Cathie Wooden, the CEO of Ark Make investments, has shared an epic Bitcoin value prediction.

She reaffirmed her optimistic outlook on Bitcoin, predicting a base value of $650,000 by 2030, with the opportunity of reaching as excessive as $1.5 million beneath extra favorable circumstances.

Wooden, a distinguished advocate for Bitcoin who started investing within the cryptocurrency in 2015, attributes her confidence to 2 major components driving its development.

In an interview with CNBC on Friday, she emphasised that rising regulatory readability is a vital growth that would bolster the cryptocurrency market, easing considerations and paving the way in which for broader adoption.

She additionally identified the rising curiosity from institutional buyers, who’re starting to understand Bitcoin’s distinctive attributes in comparison with conventional belongings. This distinction, in response to Wooden, is strengthening Bitcoin’s place as a priceless asset class and an important software for portfolio diversification.

Bitcoin outpaces historic averages in November

Based on information supplied by ARK Make investments, Bitcoin’s value as of Nov. 13, 2024, was 1.33 instances increased than its earlier cycle peak of $67,589 on Nov. 8, 2021.

Notably, Bitcoin’s most drawdown in the course of the 2022 bear market was 76.9%, which is a smaller decline in comparison with earlier cycle drops of 86.3% in 2018, 85.1% in 2015 and 93.5% in 2011.

Because the final cycle low, Bitcoin’s value has elevated 5.72 instances, intently mirroring the 5.18x and 5.93x development seen at equal factors within the 2015-2018 and 2018-2022 cycles, respectively.

If Bitcoin continues to comply with the common trajectory of those two cycles, its value might probably enhance 15.4 instances to round $243,000 in the course of the subsequent yr, roughly 880 days after the November 2021 cycle low.

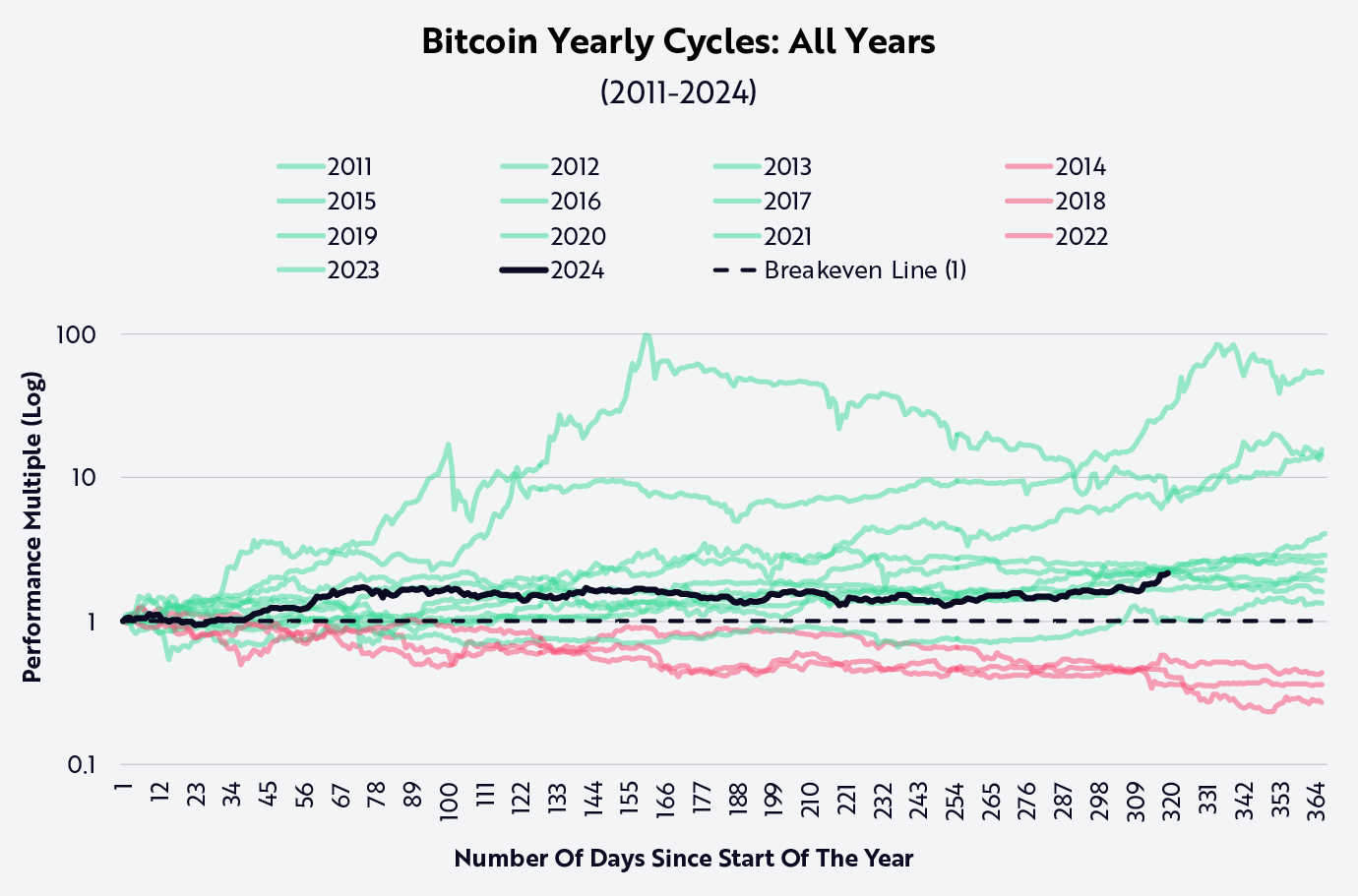

By November 2024, Bitcoin’s value had risen 114.1% year-to-date, or 2.14 instances, marking robust development in comparison with its common annual efficiency.

Whereas this a number of exceeded the two.06x common throughout all years sampled from 2011 to 2023 and the two.04x common for halving years similar to 2012, 2016 and 2020, it lagged behind a few of the highest annual returns in prior cycles.

In 2024, Bitcoin skilled a notable overbought surge within the second quarter following the launch of U.S.-based spot Bitcoin ETFs. Nevertheless, a protracted oversold interval ensued as a result of elevated provide from authorities seizures and repayments to Mt. Gox collectors.

As of November, Bitcoin’s efficiency a number of outpaced historic averages, and projections counsel that if it aligns with previous developments, its value might vary between $104,000 and $124,000 by the tip of 2024, leading to efficiency multiples of two.48x to 2.94x.

With institutional adoption gaining traction and discussions across the U.S. authorities probably including Bitcoin to its strategic reserves, a robust near 2024 is anticipated, setting the stage for sustained momentum into 2025.