Este artículo también está disponible en español.

Bitcoin is buying and selling round $75,000 following Donald Trump’s victory within the U.S. election, stirring recent optimism within the crypto market. Trump’s pro-crypto stance has ignited pleasure amongst analysts and buyers who anticipate favorable insurance policies for digital property in his administration. With Bitcoin now sitting at all-time highs, many speculate this might start a brand new rally part.

Associated Studying: Ethereum Analyst Units $3,400 Goal As soon as ETH Breaks Key Resistance – Particulars

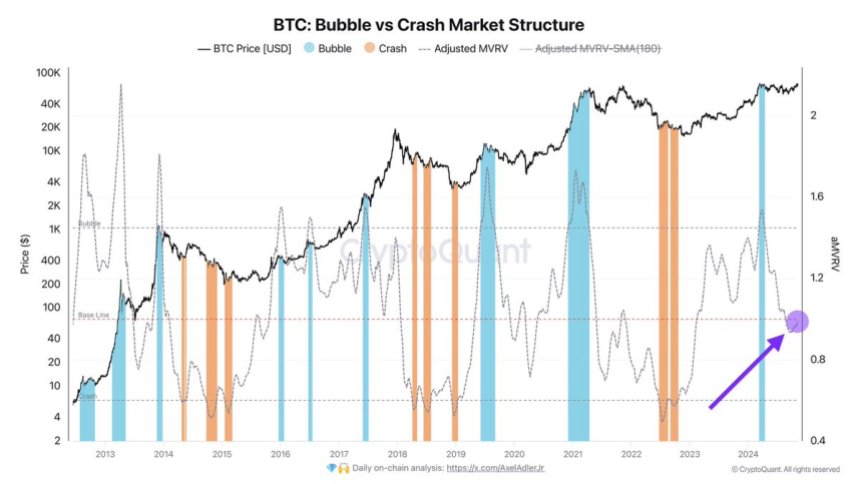

Key knowledge from CryptoQuant signifies that Bitcoin has reached a value equilibrium, suggesting there aren’t any robust market forces pulling the value decrease. This constructive equilibrium reinforces the bullish outlook and hints at a secure basis for additional development. Analysts imagine Bitcoin could also be set for brand spanking new highs with fewer obstacles within the coming weeks.

As investor confidence builds, some view this part as a essential second for Bitcoin to solidify its place in a pro-crypto coverage setting. The mixture of robust technical assist and constructive sentiment from Trump’s victory has set the stage for what many hope shall be a big upward pattern, probably driving the broader crypto market greater.

Bitcoin Enters A Bullish Section

Bitcoin has formally entered a bullish part after breaking previous its earlier all-time highs, reaching $76,500. This degree has change into a brand new space of focus as many analysts establish it as a possible resistance zone.

In accordance with CryptoQuant analyst Axel Adler, the market is presently balanced between a “Bubble” and a “Crash” part. Adler’s evaluation, which incorporates key on-chain knowledge, means that Bitcoin’s market construction is at an equilibrium, that means there aren’t any important elementary causes to anticipate a drop. As an alternative, this setup gives a secure basis for probably persevering with Bitcoin’s upward pattern.

With the Federal Reserve’s rate of interest choice set to be introduced at the moment, the subsequent few weeks promise to be pivotal. A secure or favorable choice from the Fed might reinforce the optimism out there, drawing in new demand and reinforcing Bitcoin’s place above $76,000.

Many buyers and analysts anticipate heightened exercise from institutional gamers, significantly given Bitcoin’s resilience round this milestone degree. The market’s steadiness at this juncture is essential. So long as Bitcoin maintains its present construction, it has the potential to proceed its upward trajectory with out substantial danger of retracement.

Associated Studying

With recent demand getting into the market and the macroeconomic backdrop shaping up favorably, Bitcoin might quickly intention for even greater ranges. For now, all eyes stay on the $76,500 mark and the way the market will reply within the wake of the Federal Reserve’s announcement. This era of consolidation may very well be the catalyst for the subsequent leg up, solidifying Bitcoin’s bullish outlook.

BTC Key Ranges To Watch

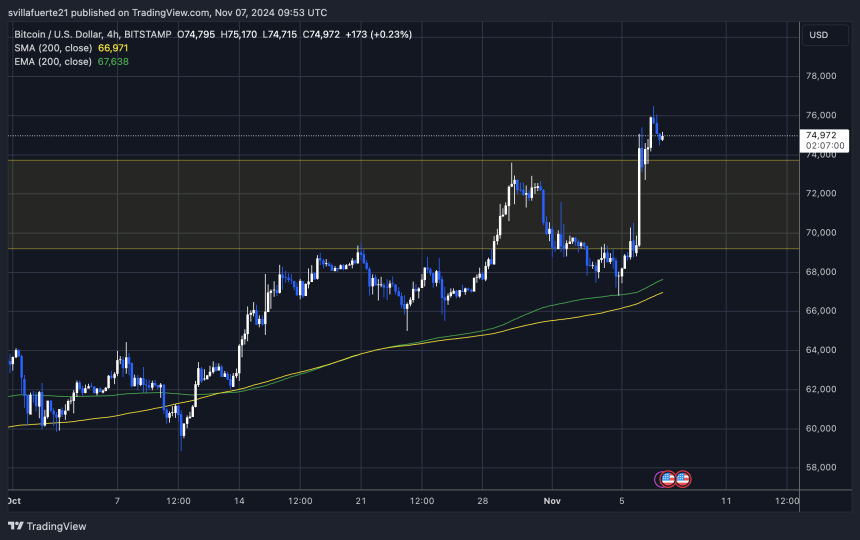

Bitcoin is buying and selling at $75,000, holding regular above its earlier all-time excessive of roughly $73,800. This degree has change into a essential assist zone as BTC continues in a well-defined 4-hour uptrend. The pattern started after a robust bounce from the 200 exponential transferring common (EMA) at $66,800, indicating renewed bullish momentum.

Bulls must hold the value above the $73,000 mark to maintain this momentum, a key psychological threshold. This degree boosts market confidence and gives a possible springboard for Bitcoin to succeed in greater targets quickly. A confirmed maintain above $73,000 might sign additional upside, inviting extra shopping for stress and probably organising BTC for brand spanking new highs.

Associated Studying

Nevertheless, if BTC fails to carry this degree, it might slip towards a decrease demand space of round $70,500. Regardless of this chance, present value motion reveals no important indicators of a downturn. The regular uptrend and agency assist ranges counsel that Bitcoin’s bullish outlook stays intact, with little indication of an imminent drop.

So long as BTC maintains its construction, the trail towards continued positive aspects stays clear, reinforcing confidence within the ongoing rally.

Featured picture from Dall-E, chart from TradingView