On November 8, the administrator overseeing FTX’s chapter filed greater than 20 new lawsuits, ramping up authorized actions in opposition to a number of entities.

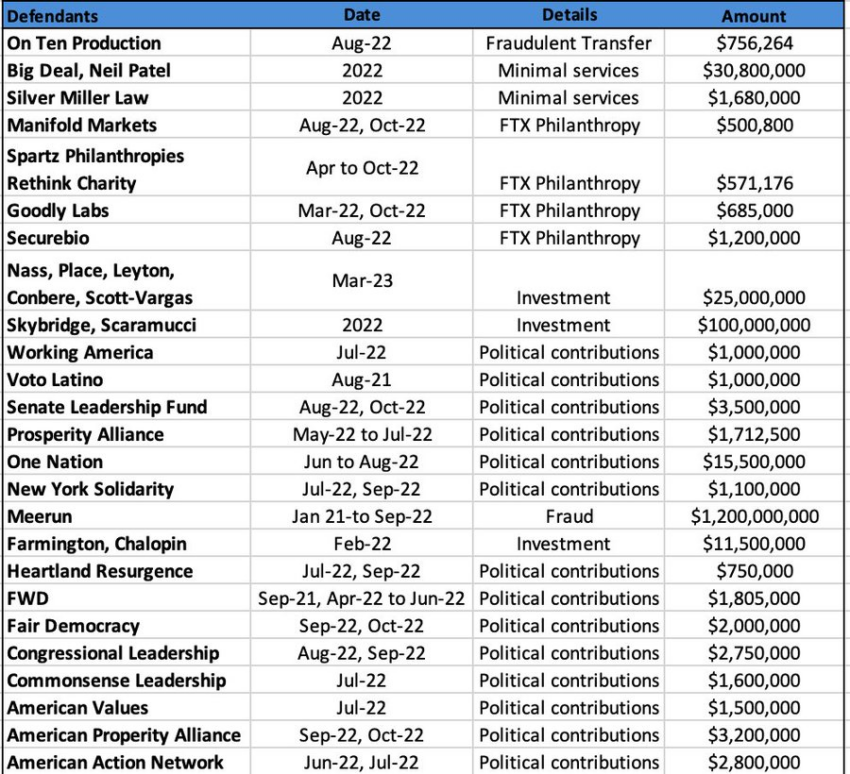

These lawsuits point out a concerted effort by FTX to recuperate property from a number of firms and people. Since November 2022, the FTX Debtors have filed 51 adversary actions, with 30 of them occurring in latest weeks.

FTX Targets $1 Billion in Losses With New Lawsuits

In response to paperwork from the FTX chapter docket, a lot of the newest filings deal with varied claims, together with political contributions, the defunct trade philanthropic efforts, investments, and allegations of market fraud and manipulation.

“FTX goes after dozens of left leaning teams for all of the donations that have been made fraudulently with buyer cash,” an FTX creditor acknowledged.

Thomas Braziel, founding father of 117 Companions, acknowledged that FTX would possibly reclaim some donations beneath US chapter legislation. He famous that funds may be recovered in the event that they have been donated with fraudulent intent or lacked equal worth. Additionally, donations made whereas the donor was bancrupt are notably vulnerable to being clawed again.

“Not all donations are immune. Chapter trustees will look carefully on the debtor’s intent, timing, and monetary situation when deciding if a charitable switch may be clawed again,” Braziel stated.

Along with the non-profits, the failed trade authorized group is pursuing different outstanding figures and entities. The property has filed a lawsuit in opposition to former White Home Communications Director Anthony Scaramucci and his firm, in search of damages of greater than $100 million. One other go well with targets the group behind Storybook Brawl, a online game that FTX co-founder Sam Bankman-Fried invested in and promoted.

FTX additionally filed a major clawback lawsuit in opposition to Nawaaz Mohammad Meerun, often called “Humpy the Whale,” who allegedly prompted over $1 billion in losses by market manipulation. Earlier this 12 months, Humpy led a governance assault on the DeFi protocol Compound Finance, inflicting important losses for the platform.

“Meerun additionally repeatedly violated FTX’s guidelines, forcing Alameda to take over Meerun’s dangerous positions and undergo a whole bunch of tens of millions of {dollars} in extra losses. All advised, FTX and Alameda suffered roughly $1 billion in losses as a consequence of Meerun’s crimes, and Meerun has used the proceeds of his exploits to fund a variety of different felony exercise,” FTX alleged.

These authorized actions replicate FTX’s rising efforts to recuperate property from quite a few people and corporations. Over the previous week, the trade has filed authorized actions in opposition to main centralized exchanges like Crypto.com and KuCoin over funds belonging to the platform.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.