BlackRock’s iShares Bitcoin Belief (IBIT) has set a brand new report for its largest single day by day influx because it was listed in January as demand for U.S. spot Bitcoin exchange-traded funds expertise surging buying and selling exercise amid heightened investor curiosity.

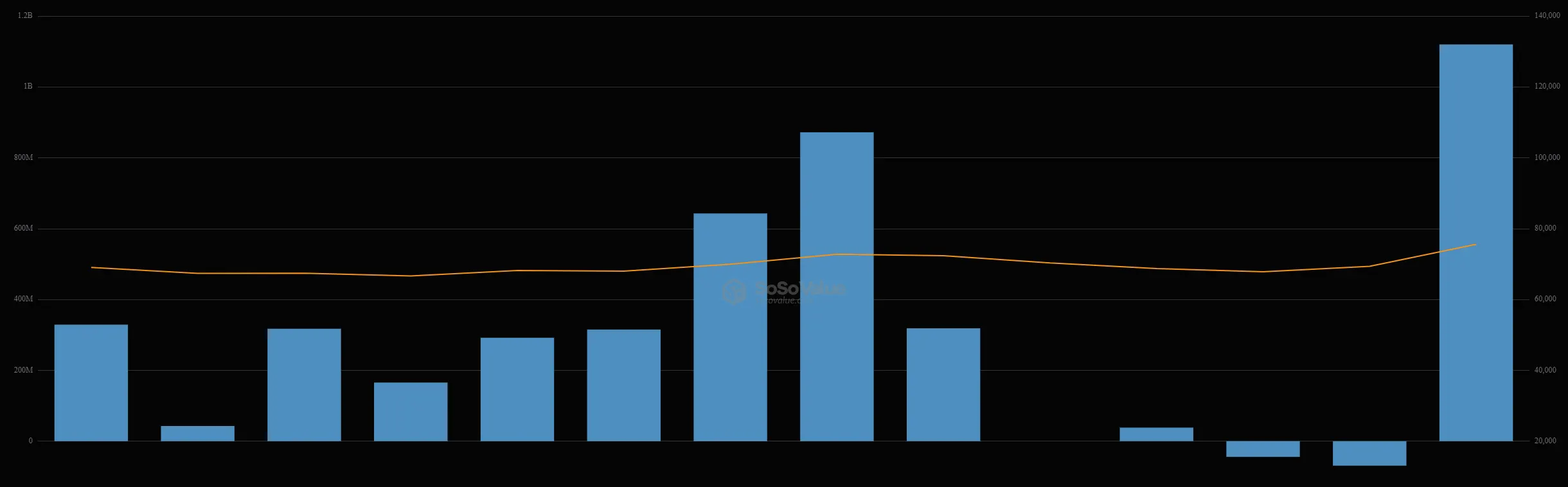

IBIT pulled in a complete of $1.12 billion on Thursday, beating out its prior October 30 report of $872 million, knowledge from SoSoValue exhibits.

The fund, which has emerged as a dominant power amongst its 10 different rivals, has a internet asset worth of $34.2 billion, bolstered by Bitcoin’s heightened worth.

“We’re in a goldilocks situation proper now of financial easing, political certainty, and strong US knowledge,” Pav Hundal, lead market analyst at crypto alternate Swyftx, instructed Decrypt. “Capital is in all places, and proper now, it’s flooding into the ETFs at a rare velocity.”

Investor curiosity on this planet’s largest crypto is at an all-time excessive, which has pushed record-setting heights for the asset, above $76,870, amid surging exercise amongst altcoins and meme cash.

“The ETFs are accumulating Bitcoin sooner than it may be created by an element of two to 1,” Hundal added. “In the end, this can tip throughout right into a broad-based crypto rally. Most likely sooner.”

It comes as IBIT posted a report $4 billion in buying and selling quantity on Wednesday, vastly exceeding its nearest rival, Constancy, after President-elect Donald Trump secured a second time period because the forty seventh president of the USA.

Trump’s Whitehouse win is seen by many within the trade as a boon for digital property. He has promised to guard crypto mining pursuits, set up a Bitcoin reserve, and usher in favorable coverage.

The ascent of IBIT as a prime Bitcoin ETF comes amid shifting sentiment over investments in institutionalized crypto. The fund has maintained regular inflows since inception, whereas competitor Grayscale’s GBTC—the second largest by internet property at $16.8 billion—has confronted detrimental outflows because of its excessive charges.

BlackRock expenses a 0.25% payment, waived till January, whereas GBTC expenses considerably larger at 1.5%. Constancy’s FBTC, in the meantime, additionally expenses 0.25%, although its waiver led to July.

Edited by Sebastian Sinclair

Every day Debrief E-newsletter

Begin each day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.