Solana’s worth has just lately witnessed a major uptick, surpassing the $200 mark and peaking at a three-year excessive of $225.21. This Solana worth surge has been fueled by the broader cryptocurrency market’s optimistic momentum and the uptick in demand for the Layer 1(L1) blockchain community.

Nonetheless, with shopping for stress waning and profit-taking on the rise, Solana has began to shed a few of its current beneficial properties. This means a potential pullback beneath the $200 mark within the meantime. How seemingly is that this state of affairs?

Solana Merchants Start Taking Income

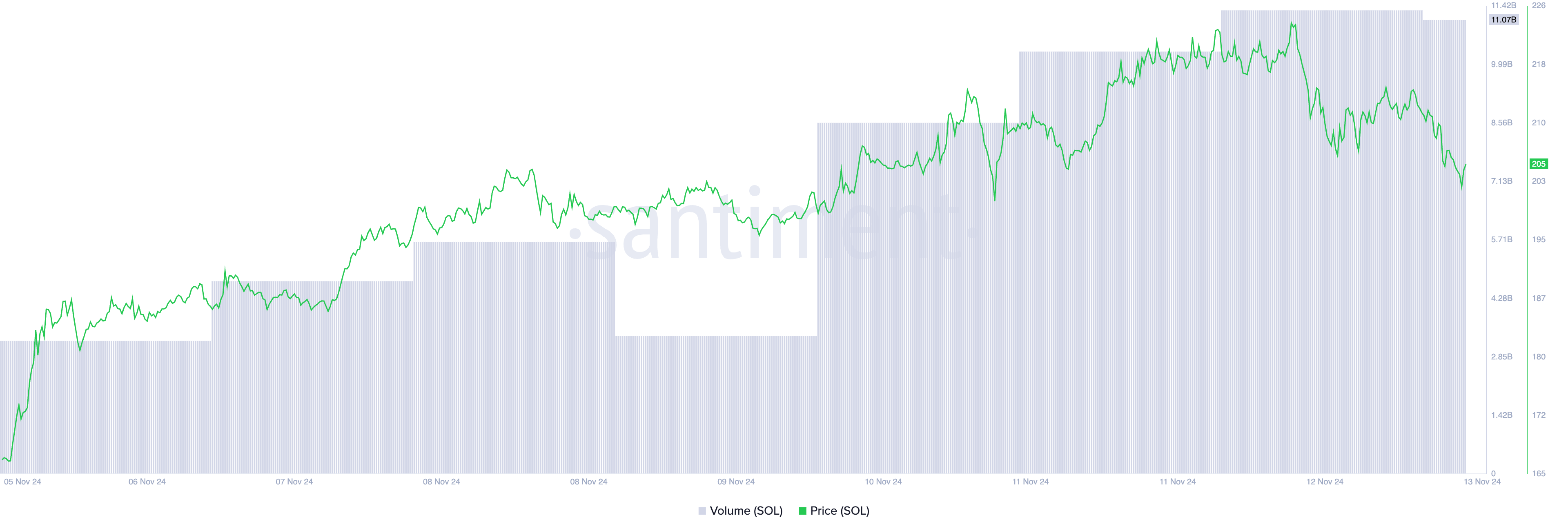

SOL at present trades at $202.51, noting a 5% decline in worth over the previous 24 hours. Notably, its buying and selling quantity has surged by 3% throughout the identical interval, highlighting the uptick in promoting stress.

When an asset’s worth declines whereas buying and selling quantity climbs, it signifies a rise in promoting exercise as extra market members actively distribute their holdings. This mixture of falling costs and rising quantity suggests a robust bearish sentiment out there.

It confirms that throughout the interval underneath overview, many SOL merchants have chosen to promote their cash moderately than purchase extra. This has pushed the coin’s worth downward as the availability being offered has overwhelmed the demand to buy it.

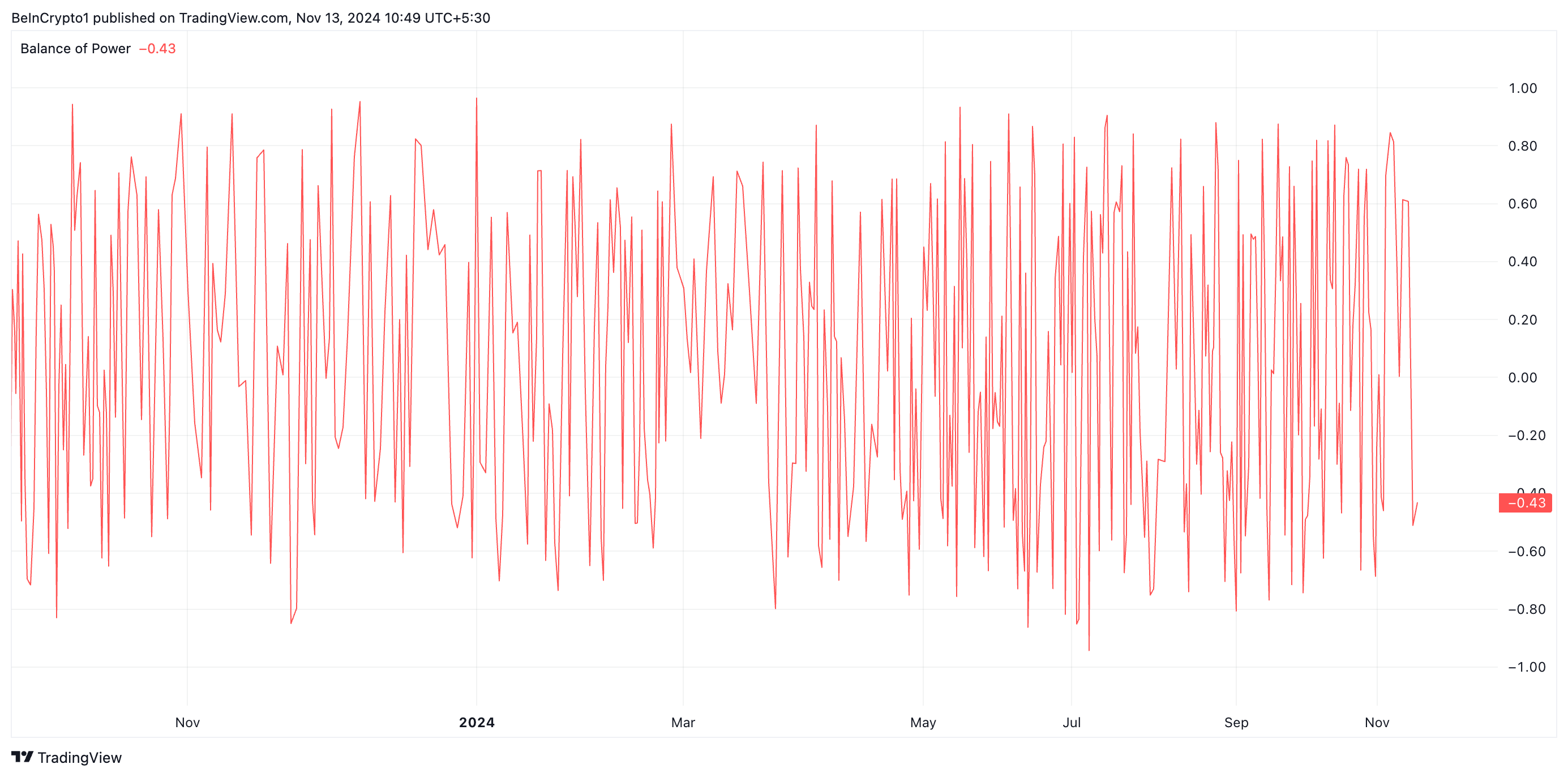

Furthermore, the coin’s destructive Stability of Energy (BoP) helps this bearish outlook. This indicator, which measures the energy of consumers versus sellers out there, is at -0.43 at press time. A destructive BoP suggests sellers are in management and making an attempt to push the asset’s worth additional downward.

SOL Value Prediction: The $193.92 Value Degree Is Key

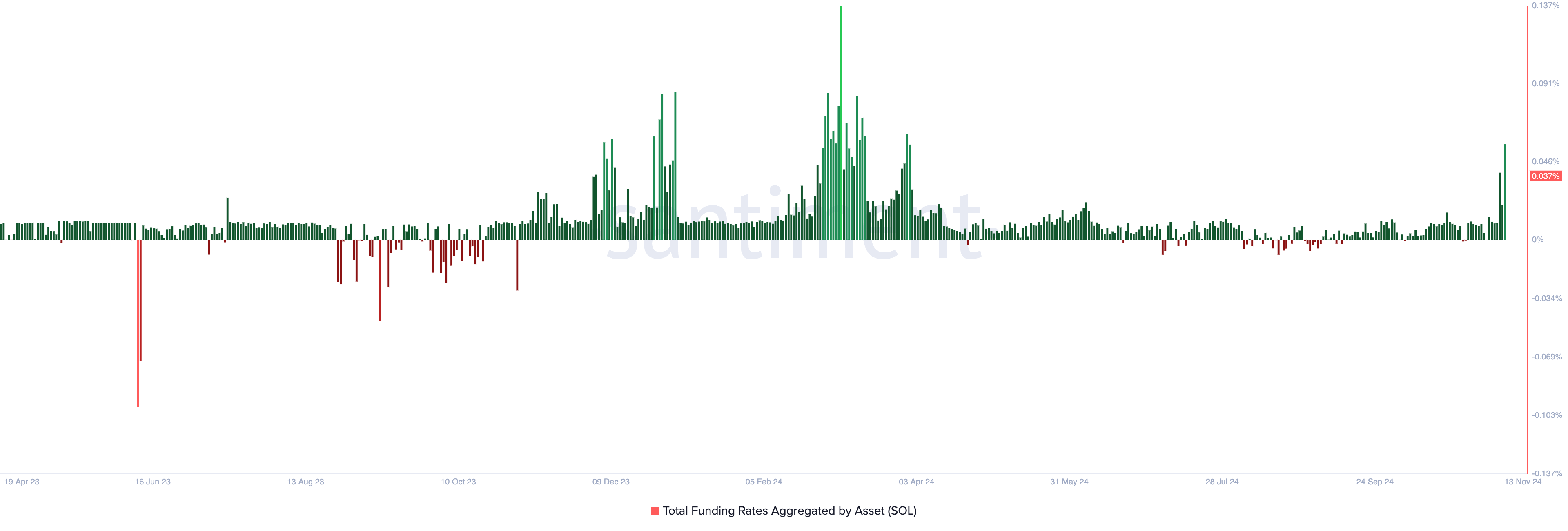

Moreover, the surge in Solana’s funding fee suggests a chance of a continued pullback beneath the $200 worth mark. As of this writing, it has spiked to an eight-month excessive of 0.037%.

The funding fee is a mechanism utilized in perpetual futures contracts to maintain the contract’s worth aligned with the spot worth of the underlying asset. When the funding fee spikes, it typically signifies a robust market imbalance—sometimes with consumers in management. That is seen as a bearish sign, which indicators an imminent worth pullback.

This occurs as a result of as holding lengthy positions turns into expensive, some merchants could decide to shut out to keep away from excessive funding charges, which may create downward stress on the asset’s worth. Moreover, if the asset’s worth begins to say no, extremely leveraged lengthy positions are vulnerable to liquidation, probably triggering a cascade impact that might drive the worth down much more.

At press time, SOL is buying and selling at $202.51, holding simply above its help degree of $193.92. Growing promoting stress might drive the coin’s worth to retest this important help. If bulls are unable to defend this degree, it confirms the downtrend, pushing SOL’s worth additional down towards $169.36.

Alternatively, a robust protection of this help degree might result in a rebound, reinitiating the Solana worth surge. If this occurs, SOL’s uptrend has the potential momentum to retest its three-year excessive of $225.21.

Disclaimer

According to the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.