Grayscale Investments has filed an up to date prospectus for its Bitcoin Lined Name ETF (exchange-traded fund).

It indicators a swift motion after the Commodity Futures Buying and selling Fee (CFTC) permitted the itemizing of spot Bitcoin ETF choices.

Grayscale Pursues Bitcoin Lined Name ETF

The fund, which can supply publicity to Bitcoin and the Grayscale Bitcoin Belief (GBTC), goals to generate revenue by means of actively managed name and put choices on Bitcoin exchange-traded merchandise (ETPs). The prospectus was initially filed with the US Securities and Alternate Fee (SEC) in January 2024.

In response to the submitting, the ETF will obtain its targets by offering publicity to GBTC. Past that, it can additionally make use of a lined name technique. This implies it can promote name choices to generate revenue whereas holding Bitcoin or GBTC as collateral.

“The fund seeks to attain its funding goal primarily by means of actively managed publicity to Grayscale Bitcoin Belief (GBTC) and the acquisition and sale of a mix of name and put possibility contracts that make the most of GBTC because the reference asset,” the January submitting learn.

James Seyffart, an ETF analyst at Bloomberg Intelligence, commented on the event. In his opinion, Grayscale is capitalizing on the approval for Bitcoin ETF choices.

“Grayscale losing no time after BTC ETF choices approval. They’ve filed an up to date prospectus for his or her Bitcoin Lined Name ETF (no ticker but). The fund will supply publicity to GBTC and BTC whereas writing and/or shopping for choices contracts on Bitcoin ETPs for revenue,” Seyffart remarked.

It comes after the US Securities and Alternate Fee’s (SEC) approval of choices buying and selling for spot Bitcoin ETFs. This regulatory milestone, introduced final month, permits ETF issuers to combine choices methods into their Bitcoin-focused funds. Amongst different advantages, this opens up new avenues for funding.

The Workplace of the Comptroller of the Foreign money (OCC) can also be getting ready to launch choices buying and selling on the Bitcoin ETF. Eric Balchunas, one other ETF trade skilled, emphasised the importance of the CFTC’s determination. He mentioned it cleared the best way for extra advanced Bitcoin funding merchandise.

With choices now on the desk, funds like Grayscale’s Lined Name ETF can cater to buyers searching for yield in a risky asset class.

Grayscale’s ETF Technique on a Broader Context

Grayscale’s submitting for the Lined Name ETF is a part of its bigger push to determine itself as a pacesetter in crypto ETFs. In October, the SEC acknowledged Grayscale’s utility to transform its Digital Massive Cap Fund into an ETF, which demonstrated the corporate’s dedication to diversifying its choices.

Moreover, Grayscale has been working with NYSE Arca to safe approval to checklist a variety of ETFs, together with these centered on digital belongings past Bitcoin. These efforts replicate the agency’s technique to deliver institutional-grade monetary merchandise to the cryptocurrency market.

The flexibility to combine choices buying and selling into Bitcoin ETFs may mark a turning level for the crypto trade. Lined name methods, which contain promoting choices on held belongings, enable funds to generate regular revenue — a characteristic that will entice a broader spectrum of buyers.

Grayscale’s swift response to those developments and push for a Bitcoin Lined Name ETF displays its agility in navigating the rising regulatory surroundings. By submitting an up to date prospectus for its Bitcoin Lined Name ETF, the agency positions itself to reap the benefits of the rising curiosity in options-based crypto investments.

If permitted, the Bitcoin Lined Name ETF may pave the best way for a brand new technology of funding merchandise that merge TradFi methods with novel digital belongings. With regulatory frameworks starting to accommodate such improvements, the crypto funding house is poised for important progress.

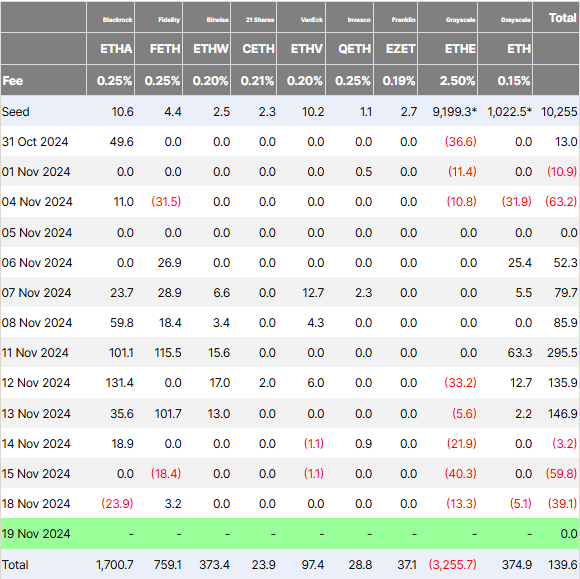

However, the agency’s Ethereum ETF stays affected by redemptions, evidenced by 5 consecutive days of outflows since November 12.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.