On-chain knowledge exhibits the Bitcoin buyers are actually carrying 121% income on common. Right here’s whether or not this has been sufficient for a high previously.

Bitcoin Profitability Index Is At the moment Sitting Round 221%

In a brand new submit on X, CryptoQuant creator Axel Adler Jr has mentioned concerning the newest pattern within the Bitcoin Common Profitability Index. The “Common Profitability Index” is an indicator for BTC that compares the asset’s spot worth with its realized value.

The “realized value” right here refers to a measure of the price foundation or acquisition worth of the typical investor within the Bitcoin market. This metric’s worth is set utilizing on-chain knowledge, with the final value at which every coin in circulation was transacted on the blockchain being taken as its present price foundation.

When the Common Profitability Index is larger than 100%, it means the spot value of the cryptocurrency is presently greater than its realized value. Such a pattern suggests the typical investor is holding a internet quantity of revenue.

Alternatively, the indicator being below this threshold implies the BTC market as a complete is carrying cash at a internet unrealized loss. Naturally, the index being precisely equal to 100% signifies the holders as a complete are simply breaking-even on their funding.

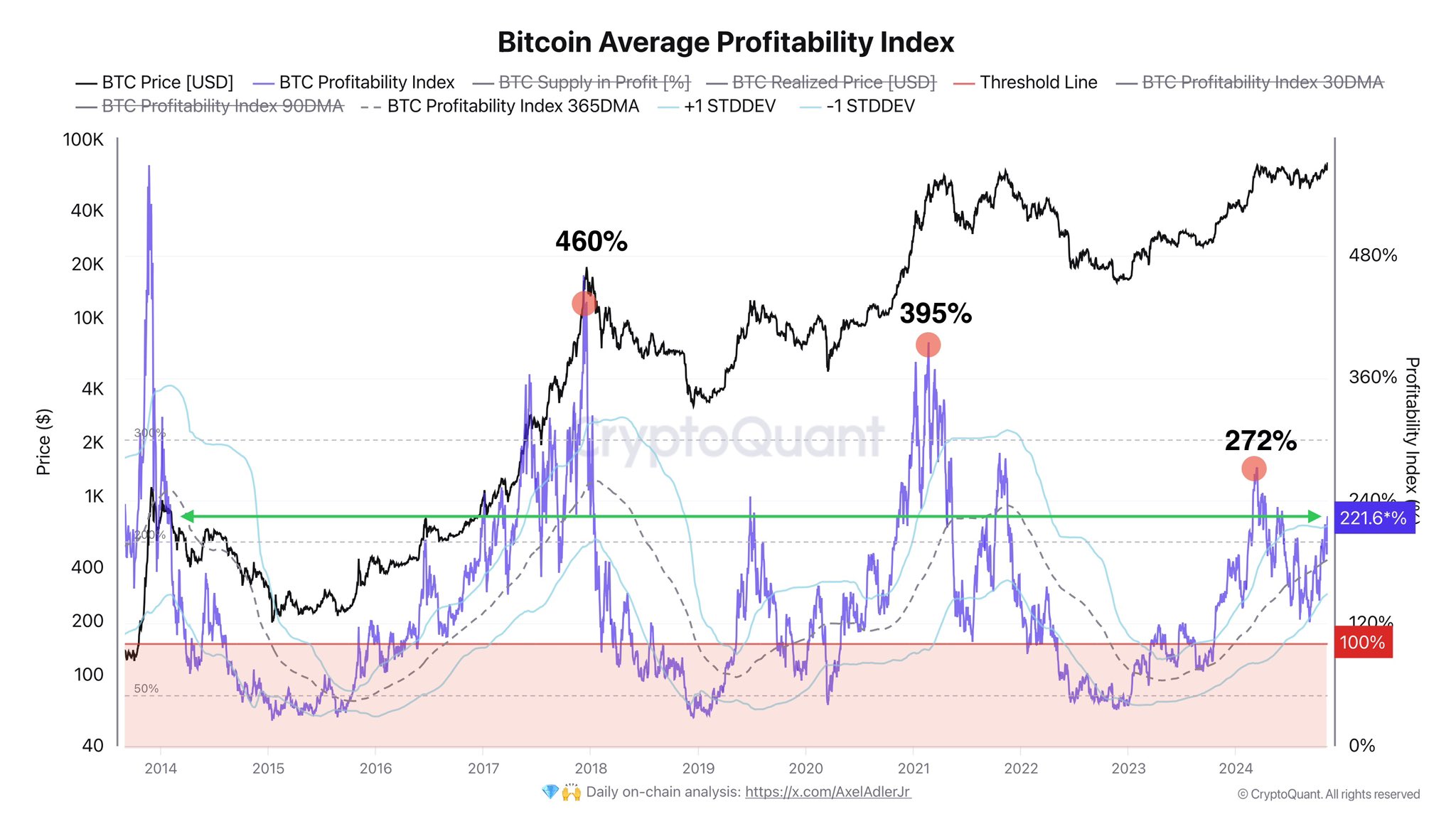

Now, here’s a chart that exhibits the pattern within the Bitcoin Common Profitability Index over the previous decade:

As is seen within the above graph, the Bitcoin Common Profitability Index has registered a notable improve just lately because the cryptocurrency’s run to the brand new all-time excessive (ATH) value has occurred.

The indicator has now reached a worth of round 221%, which suggests the buyers are in a big quantity of positive factors. Extra significantly, the BTC addresses as a complete are in a internet revenue of 121%.

Usually, the upper the income of the holders get, the extra seemingly they change into to fall to the attract of profit-taking. The present Common Profitability Index stage is excessive, however it’s unsure if it’s excessive sufficient for a mass selloff to change into a threat.

Within the chart, the analyst has marked how excessive the metric went on the time of the tops of the earlier bull runs. It could seem that 2017 peaked at 460%, whereas 2021 at 395%.

To this point within the present cycle, the very best that the index has gone was 272%, which occurred through the high again in March of this yr. Given the truth that the indicator is but to hit this stage, not to mention the peaks from the final cycles, it’s potential that Bitcoin nonetheless has enough space to run, earlier than a high turns into possible.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $76,200, up greater than 9% over the previous week.