MicroStrategy has as soon as once more solidified its place because the world’s largest company holder of Bitcoin. The corporate introduced its acquisition of 51,780 BTC, bringing its complete Bitcoin holdings to a staggering 331,200 BTC.

With this strategic transfer, MicroStrategy not solely strengthens its Bitcoin reserves but additionally highlights sturdy yield efficiency, reporting a quarter-to-date (QTD) yield of 20.4% and a year-to-date (YTD) yield of 41.8%.

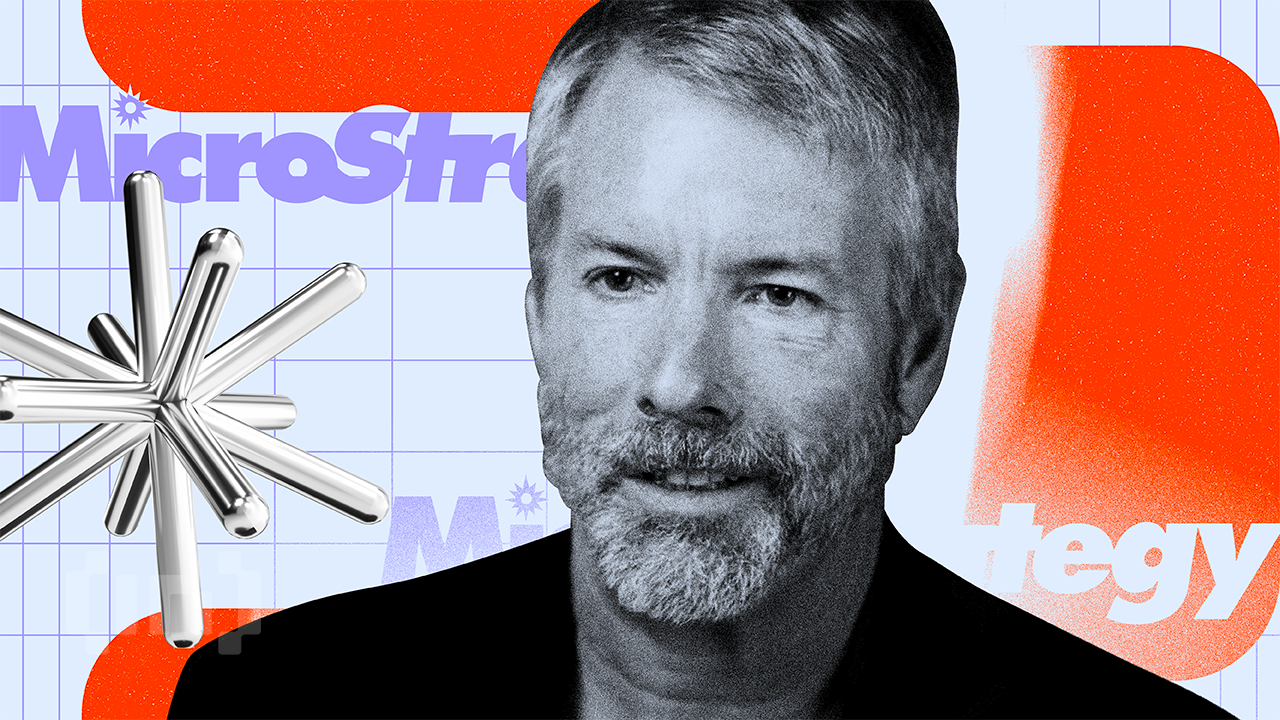

MicroStrategy Provides 51,780 BTC, Reviews Spectacular Yield Progress

This newest acquisition highlights MicroStrategy’s dedication to its Bitcoin-focused technique. The corporate has been a vocal proponent of Bitcoin as a long-term retailer of worth, typically advocating its use as a hedge towards inflation and a device for monetary independence.

That is the agency’s second BTC buy in November 2024. Between October 31 and November 10, MicroStrategy acquired 27,200 Bitcoin at a mean value of $74,463 per Bitcoin, together with charges. Earlier this week, it was reported that their BTC stash surpassed the money and liquid property held by main international firms, together with IBM, Nike, and Johnson & Johnson.

The corporate’s yield efficiency speaks volumes in regards to the effectiveness of its Bitcoin technique. A 20.4% QTD yield highlights the fast appreciation of its Bitcoin holdings over the present quarter. The much more spectacular 41.8% YTD yield demonstrates MicroStrategy’s foresight in capitalizing on Bitcoin’s restoration and progress in 2024.

The choice to accumulate Bitcoin at such a scale isn’t with out challenges. Critics typically query Bitcoin’s volatility and potential affect on MicroStrategy’s monetary stability. But, the corporate’s continued yield progress demonstrates that its technique is reaping important rewards.

The acquisition additionally hints at broader market traits. Bitcoin’s latest value restoration has probably inspired the corporate to double down on its holdings much more aggressively.

The cryptocurrency market has proven resilience, with rising institutional curiosity and adoption driving progress. By accumulating extra Bitcoin, MicroStrategy aligns itself with this momentum, betting on a continued upward trajectory.

“This morning: – MicroStrategy buys one other 51,780 BTC for $4.6B – MARA declares $700 million convert to accumulate extra BTC – Semler Scientific raises $21mm ATM and acquires 215 BTC – Metaplanet points ¥1.75B debt providing to purchase extra BTC The company Bitcoin race is heating up,” one X person commented.

With 331,200 BTC below its management, the agency now holds one of the crucial influential positions within the Bitcoin ecosystem. Its newest acquisition cements its position as a key participant, with potential implications for Bitcoin’s value actions and total market sentiment. As the corporate reaps the advantages of its daring technique, it additionally sends a robust sign to different establishments contemplating Bitcoin investments.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.