to present developments, indicating that the market is probably not following the identical patterns it did only a few years in the past.

Are We in for One other Double Peak?

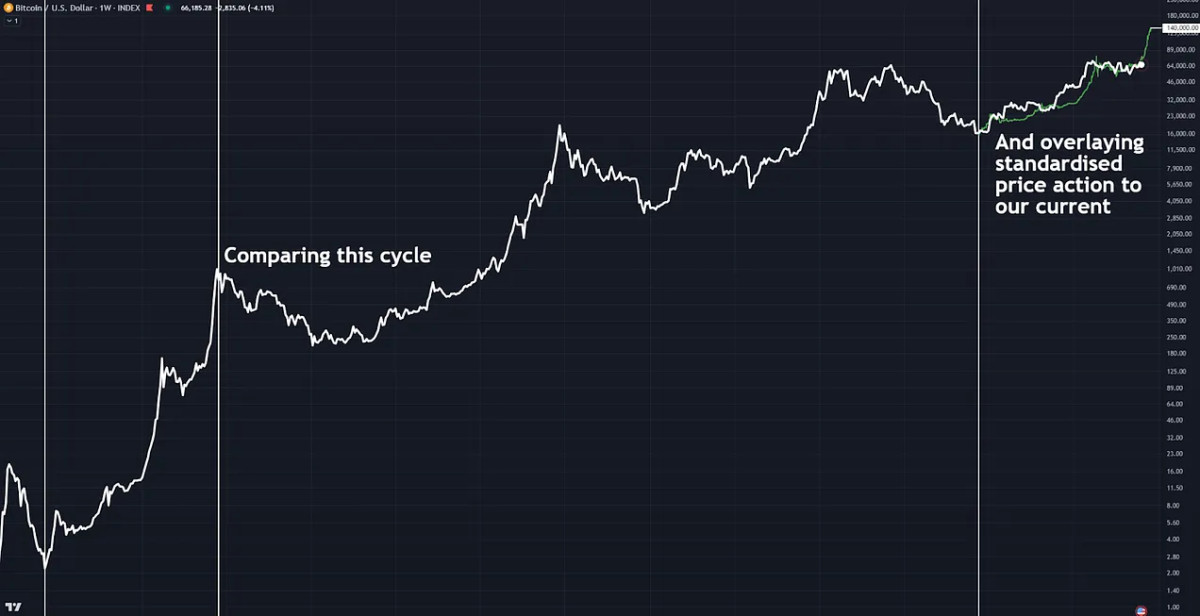

The robust correlation with the 2011-2013 cycle is especially noteworthy. Throughout that interval, Bitcoin skilled a double peak, the place the value surged to new all-time highs twice earlier than coming into a chronic bear market. If Bitcoin follows this sample, we could possibly be on the verge of serious value actions within the coming weeks. After overlaying the value motion fractal from this era over our present cycle and standardizing the returns, the similarities are immediately noticeable.

In each circumstances, Bitcoin had a speedy run-up to a brand new excessive, adopted by a protracted, uneven interval of consolidation. If historical past repeats itself, we may see a large value rally quickly, doubtlessly to round $140,000 earlier than the top of the yr when accounting for diminishing returns.

Patterns In Investor Habits

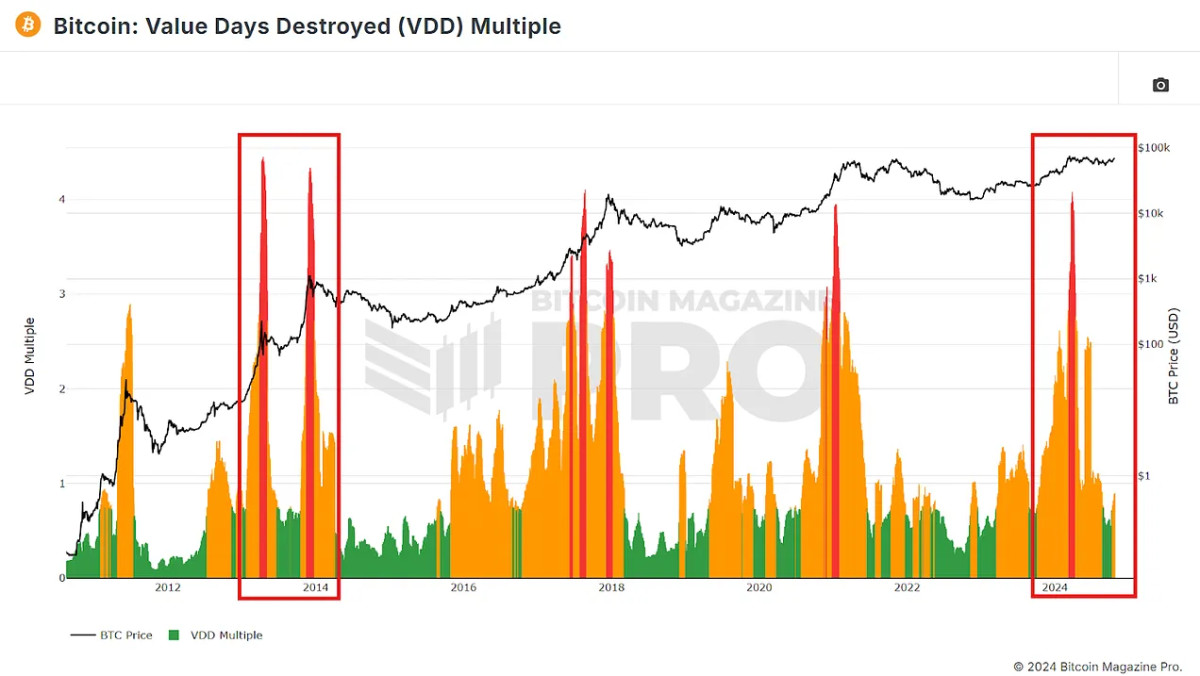

One other precious metric to look at is the Worth Days Destroyed (VDD). This metric weights BTC actions by the quantity being moved and the time because it was final transferred and multiplies this worth by the value to supply insights into long-term traders’ conduct, particularly profit-taking.

Within the present cycle, VDD has proven an preliminary spike just like the purple spikes we noticed in the course of the 2013 double peak. This run-up as BTC ran to a brand new all-time excessive earlier this yr earlier than a sustained consolidation interval may see us reaching new highs quickly once more if this double peak cycle sample continues.

A Extra Sensible Situation

As Bitcoin has grown and matured as an asset, we’ve seen prolonged cycles and diminishing returns in our two most up-to-date cycles in comparison with our preliminary two. Due to this fact, it’s in all probability extra possible that BTC follows the cycle during which we’re seeing the strongest correlation in value motion.

Determine 6: Overlaying a fractal of the 2017 cycle on our present value motion.

If Bitcoin follows the 2015-2017 sample, we may nonetheless see new all-time highs earlier than the top of 2024, however the rally would possible be slower and extra sustainable. This state of affairs predicts a value goal of round $90,000 to $100,000 by early 2025. After that, we may see steady progress all year long, with a possible market peak in late 2025, though a peak of $1.2 million if we observe this sample precisely could also be optimistic!

Conclusion

Historic knowledge suggests we’re approaching a essential turning level. Whether or not we observe the explosive double-peak cycle from 2011-2013 or the slower however regular rise of 2015-2017, the outlook for Bitcoin stays bullish. Monitoring key metrics just like the MVRV ratio and Worth Days Destroyed will present additional clues as to the place the market is headed, and evaluating correlations with our earlier cycles will give us higher insights into what could also be coming.

With Bitcoin poised for a breakout, whether or not within the subsequent few weeks or in 2025, if BTC even remotely follows the patterns of any of our earlier cycles, traders ought to put together for vital value motion and potential new all-time highs sooner reasonably than later.

For a extra in-depth look into this matter, try a latest YouTube video right here: Evaluating Bitcoin Bull Runs: Which Cycle Are We Following