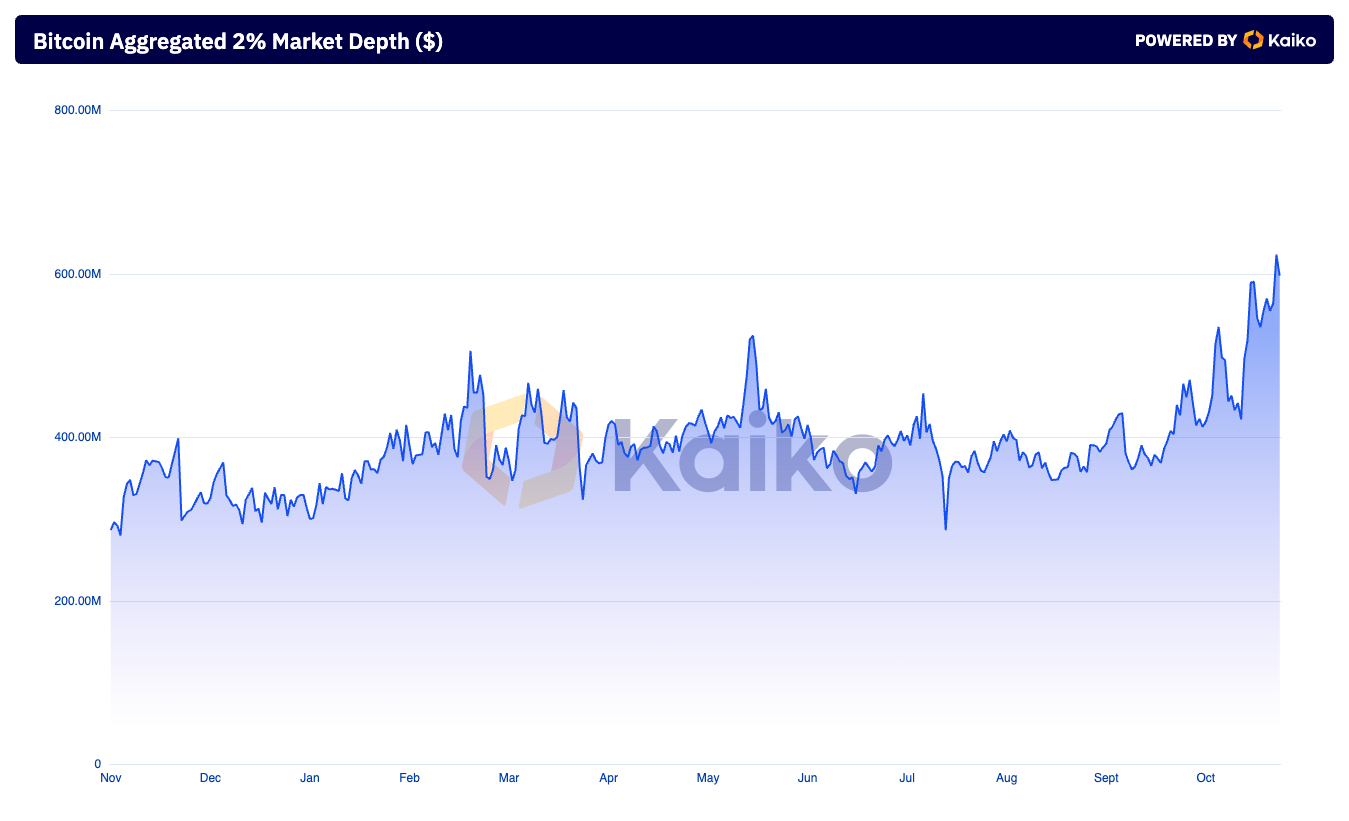

Bitcoin’s aggregated 2% market depth, a measure of liquidity that mixes purchase and promote orders inside a slim 2% value vary across the market value, has surged to a one-year excessive of $623.40 million as of Nov. 16. This represents a big improve from $422 million on Nov.5 — a big improve in liquidity over a brief interval.

It suggests rising market confidence, as deeper liquidity usually signifies that merchants and establishments are extra prepared to take part available in the market, offering a buffer towards value volatility.

This improve in market depth main as much as and following the US presidential election isn’t an remoted occasion however a part of a broader shift in macroeconomic and political situations. Donald Trump’s election and his administration’s introduced intention to assist Bitcoin and the crypto business via concrete insurance policies have catalyzed elevated market exercise.

This newfound political alignment with the crypto area possible signaled to institutional and retail traders that the regulatory setting may develop into considerably extra favorable, decreasing perceived dangers and inspiring higher participation.

The market responded enthusiastically to the prospect of a pro-crypto administration, with merchants possible decoding the information as a inexperienced gentle for broader adoption and institutional inflows. This value surge, mixed with the rise in aggregated market depth, means that market contributors have been buying and selling in response to the election outcomes and positioning for a sustained bullish development. The expanded market depth displays this elevated engagement, as deeper liquidity permits bigger orders to be executed with minimal slippage—crucial in a market experiencing fast upward value actions.

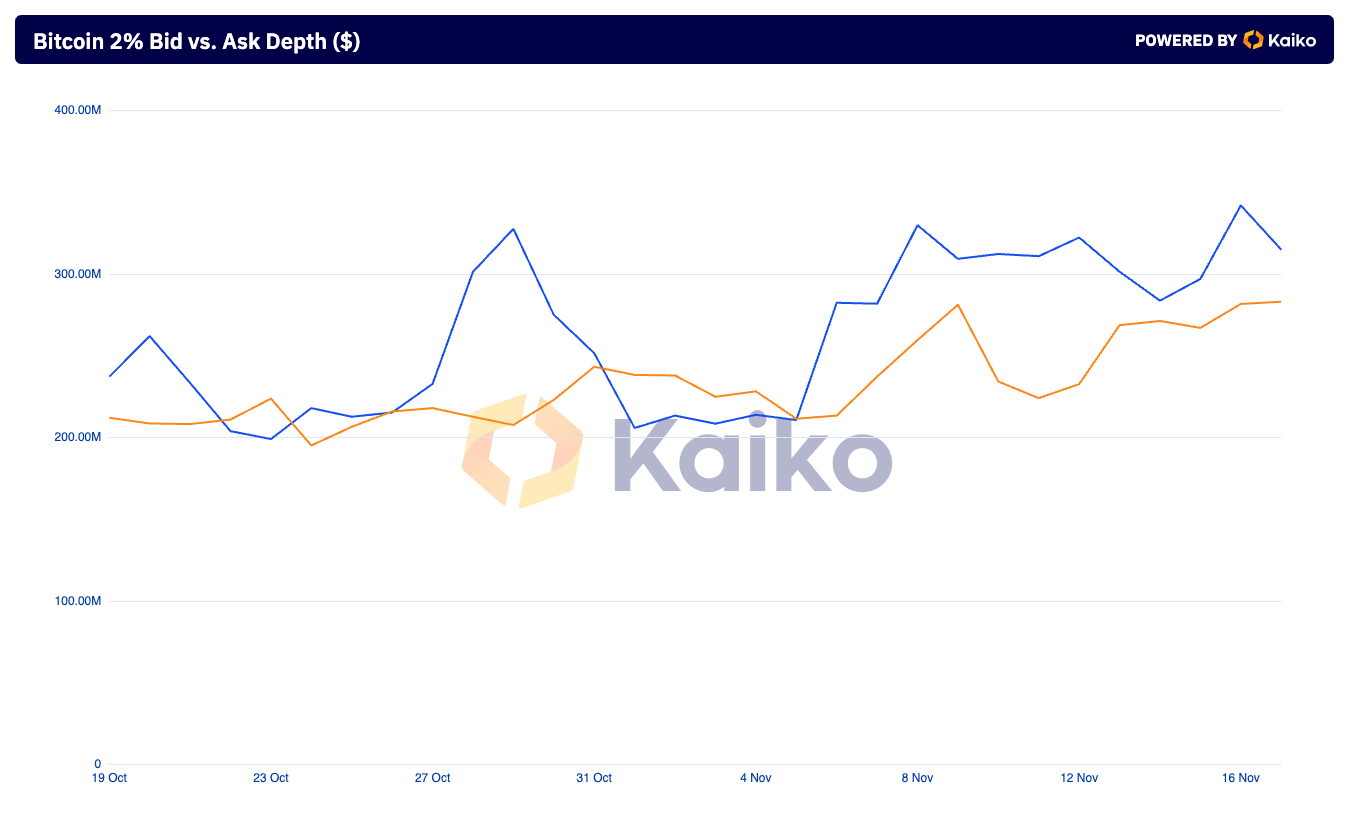

The election’s influence may also be noticed within the bid versus ask depth. Whereas the imbalance favoring promote orders at $341.81 million over $281.59 million in purchase orders suggests some profit-taking, you will need to be aware that this exercise didn’t set off a big value correction. As a substitute, the market absorbed sell-side strain effectively, indicating sturdy purchaser demand whilst Bitcoin crossed $93,000.

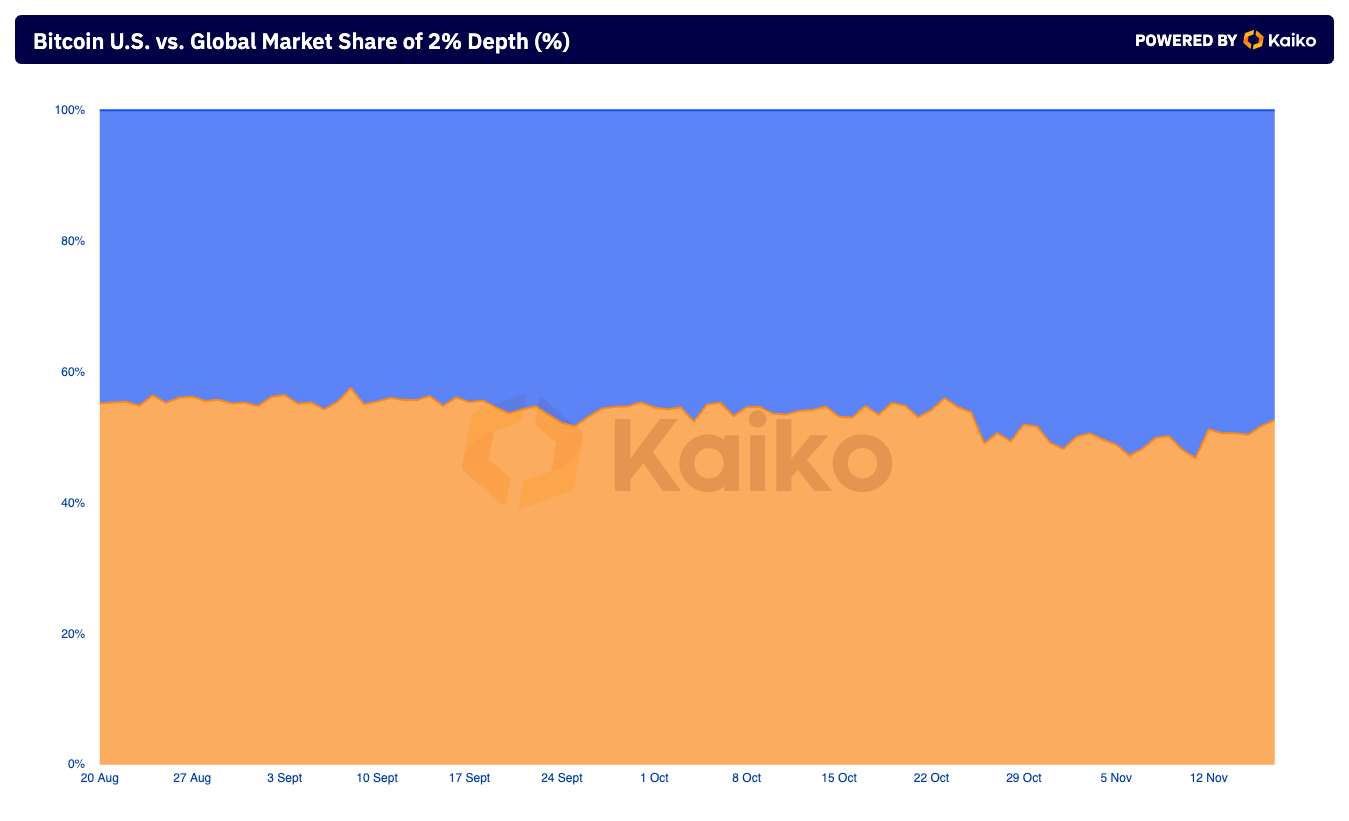

The US market’s traditionally dominant share of world market depth seems to have performed a big position in driving this liquidity surge. Though US market share dipped barely post-election, the broader development all through 2024—the place the US accounted for over 50% of world depth—means that American establishments and merchants have been pivotal in shaping market exercise.

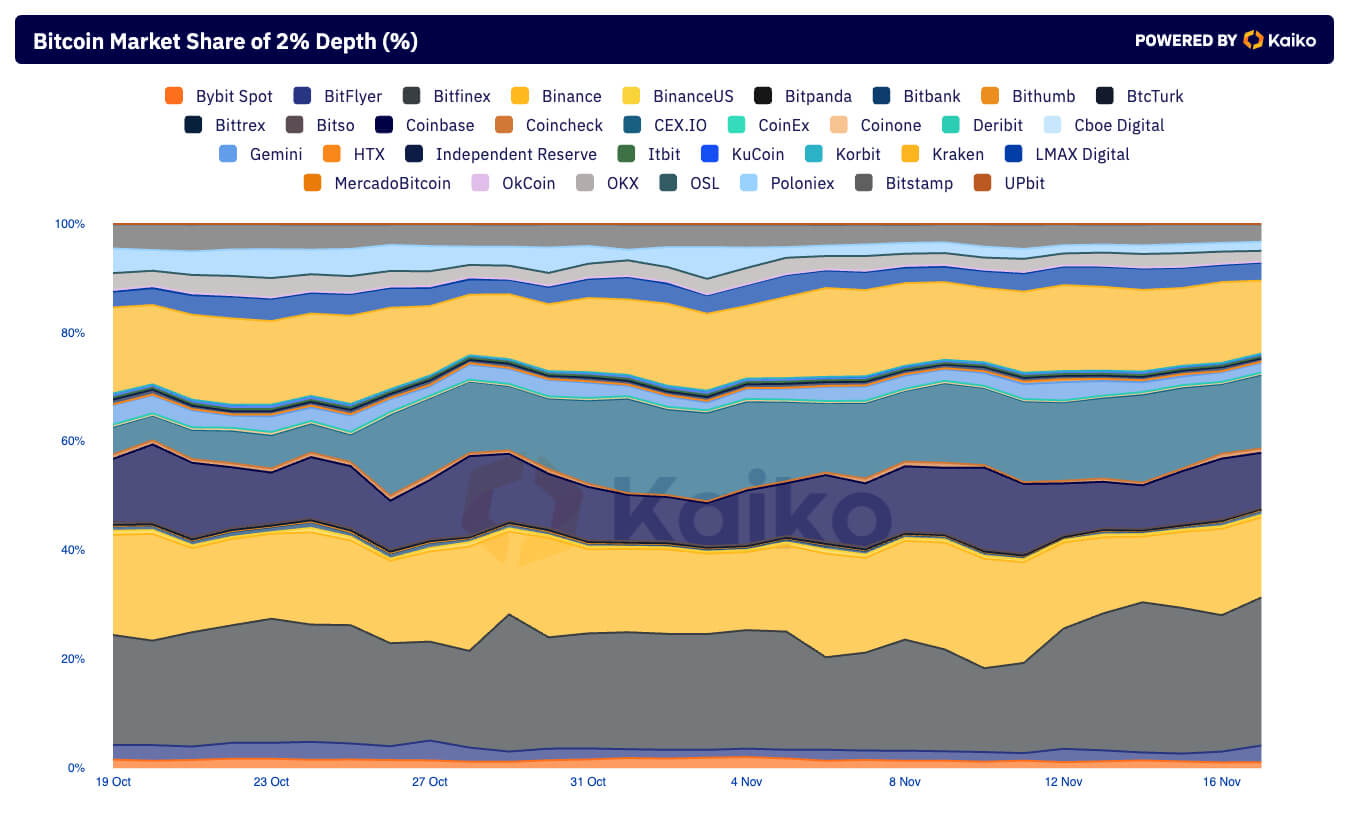

On an exchange-specific degree, the rise of Bitfinex because the chief in world market depth might replicate its capability to draw liquidity amid these political and market shifts. The alternate’s 27% share on Nov. 16 coincides with Bitcoin’s post-election rally, suggesting that Bitfinex efficiently captured a good portion of the elevated buying and selling exercise.

In distinction, Binance’s declining share, hovering between 10% and 15% in November, may very well be attributed to ongoing regulatory scrutiny, which can have deterred institutional gamers from using its platform regardless of the broader market optimism.

The submit US elections boosted Bitcoin’s liquidity to new highs appeared first on CryptoSlate.