Reviews counsel that Gary Gensler, Chair of the US Securities and Trade Fee (SEC), could step down earlier than Donald Trump assumes workplace in January.

Hypothesis round Gensler’s resignation follows rising backlash from the crypto group in opposition to his management on the regulatory company.

Gensler Might Resign SEC Function Earlier than January

On November 15, Fox Enterprise reporter Eleanor Terrett hinted that Gensler might announce his resignation shortly after Thanksgiving.

“It’s anybody’s guess when his resignation announcement will come, however chatter in DC circles is that he’ll seemingly announce after Thanksgiving his intention to exit in early January, forward of Trump’s inauguration,” Terrett mentioned.

Notably, current remarks from Gensler himself add to the hypothesis. In a Nov. 14 speech, he expressed satisfaction in his service on the SEC, calling consideration to the company’s efforts to guard American buyers. Gensler’s speech additionally included reflections on his tenure and what some interpreted as a farewell message.

“I’ve been proud to serve with my colleagues on the SEC who, day in and time out, work to guard American households on the highways of finance,” Gensler wrote.

Throughout his management, the SEC authorised the primary spot crypto exchange-traded funds (ETFs), which Gensler described as a major step ahead. He positioned this as a distinction to prior administrations that had blocked comparable developments.

Nevertheless, his tenure has been marked by intense criticism from the crypto sector. Tyler Winklevoss, co-founder of Gemini, accused Gensler of harming the business by a heavy-handed regulatory method. Winklevoss argued that Gensler prioritized private ambitions over honest regulation, describing his actions as damaging and deliberate.

Winklevoss warned the crypto group in opposition to associating with Gensler sooner or later, stating:

“No quantity of apology can undo the injury he has executed to our business and our nation. This sort of individual has no place at any establishment, large or small. People have had sufficient of their tax {dollars} going in direction of a authorities that’s supposed to guard them, however as an alternative is wielded in opposition to them by politicians trying to advance their careers.”

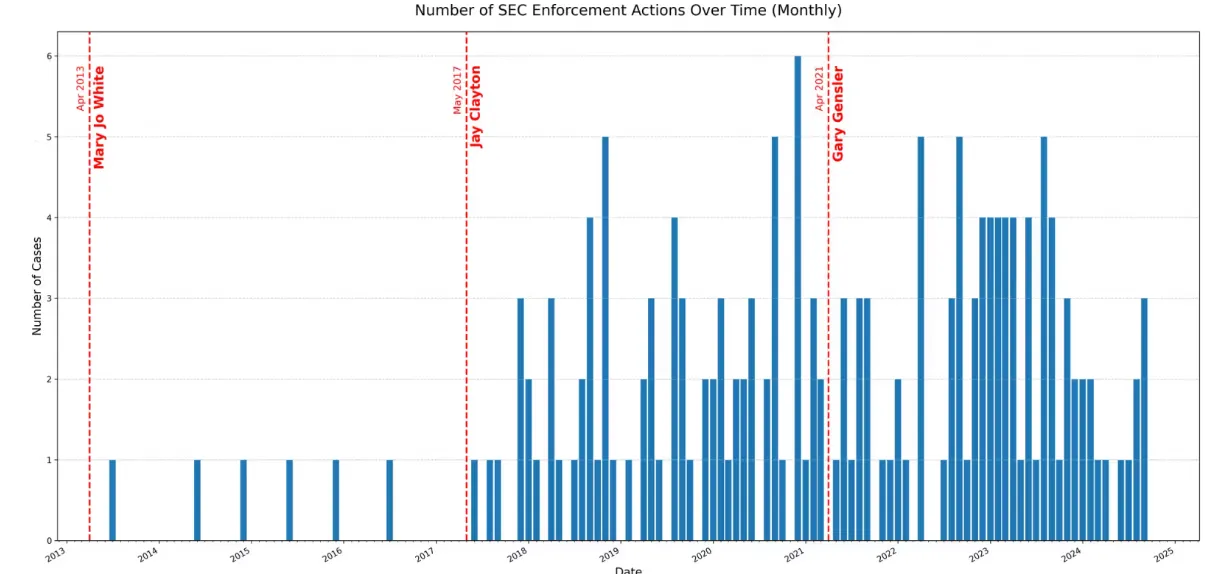

Gensler’s SEC has pursued high-profile enforcement actions in opposition to main crypto corporations, together with Binance, Coinbase, and Ripple. Critics declare this enforcement-heavy technique has stifled innovation and created an adversarial relationship between regulators and the business.

Eyes on Gensler’s Successor

As hypothesis about Gensler’s resignation grows, consideration has shifted to his potential substitute beneath Trump’s administration. Attainable candidates embrace Robinhood’s Chief Authorized Officer Dan Gallagher, former SEC Basic Counsel Bob Stebbins, and present Republican SEC Commissioner Mark Uyeda.

Though Gallagher seems reluctant to just accept the function, former SEC Chair Jay Clayton has endorsed Stebbins. Different contenders reportedly embrace Brad Bondi, Paul Atkins, Heath Tarbert, and Norm Champ.

The following SEC Chair will inherit a divided regulatory panorama and face the problem of repairing strained relations with the cryptocurrency sector. Because the business continues to evolve, the SEC’s method beneath new management will play a vital function in shaping the way forward for crypto in the US.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.