Ki Younger Ju, the CEO of analytics agency CryptoQuant says that indicators of retail participation within the Bitcoin (BTC) bull market are getting stronger.

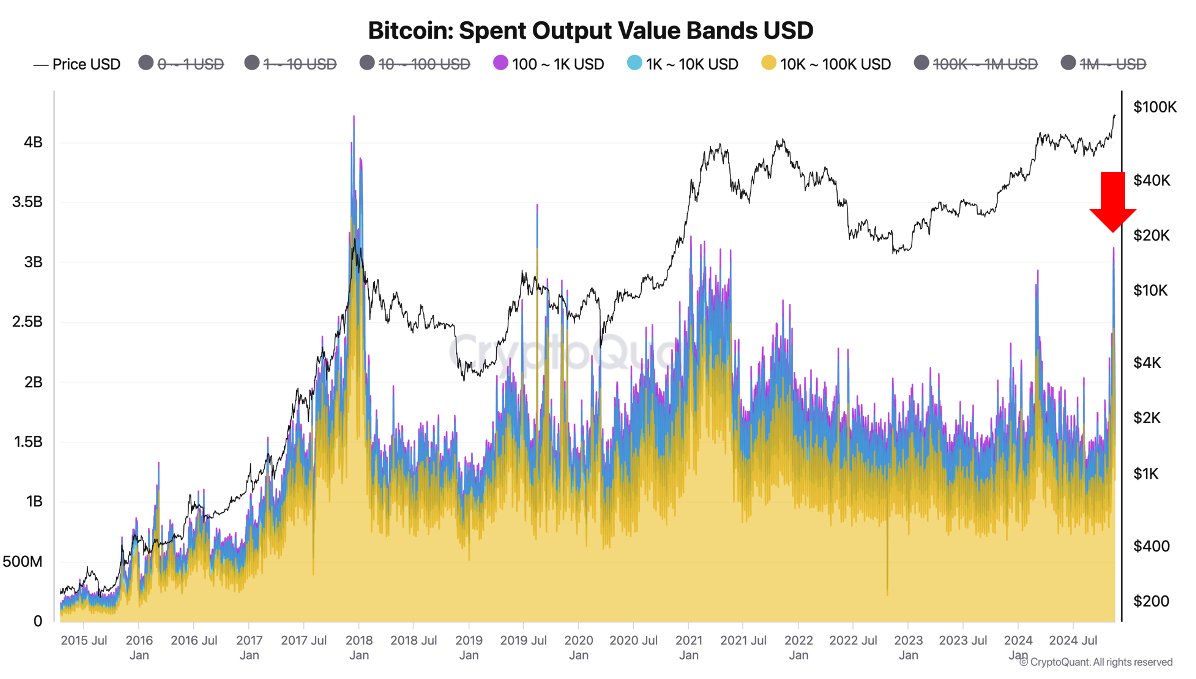

Ju tells his 369,000 followers on the social media platform X that sub-$100,000 transactions on the Bitcoin blockchain have spiked, implying that smaller retail entities are beginning to kind positions in BTC.

“Retail traders are coming: Bitcoin transaction quantity below $100K hit a 3-year excessive.”

Then again, Ju shares knowledge suggesting that bigger entities are a lot much less concerned now in comparison with late 2021 on the bull market’s high, suggesting that BTC isn’t able to enter a bear market.

“Right here’s Bitcoin transaction quantity over $1M.

If I have been a giga whale, I’d look forward to extra exit liquidity. It’s simply beginning. Think about retail in FOMO becoming a member of at $100K.

We would see some corrections, but it surely wouldn’t mark the beginning of a bear market, for my part.”

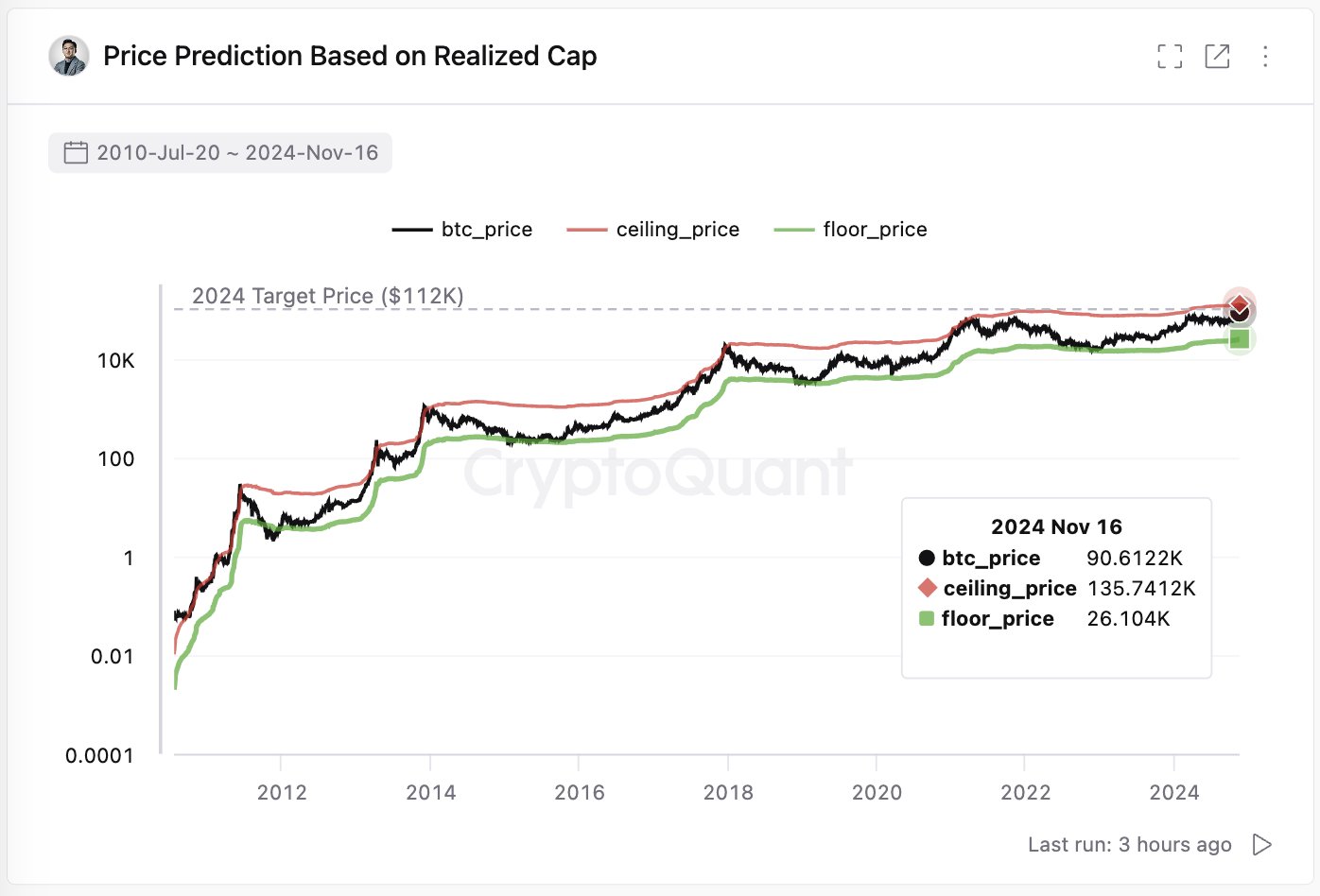

Utilizing the realized cap metric, which measures the cumulative sum of all realized income minus realized losses, Ju shares a chart pinpointing potential future bear market flooring and bull cycle tops.

The analyst says that $135,000 is a possible value goal in its present market cycle.

“We’re within the bull market. Bitcoin will go up.

Apologies for my off prediction on the short-term correction. I wasn’t implying a bear market, only a correction.

Primarily based on the cumulative capital flowing into the Bitcoin market, the present higher restrict seems to be $135K.”

At time of writing, BTC is buying and selling at $92,114.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses you could incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/ledokolua/Natalia Siiatovskaia