Este artículo también está disponible en español.

Bitcoin (BTC) has been on a tear not too long ago, hitting a number of all-time highs (ATH) ranges since Donald Trump emerged victorious within the 2024 US presidential elections. Though the highest cryptocurrency has witnessed a slight pullback up to now 24 hours, rebounding to an earlier value stage might spell hassle for the bears.

Bitcoin Bears May Be Beneath Bother

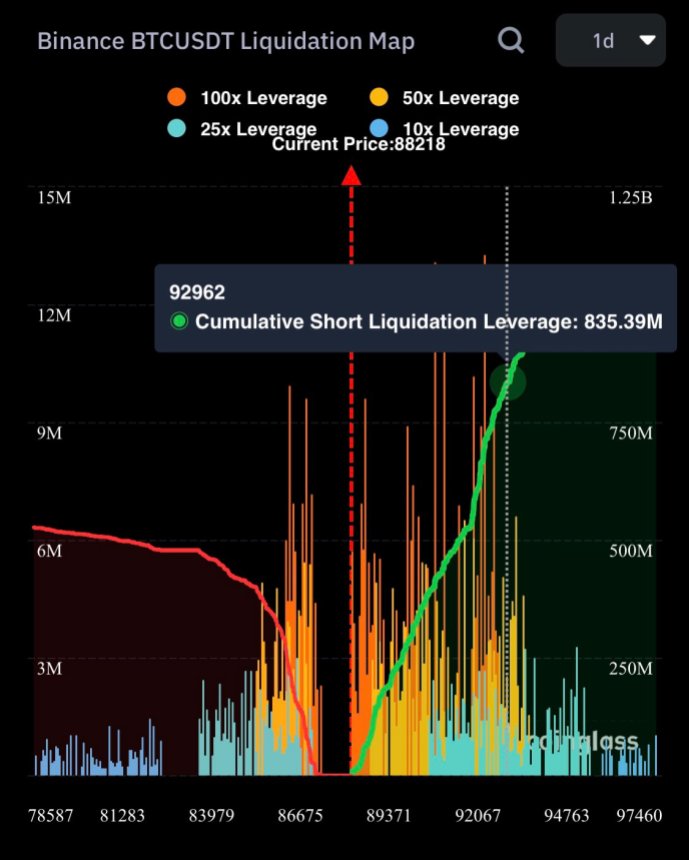

In line with evaluation shared by crypto analyst Ali Martinez on X, greater than $800 million is susceptible to liquidation if the flagship digital asset reclaims the $93,000 value stage. Notably, BTC’s present ATH stands at $93,477.

Associated Studying

On the time of writing, BTC is buying and selling at $89,480, down 1.9% up to now 24 hours. On the 4-hour chart, BTC’s subsequent outstanding help stage seems to be across the $86,000.

The digital asset has already examined this help stage 3 times, and an extra dip to this value might ship BTC tumbling towards $81,600, its subsequent main help. If BTC fails to carry above $81,600, a decline to $79,700 might observe.

Whereas a decrease BTC value would favor the bears, a reclaim of the $93,000 stage might severely damage them. Such a transfer would danger over $800 million in liquidations, doubtlessly forcing bearish merchants to capitulate.

Knowledge from Coinglass reveals that contracts price greater than $508 million had been liquidated up to now 24 hours. Of this, $355 million had been lengthy, whereas $153 million had been brief.

A latest evaluation by outstanding crypto analyst @CryptoKaleo suggests that Martinez’s warning for bears could also be justified. In line with @CryptoKaleo, BTC might retrace to $86,000 earlier than embarking on one other rally to set new ATHs – probably past $100,000. The analyst said:

Just a bit dip and a bit extra ranging then ship to $100K+. Truthfully assume that is the very best case state of affairs for alts if we someway get it. Would search for outperformance whereas BTC is accumulating round $90K.

What’s Behind BTC’s Run?

A number of components have contributed to BTC’s historic value motion, together with the halving earlier this yr, the approval of Bitcoin exchange-traded funds (ETFs), and rising institutional adoption of the digital asset.

Associated Studying

Nevertheless, Trump’s win within the 2024 US presidential elections – a end result seen as pro-crypto – served as a serious catalyst for BTC’s surge. Since Trump’s victory on November 5, BTC has climbed from round $69,000 to a excessive of $93,000, recording features of greater than 30% in simply 10 days.

Regardless of this spectacular value rally, specialists counsel that BTC might have additional room to develop. As an illustration, a latest analysis report predicts that BTC’s bullish momentum might proceed till mid-2025 when it’s anticipated to peak.

Moreover, comparatively low profit-taking throughout this bull run might additional propel BTC to new heights. Nevertheless, bulls ought to stay cautious of a big CME hole across the $78,000 stage, which may very well be a magnet for value correction.

On the time of writing, the full cryptocurrency market capitalization stands at $2.904 trillion, reflecting a 3.7% decline over the previous 24 hours. In the meantime, Bitcoin dominance is at 60.97%, underscoring BTC’s continued power out there.

Featured picture from Unsplash, Charts from X, Coinglass, and Tradingview.com