On-chain information reveals that there have been persistent outflows from main cryptocurrency alternate Binance, at the same time as the value of Bitcoin hovers across the $90,000 mark, down from a brand new all-time excessive above $93,000.

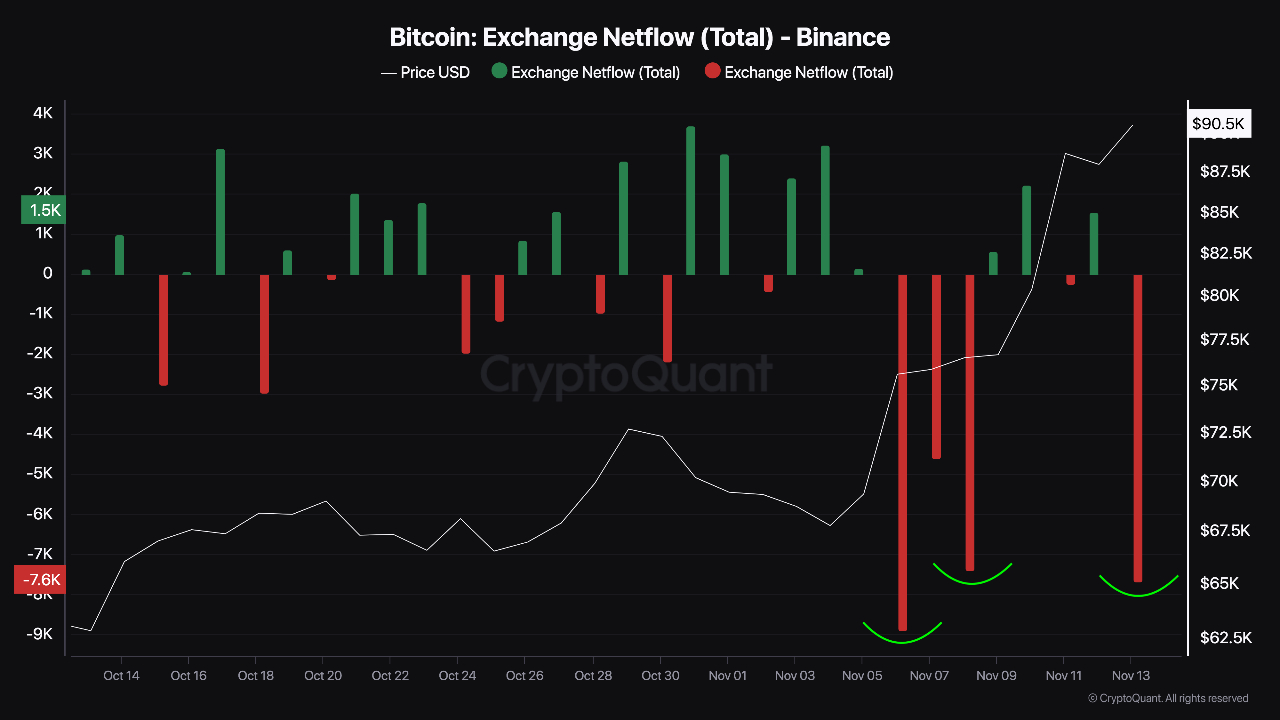

As highlighted by a latest CryptoQuant Quicktake publish, Binance’s Alternate Netflow has constantly registered damaging values over the previous few weeks. The metric tracks the online motion of Bitcoin into or out of alternate wallets, with a damaging worth indicating a web outflow, suggesting that holders are opting to retailer their Bitcoin in self-custodial wallets, a bullish signal for the long-term outlook of the cryptocurrency.

Internet outflows are interpreted as a bullish sign given Bitcoin’s restricted provide, as extra cash being saved on-chain suggests accessible provide on exchanges is dropping, resulting in potential value will increase if demand stays or will increase.

A chart offered by CryptoQuant illustrates the numerous damaging spikes in Bitcoin Alternate Netflow for Binance earlier this month, coinciding with the latest rally. These large-scale accumulation strikes doubtless contributed to the value surge.

The outflows come because the spot Bitcoin exchange-traded fund (ETF) supplied by the world’s largest asset supervisor BlackRock, the iShares Bitcoin Belief (IBIT), has seen over $3 billion of inflows over the previous 5 days.

As CryptoGlobe reported, the spot Bitcoin ETFs launched in the US earlier this yr have seen their whole belongings cross the $90 billion mark after seeing a $6 billion ump in a single day, and are actually over three-thirds of the way in which of surpassing gold ETFs in belongings.

That’s based on senior Bloomberg ETF analyst Eric Balchunas, who on the microblogging platform X (previously often called Twitter) identified that spot Bitcoin ETFs’ $6 billion leap in a day got here with $1 billion of inflows, and $5 billion of market appreciation amid a big BTC value rise.

Notably, cryptocurrency funding merchandise have additionally been seeing vital inflows, bringing in $1.98 billion within the week after Republican candidate Donald Trump gained the US presidential elections.

In response to CoinShares newest Digital Asset Fund Flows report, the inflows couple with the cryptocurrency market rally have pushed the whole belongings below administration of crypto funding merchandise to a $116 billion excessive.

The report particulars that Bitcoin-focused funding merchandise noticed $1.79 billion inflows over the previous week, whereas Ethereum-focused merchandise noticed $157 million inflows.

Featured picture through Unsplash.