The spot Bitcoin exchange-traded fund (ETF) provided by the world’s largest asset supervisor BlackRock, the iShares Bitcoin Belief (IBIT), has seen over $3 billion of inflows over the previous 5 days.

Based on information from Farside Buyers, on November 7 BlackRock’s fund noticed $1.119 billion inflows, whereas on the next day its inflows topped the $206 million mark. Initially of this week, the fund noticed $756.5 million coming in, whereas on November 12 it introduced in $778.3 million. On November 13, IBIT noticed $230.8 million inflows.

In whole, the fund noticed over $3 billion inflows, at a time during which cryptocurrency costs have been surging. Over the previous week, BTC’s rise rose 21.1% to now commerce at $90,700, down from a brand new all-time excessive round $93,000.

As CryptoGlobe reported, the spot Bitcoin ETFs launched in the US earlier this 12 months have seen their whole belongings cross the $90 billion mark after seeing a $6 billion ump in a single day, and are actually over three-thirds of the way in which of surpassing gold ETFs in belongings.

That’s in accordance with senior Bloomberg ETF analyst Eric Balchunas, who on the microblogging platform X (previously often known as Twitter) identified that spot Bitcoin ETFs’ $6 billion bounce in a day got here with $1 billion of inflows, and $5 billion of market appreciation amid a major BTC value rise.

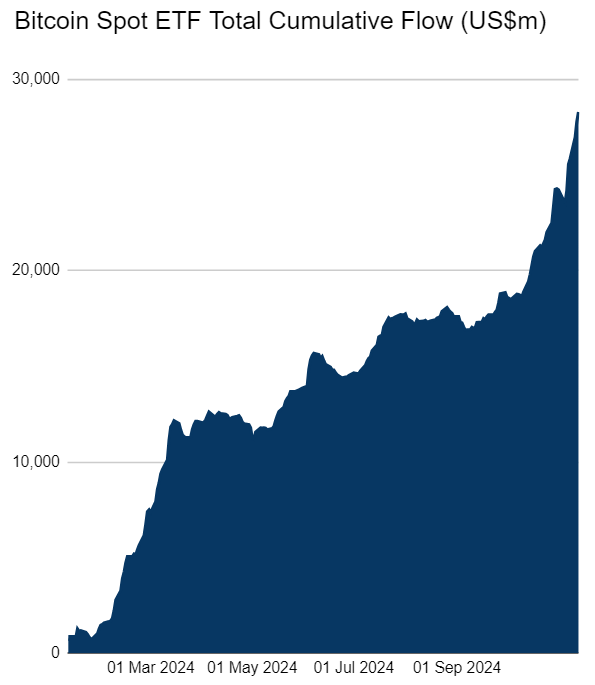

Based on Farside Buyers’ information, spot Bitcoin ETFs’ whole cumulative circulate is at $28.3 billion.

Notably, cryptocurrency funding merchandise have additionally been seeing vital inflows, bringing in $1.98 billion within the week after Republican candidate Donald Trump gained the US presidential elections.

Based on CoinShares newest Digital Asset Fund Flows report, the inflows couple with the cryptocurrency market rally have pushed the overall belongings underneath administration of crypto funding merchandise to a $116 billion excessive.

The report particulars that Bitcoin-focused funding merchandise noticed $1.79 billion inflows over the previous week, whereas Ethereum-focused merchandise noticed $157 million inflows.

Featured picture through Pexels.