Este artículo también está disponible en español.

Bitcoin surged to new all-time highs throughout election evening, hitting a powerful $75,300 as market pleasure reached a fever pitch. This milestone pushed Bitcoin into worth discovery, igniting vital liquidations throughout buying and selling platforms.

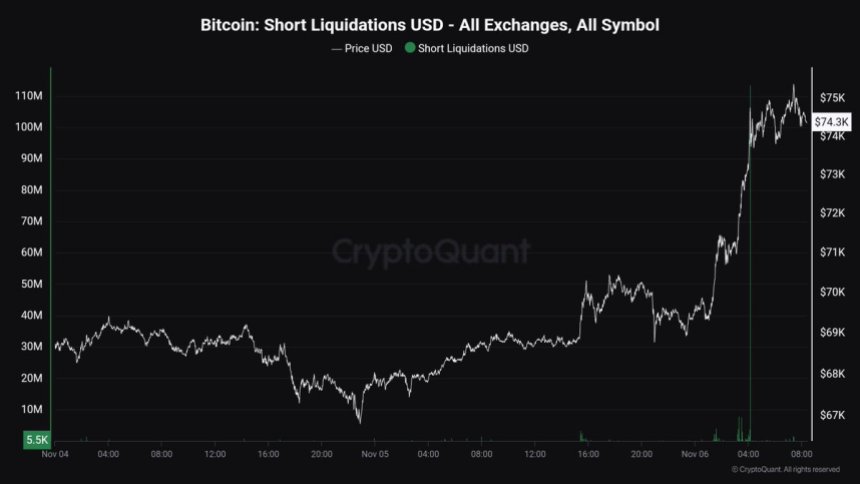

Knowledge from CryptoQuant reveals an unprecedented surge in brief liquidations, surpassing $100 million inside a single one-minute candle, marking a historic second for BTC.

This explosive worth motion was fueled by the shock Trump win within the U.S. election, which seems to have sparked renewed enthusiasm for crypto property as traders reply to the potential financial insurance policies forward. The election consequence has despatched shockwaves by way of the market, with Bitcoin main a recent rally throughout the crypto area.

Associated Studying

Now in uncharted territory, Bitcoin’s transfer above $75,000 represents a robust assertion of investor confidence regardless of broader financial uncertainties. As BTC enters worth discovery mode, merchants and traders alike are bracing for additional volatility, whereas many anticipate that this momentum may prolong into even increased highs.

The approaching days will likely be crucial as Bitcoin’s worth motion continues to drive liquidations and form the outlook for the broader market.

Bitcoin Bullish Part Begins

Bitcoin has formally entered a bullish section, setting new all-time highs following Donald Trump’s election victory. As a identified crypto supporter, Trump’s win has spurred market optimism, pushing BTC’s worth above earlier ATHs in a surge that started as election outcomes favored his lead.

This bullish breakout was accompanied by a dramatic liquidation spike, signaling robust shopping for strain as bearish bets have been swiftly unwound. Knowledge from CryptoQuant analyst Maartunn exhibits that brief liquidations exceeded $100 million in a single one-minute candle—an unprecedented occasion that underscores the ability behind this rally and means that Bitcoin’s upward momentum is simply starting.

Within the coming days, volatility will stay excessive as international markets digest the election consequence and brace for the Federal Reserve’s upcoming rate of interest determination on Thursday. Buyers anticipate a dynamic market response, with doable ripple results throughout conventional and crypto markets.

Ought to the Fed maintain charges regular or make any dovish changes, it may additional bolster Bitcoin’s rally and strengthen the broader crypto market.

Associated Studying

The outlook stays bullish as market sentiment shifts positively with Bitcoin’s new worth discovery section. Whereas short-term fluctuations are probably amid these main occasions, the long-term view favors a bullish development as Bitcoin leads the crypto market increased on this new post-election setting.

BTC Visits Uncharted Territory

Bitcoin is buying and selling at $73,800 after breaking its earlier all-time highs and reaching a brand new peak of $75,300. This breakout has pushed BTC into uncharted territory, a section that traditionally alerts huge positive factors as bullish momentum builds.

The main target is whether or not Bitcoin can keep its momentum above the earlier ATH of $73,800, a crucial help stage that might propel it additional into new highs if held efficiently. Nevertheless, the timing of this transfer aligns with a very risky week, because the market anticipates the Federal Reserve’s upcoming assembly.

The Fed’s determination on rates of interest may introduce vital unpredictability, doubtlessly tempering BTC’s rise and even sending it under the $70,000 mark if the end result diverges from market expectations. As BTC navigates this worth discovery section, traders are carefully eyeing key ranges.

Associated Studying

Holding above $73,800 would strengthen the bullish narrative, whereas any pullback would take a look at help ranges and investor resilience amid broader market uncertainty. With volatility anticipated, this week might be pivotal for Bitcoin’s trajectory within the months forward.

Featured picture from Dall-E, chart from TradingView