Michael Saylor’s MicroStrategy has made its largest Bitcoin buy thus far, buying 51,780 BTC for $4.6 billion at a mean acquisition value of $88,627 per coin, in accordance with a Nov. 18 submitting with the US Securities and Change Fee (SEC).

The transfer comes only a week after the agency bought 27,200 BTC for $2.03 billion. Mixed, the transactions convey the corporate’s whole Bitcoin purchases for November to just about 80,000 BTC, valued at over $6.6 billion.

These aggressive BTC purchases have bolstered its whole Bitcoin holdings to 3331,200 BTC, which it acquired for $16.5 billion at a mean value of $49,875 per coin. At present costs, these belongings are price round $30 billion.

The agency acknowledged that its newest buy pushed its BTC yield on the year-to-date metric to 41.8%. Bitcoin yield is an important key efficiency indicator the corporate makes use of to measure how its BTC funding technique impacts its shareholders.

Nonetheless, regardless of the dimensions of this acquisition, MicroStrategy’s inventory value noticed minimal motion. Pre-market buying and selling information from Google Finance reveals a slight improve of 0.23%.

MicroStrategy vs. Bitcoin ETFs

In the meantime, the most recent Bitcoin purchase means MicroStrategy has bought extra of the highest crypto than all the US spot Bitcoin exchange-traded funds this month.

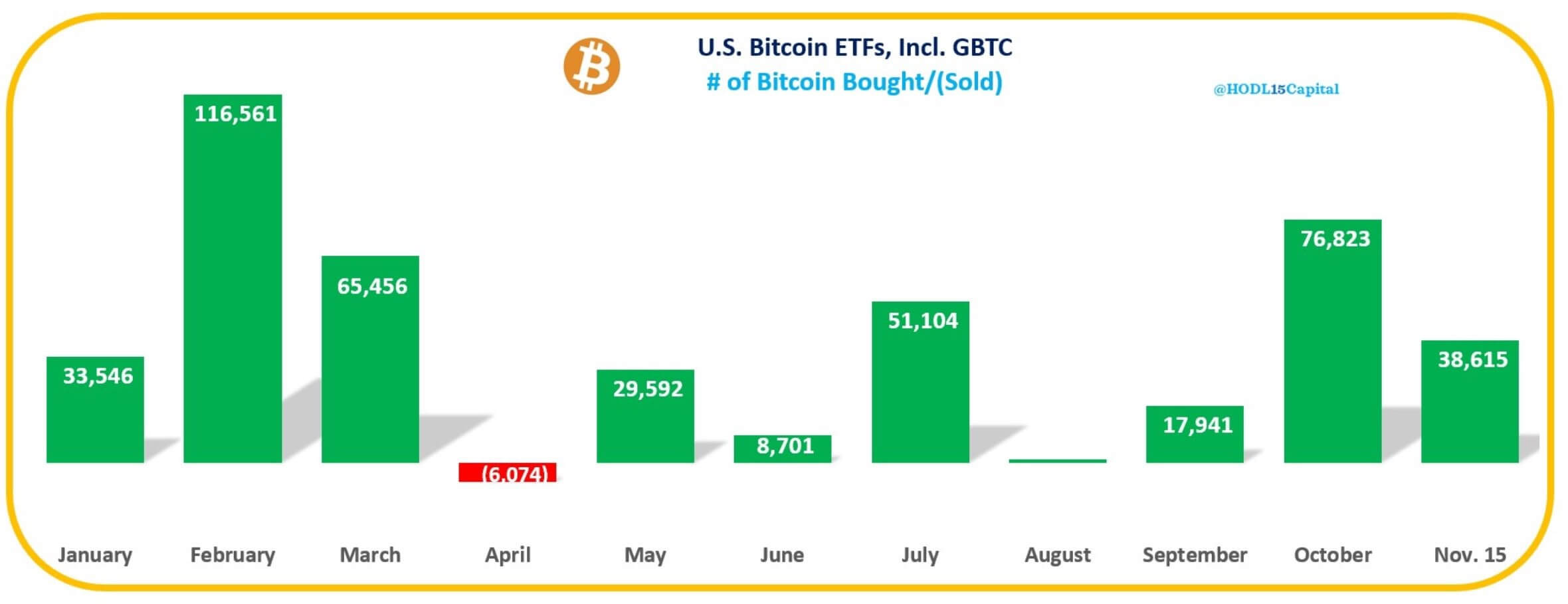

Knowledge compiled by HODL15Capital reveals that these high-flying BTC-related monetary devices have acquired 38,615 BTC as of Nov. 15. BlackRock’s IBIT led the acquisitions throughout this era, buying greater than 37,000 BTC.

Unsurprisingly, MicroStrategy’s BTC shopping for technique has drawn important market consideration for altering the software program agency’s monetary construction and positioning it as a distinguished advocate for digital asset adoption.

Market observers have identified that the agency’s company treasury reserve now surpasses all however 14 S&P 500 corporations just like the iPhone maker Apple and Google’s mother or father firm, Alphabet.