Este artículo también está disponible en español.

Bitcoin has maintained its bullish momentum over the weekend, solidifying its place above the $90,000 mark. This milestone showcases Bitcoin’s resilience because it continues to captivate traders with its upward trajectory. The market has been buzzing with optimism as Bitcoin inches nearer to new highs. Nonetheless, latest on-chain information suggests {that a} potential pullback might be on the horizon.

Associated Studying

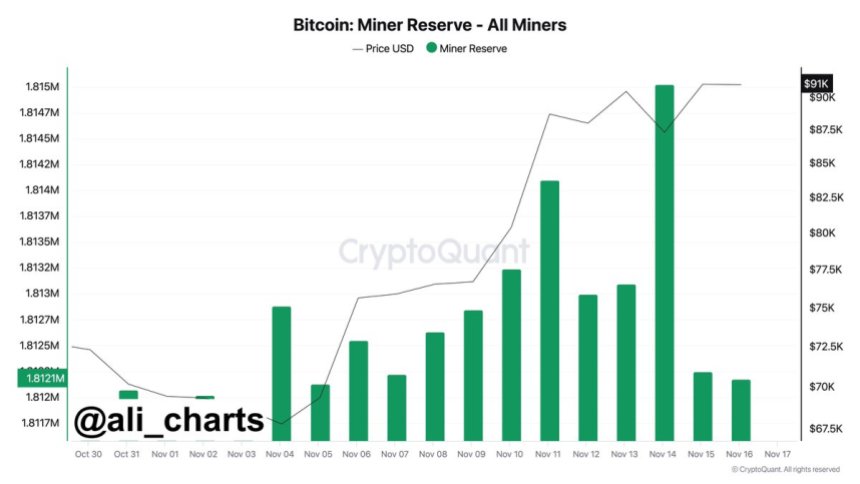

Key information from CryptoQuant reveals that Bitcoin miners have bought over 3,000 BTC prior to now 48 hours. This wave of miner profit-taking typically alerts a cooling section, because it introduces extra provide into the market. Whereas the promoting exercise shouldn’t be unusual in periods of sturdy worth motion, it may result in a short-term consolidation section beneath the all-time excessive of $93,400 set earlier this week.

Regardless of this, Bitcoin’s potential to carry above $90,000 highlights sturdy underlying demand and strong market sentiment. Traders and analysts are intently watching the approaching days to see if Bitcoin can take up this promoting stress and preserve its bullish trajectory.

Bitcoin Seems to be Very Robust

Bitcoin’s worth motion has remained strong, breaking all-time highs a number of instances over the previous 11 days and reaffirming its bullish momentum. Nonetheless, after such an aggressive upward motion, the market seems to be getting into a interval of consolidation as some traders and entities lock in earnings.

Crypto analyst Ali Martinez shared key information on X that highlights that Bitcoin miners have bought over 3,000 BTC prior to now 48 hours, valued at roughly $273 million. This promoting exercise means that miners, sometimes long-term holders, are taking earnings amid the latest surge. Such strikes are widespread throughout sturdy bull runs and may point out that market members anticipate a short-term worth plateau or retrace.

Whereas miner promoting is a pure a part of market dynamics, sustained exercise of this type may sign a shift in sentiment. If promoting stress persists, it’d push Bitcoin towards decrease demand zones, offering potential re-entry alternatives for sidelined traders.

Associated Studying

Presently, Bitcoin’s potential to soak up this promoting stress will decide whether or not the present bullish development stays intact. A short consolidation section could also be useful, permitting the market to ascertain a stronger basis for the following leg up. For now, traders are intently watching key ranges to gauge the potential for continued progress or a deeper correction.

BTC Holds Regular Above $90,000

Bitcoin is presently buying and selling at $90,600 after a unstable few days that noticed its worth vary between its all-time excessive of $93,483 and a neighborhood low of $86,600. This consolidation comes after aggressive bullish momentum that set new data, leaving traders and analysts watching the following strikes intently.

Regardless of the latest cooling off, Bitcoin’s worth motion stays sturdy, supported by rising demand and total bullish sentiment. If Bitcoin can maintain above the $86,000 degree over the following few days, a renewed surge to problem and probably surpass its all-time excessive appears believable. The market has proven resilience, with recent demand persevering with to emerge at the same time as minor profit-taking happens.

Associated Studying

Nonetheless, there’s a threat of a deeper retracement. Ought to Bitcoin lose help at $86,000, it could seemingly check decrease demand ranges, looking for a powerful base to gasoline its subsequent upward transfer. Key help zones may present the muse for renewed shopping for curiosity and set the stage for the following bullish section.

Featured picture from Dall-E, chart from TradingView