On-chain information exhibits the Bitcoin retail quantity has sharply elevated lately because the cryptocurrency has surged to a brand new excessive.

Bitcoin Retail Quantity Is Up Extra Than 15% Over Final 30 Days

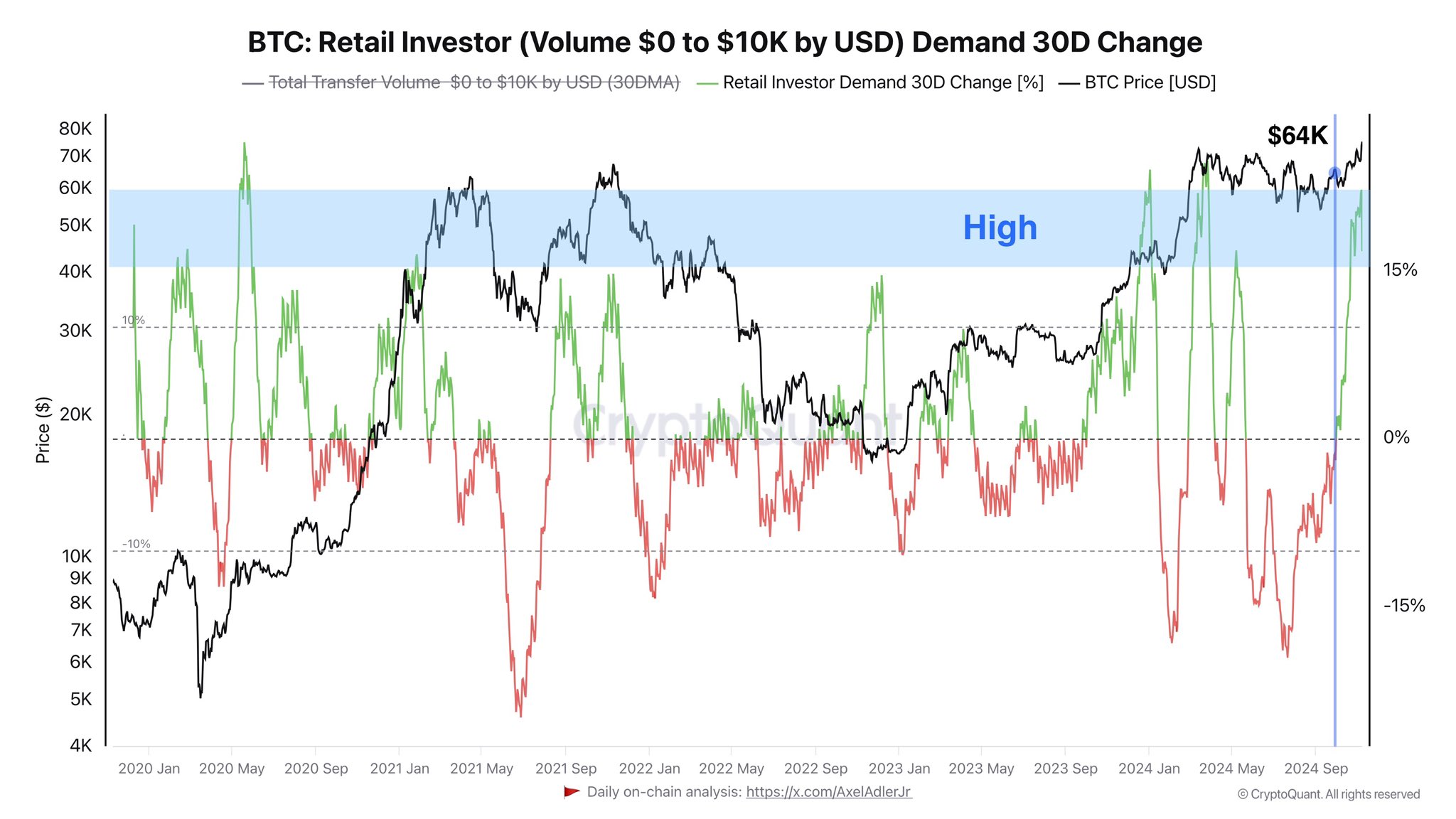

As defined by CryptoQuant writer Axel Adler Jr in a brand new submit on X, the demand from retail buyers has gone up lately. Retail buyers sometimes consult with the a part of the BTC userbase with the smallest holdings.

One option to gauge the demand from these buyers is thru their transaction quantity. Given the small dimension of their holdings, these holders don’t make too massive transfers, so their quantity will be decided by solely retaining monitor of the switch information, which has a price of lower than $10,000.

Under is the chart shared by the analyst, which exhibits the pattern within the 30-day change of the retail investor switch quantity over the previous couple of years.

The worth of the metric seems to have spiked in current days | Supply: @AxelAdlerJr on X

As displayed within the graph, the Bitcoin retail switch quantity noticed a unfavorable 30-day change earlier, but it surely has seen a flip with the current rally within the asset’s value. The indicator has now surged to important optimistic ranges, which suggests curiosity from this group has been sharply rising lately.

Retail buyers being drawn to the community isn’t uncommon throughout a risky interval just like the one BTC has witnessed lately, as these holders have a tendency to search out such occasions thrilling.

The chart exhibits that this cohort confirmed an analogous burst of demand again in the course of the rally of the primary quarter of the 12 months. Comparable tendencies have been additionally noticed on a number of events within the 2021 bull run.

Traditionally, rallies which have didn’t amass retail curiosity have normally ended up not lasting for too lengthy, because the inflow of buyers tends to maintain such runs. From this attitude, the present rally seems protected, as retail quantity has elevated by greater than 15% over the previous month.

One other indicator for measuring demand associated to Bitcoin is the Coinbase Premium Index. This metric retains monitor of the distinction between the Bitcoin costs listed on Coinbase (USD pair) and Binance (USDT pair).

This indicator doesn’t replicate the demand from retail buyers however from American institutional buyers, who’ve a powerful presence on Coinbase.

As CryptoQuant head of analysis Julio Moreno identified in an X submit, the Bitcoin Coinbase Premium Index has lately shot up into the optimistic area.

The pattern within the BTC Coinbase Premium Index over the previous week | Supply: @jjcmoreno on X

A optimistic worth of the index suggests BTC is buying and selling at the next value on Coinbase as in comparison with Binance, which in flip implies the US-based whales are exhibiting demand for the cryptocurrency.

BTC Worth

Bitcoin is trying to discover one other excessive as its value has surged again to the $75,900 mark.

Seems like the worth of the coin has seen a pointy enhance lately | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com