MicroStrategy’s determination to shift from conventional money reserves to Bitcoin has reshaped its monetary profile, catapulting the corporate into the highlight as a pacesetter in digital asset adoption.

This transformation coincides with Bitcoin’s latest surge to unprecedented worth ranges, considerably boosting MicroStrategy’s standing in company monetary rankings.

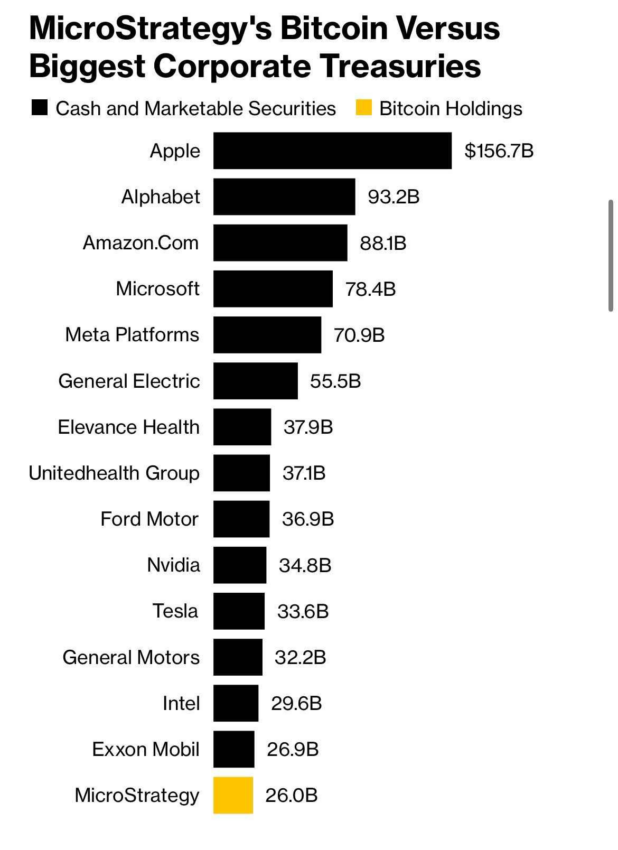

Bitcoin-Targeted MicroStrategy Outshines IBM and Nike in Asset Reserves

The corporate’s Bitcoin stash, now valued at roughly $26 billion, reportedly surpasses the money and liquid belongings held by giants like IBM, Nike, and Johnson & Johnson. For comparability, CompaniesMarketCap information reveals that Nike’s reported money and securities totaled $10.9 billion as of August, whereas IBM held $13.7 billion. Johnson & Johnson’s newest quarterly figures listed $20.29 billion.

This monetary place reveals that the area of interest software program supplier has redefined its identification by embracing Bitcoin as a core monetary asset. Nevertheless, regardless of this spectacular place, MicroStrategy nonetheless trails round 14 firms, together with Apple and Alphabet, by way of company treasury belongings.

The corporate started buying Bitcoin in 2020 as a countermeasure towards inflation and declining income development. Initially funded by way of operational money movement, these purchases expanded to incorporate capital raised through inventory gross sales and convertible debt issuance.

So far, MicroStrategy has amassed 279,240 BTC at a mean acquisition price of $42,888, with a complete funding of roughly $11.9 billion. This positions the agency as the biggest publicly traded Bitcoin holder, controlling round 1.3% of the cryptocurrency’s whole provide.

What initially confronted skepticism has now grow to be a significant draw for buyers in search of oblique publicity to Bitcoin. The shift in sentiment has propelled MicroStrategy’s inventory by over 2,500% since 2020. This aligns with Bitcoin’s outstanding 700% worth development throughout the identical timeframe.

At present, the unrealized revenue of MicroStrategy’s Bitcoin holdings stands at $13.4 billion, representing a 112% improve. The agency’s Bitcoin yield — measuring the connection between its Bitcoin holdings and excellent shares — has risen 26.4% year-to-date.

Nevertheless, MicroStrategy’s govt chairman, Michael Saylor, stays steadfast within the firm’s Bitcoin-centric imaginative and prescient. The agency plans to lift $42 billion over the approaching years to broaden its Bitcoin holdings additional. In the meantime, MicroStrategy goals to remodel right into a trillion-dollar Bitcoin financial institution, solidifying its position as a pioneer in company Bitcoin adoption.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.