Solana (SOL) value is displaying some promising indicators, with the coin up nearly 20% within the final week, however warning is required. Whereas current indicators reveal robust upward momentum, the sustainability of this pattern stays in query.

The present BBTrend means that SOL’s current value surge could also be influenced by broader market situations fairly than a standalone rally.

SOL BBTrend Isn’t That Large But

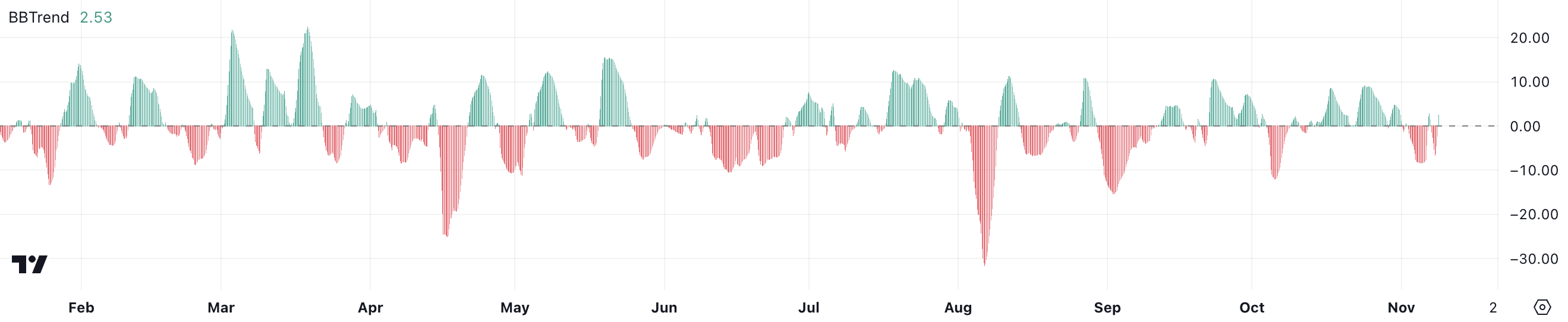

The BBTrend indicator for SOL is at present at 2.53. Simply days in the past, it dropped near -10, indicating excessive bearish strain, earlier than recovering barely. This restoration means that some shopping for curiosity has returned.

BBTrend, or Bollinger Band Development, measures momentum in relation to the Bollinger Bands. When the worth is optimistic, it signifies value power, whereas detrimental values suggest weak spot. A BBTrend of two.53 for Solana reveals that it’s beginning to acquire optimistic momentum after the earlier decline.

This reveals that the current pump could possibly be the results of the general market pumping and BTC reaching new all-time highs, as SOL BBTrend doesn’t look that bullish.

Solana Present Uptrend Is Very Robust

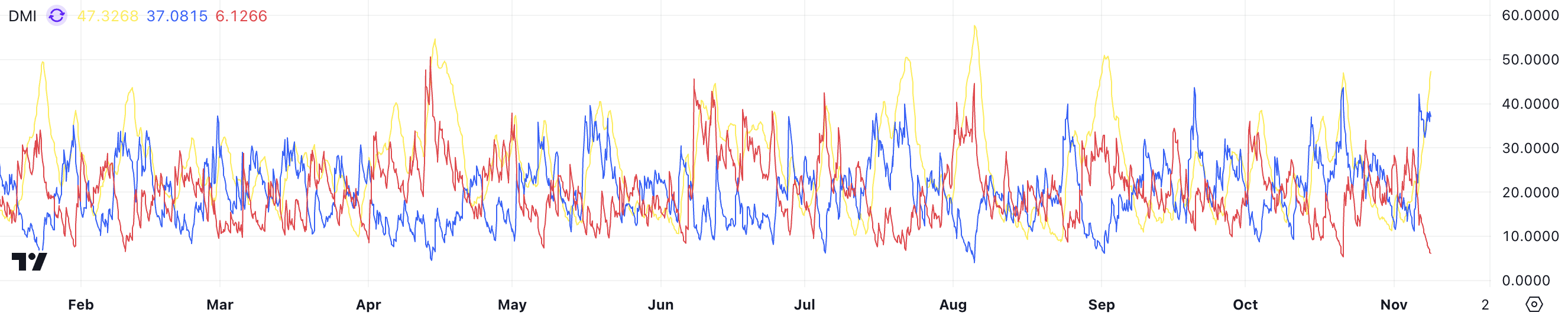

The DMI chart for Solana (SOL) reveals the ADX at 47.3, a big improve from practically 10 only a week in the past.

This sharp rise signifies that the power of SOL’s pattern has intensified significantly in a brief interval.

The Common Directional Index (ADX) measures the power of a pattern, no matter route. An ADX beneath 20 normally implies a weak pattern, whereas a worth above 25 suggests a robust pattern. With an ADX at 47.3, SOL is clearly in a strong pattern.

Alongside this, the +DI (Directional Indicator) is at 37 and the -DI at 6.1, signaling that purchasing strain is far stronger than promoting strain. Since SOL is in an uptrend, this mixture highlights a robust and accelerating bullish transfer, indicating that patrons are firmly in management.

SOL Value Prediction: It Will Break $210 Subsequent?

The EMA traces for Solana are displaying a really bullish sample. SOL value is positioned above all of the EMA traces, and the shorter-term EMAs are stacked above the longer-term ones.

Moreover, the gap between these traces is important, highlighting robust upward momentum and a transparent pattern route.

If this uptrend continues, SOL is prone to take a look at the $210 resistance degree. That may be its greatest value since March. Nevertheless, as indicated by the BBTrend, the present momentum could possibly be closely influenced by broader market sentiment and Bitcoin’s efficiency.

If this exterior momentum weakens, SOL would possibly face challenges and probably take a look at help ranges round $179 and even drop additional to $165. The important thing lies in how lengthy the broader market can maintain the present optimistic momentum.

Disclaimer

In keeping with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.