Crypto markets have a number of US financial knowledge to stay up for this week. The occasions have the potential to affect merchants’ and traders’ sentiment and, subsequently, buying and selling methods, with volatility more likely to comply with.

As merchants place themselves for doable volatility, Bitcoin (BTC) is holding above the $90,000 psychological degree as of this writing.

Preliminary Jobless Claims

The US Division of Labor releases weekly jobless claims knowledge, monitoring people making use of for unemployment advantages. This week’s report, set for Thursday, Nov. 21, follows preliminary claims for the week ending Nov. 16 totaling 217,000. This determine got here in beneath the anticipated 223,000 and marked a lower from the prior week’s unrevised rely of 221,000.

“Jobless claims (LEADING Indicator) proceed to recommend the labor market may be very wholesome,” mentioned $15.6 billion AUM Richard Bernstein Advisors.

The newest jobless claims figures point out regular demand for staff, even after latest disruptions from storms and strikes. If this downward pattern persists, it could sign an easing of financial challenges and a strengthening labor market. This might increase client spending and confidence, probably benefiting monetary markets.

When jobless claims lower, it means that extra persons are employed or capable of finding work. The result’s increased disposable revenue and elevated funding in property like Bitcoin.

S&P International US Manufacturing PMI

The S&P International US Manufacturing Buying Managers’ Index (PMI) for November is due for launch on Friday. It’s a key financial indicator measuring the efficiency and well being of the US manufacturing sector. With a earlier studying of 48.5 and a 48.8 consensus forecast, this metric is among the many US macroeconomic indicators on the watchlist this week.

The next PMI studying sometimes signifies enlargement within the manufacturing business, thus sturdy financial progress and elevated manufacturing exercise. This might increase investor confidence within the general economic system. This constructive sentiment might spill over into the cryptocurrency market as traders search higher-yield funding alternatives like Bitcoin.

In the identical approach, the PMI knowledge can affect market sentiment and danger urge for food amongst traders. Constructive PMI figures might result in a extra optimistic funding setting, probably benefiting danger property like crypto.

S&P International Providers PMI

One other US financial knowledge level is the S&P International Providers Buying Managers’ Index (PMI), due for launch on Friday. This indicator measures the efficiency of the US providers sector and gives beneficial insights into financial exercise and enterprise sentiment in service industries reminiscent of hospitality, finance, healthcare, and expertise.

After a earlier studying of 54.1, adjustments within the Providers PMI also can have implications for Bitcoin and the broader cryptocurrency market. The next Providers PMI studying sometimes indicators progress within the providers sector, which is a major driver of financial exercise. This might translate to constructive sentiment in monetary markets, probably benefiting cryptocurrencies like Bitcoin as traders search various property with progress potential.

A powerful Providers PMI may additionally increase optimism in regards to the enterprise setting, main traders to tackle extra danger, together with funding in cryptocurrencies.

“The primary indications of financial traits on the planet’s main economies after the US Presidential Election might be eagerly awaited from the November flash PMI surveys, with US client confidence additionally due,” the PMI insights account famous.

Nvidia Company Earnings

Nvidia (NVDA), the GPU chief, is about to announce its Q3 earnings on Wednesday, Nov. 20. The report usually highlights GPU demand for gaming, AI, and crypto mining. Analysts are projecting an 84% surge in income to $33.28 billion, largely fueled by AI infrastructure demand. Web revenue per share is anticipated to climb from $0.37 to $0.70.

Sturdy GPU gross sales for AI may increase investor confidence in AI-driven sectors, together with AI-focused cryptocurrencies. Traditionally, Nvidia’s efficiency has influenced the costs of AI-related tokens, with potential bullish momentum if this week’s earnings level to continued progress in AI and crypto functions.

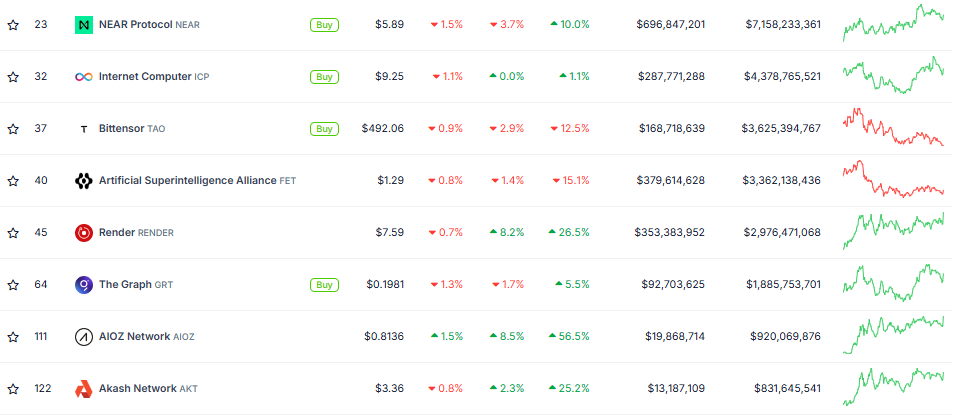

The sentiment surrounding AI shares forward of Nvidia’s Q3 earnings launch is more likely to have an effect on AI-focused cryptocurrencies reminiscent of Render (RENDER), Worldcoin (WLD), Close to Protocol (NEAR), and Bittensor (TAO). Moreover, DePin challenge Aethir (ATH), recognized for its GPU rendering capabilities and infrequently dubbed the “Nvidia of crypto,” may additionally see results from the earnings report.

Notably, Nvidia’s outcomes will come shortly after the US Supreme Court docket signaled plans for a slender ruling in a shareholder lawsuit towards the corporate. As beforehand reported by BeInCrypto, the lawsuit accuses Nvidia of deceptive traders about its dependence on crypto mining income, which may add additional volatility to each Nvidia’s inventory and associated crypto sectors.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.