GRASS value has proven exceptional exercise since its itemizing on main exchanges on the finish of October. In its first week, the worth skyrocketed from $0.65 to $1.60. Nonetheless, current metrics present GRASS coming into a impartial zone, with its RSI at 51 and ADX at 14.84, indicating reasonable restoration and weak development power.

As merchants watch key resistance and help ranges, the potential for a 44% surge or a 26% correction relies upon closely on the power of its ongoing uptrend.

GRASS Is Presently In The Impartial Zone

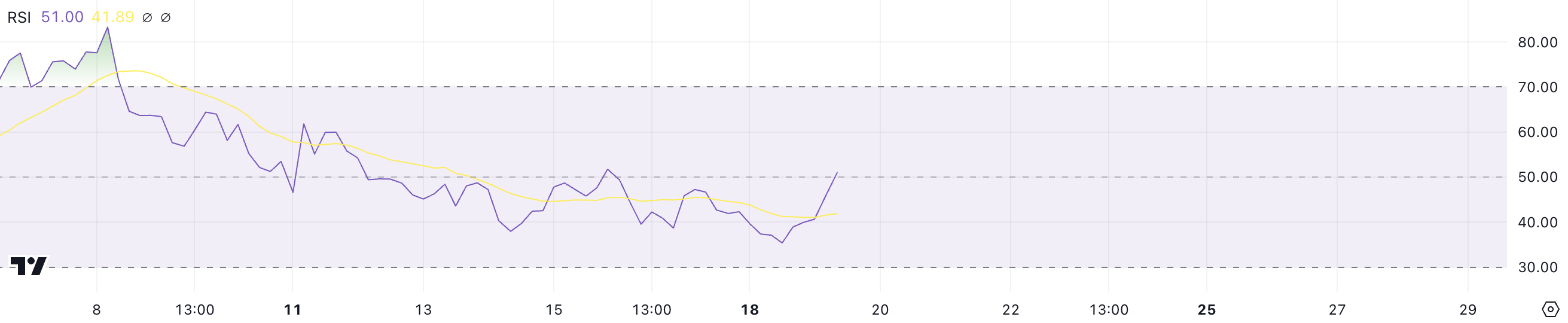

The Relative Power Index (RSI) for GRASS has climbed to 51, up from a low of roughly 35. This shift signifies a restoration in momentum, shifting from oversold territory towards a extra balanced state. RSI, a key momentum indicator, measures the power and velocity of value actions, offering perception into whether or not an asset is overbought or oversold.

Values beneath 30 sometimes sign oversold circumstances, whereas readings above 70 recommend overbought ranges. At 51, GRASS’s RSI displays impartial momentum, implying neither sturdy shopping for nor promoting strain at present dominates.

Regardless of being down almost 15% over the previous seven days, GRASS value has surged nearly 10% within the final 24 hours. The RSI’s motion to 51 aligns with this short-term rebound, suggesting a shift towards stabilization after current declines.

With RSI within the impartial zone, GRASS could also be poised for consolidation or reasonable positive factors, although a break above 70 might sign stronger upward momentum for one of many largest airdrops of 2024.

GRASS Present Pattern Isn’t That Sturdy

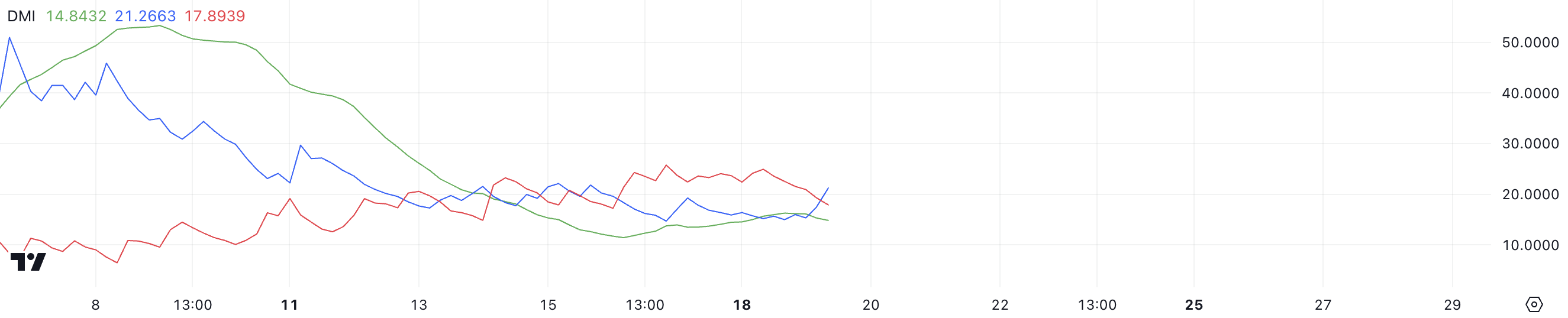

The Directional Motion Index (DMI) for GRASS reveals an ADX worth of 14.84, suggesting a weak market development. The Common Directional Index (ADX) measures the power of a development with out indicating its path. Usually, values above 25 sign a powerful development, whereas values beneath 20 point out a scarcity of clear development momentum.

At 14.84, the ADX means that GRASS is experiencing a interval of low development power, which implies that value actions are much less prone to comply with a sustained path.

The DMI additionally consists of the +DI (Directional Indicator) and -DI, which give insights into the path of the worth development. GRASS’s +DI is at 21.26, indicating barely stronger bullish strain, whereas the -DI is at 17.89, reflecting weaker bearish momentum.

Nonetheless, with the ADX beneath 20, neither the bullish nor bearish strain is robust sufficient to ascertain a transparent development. This setup suggests a uneven market the place value actions might proceed with no decisive upward or downward trajectory except the ADX rises considerably.

GRASS Worth Prediction: A 44% Surge?

GRASS’s present value is shifting above its short-term EMA strains, indicating rising bullish momentum within the quick time period. Exponential Transferring Averages (EMAs) easy out value information and spotlight tendencies, with shorter-term EMAs responding rapidly to cost adjustments.

This motion means that consumers are gaining management, and the asset’s fast development is popping constructive. If this momentum continues, GRASS value might take a look at key resistance ranges, offering a clearer sign of sustained upward motion.

If the uptrend strengthens, GRASS might face its subsequent resistance at $2.91. Breaking by way of this stage might set off additional bullish exercise, doubtlessly driving the worth to $3.66, representing a major 44% upside. Conversely, if the uptrend weakens, the worth might reverse, testing help at $2.41.

Failure to carry this stage might result in a deeper correction, with GRASS value doubtlessly dropping to $1.87, marking a 26% draw back. These ranges spotlight the significance of development power in figuring out the following vital value motion.

Disclaimer

In step with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.