MicroStrategy Founder Michael Saylor introduced the agency would supply $1.75 billion in zero-coupon convertible notes to buy extra Bitcoin. Earlier right this moment, MicroStrategy purchased over $4.6 billion in BTC.

The post-Trump bull market has turbocharged MicroStrategy’s Bitcoin-first coverage, as the corporate makes document investments in BTC.

MicroStrategy to Purchase Even Extra Bitcoin

In line with the newest announcement, the convertible senior notes will probably be provided as zero-coupon convertibles, which means they are going to pay no curiosity. In 2029, these notes will mature into MicroStrategy inventory and are subsequently provided at a reduction.

“MicroStrategy intends to make use of the online proceeds from this providing to accumulate extra bitcoin and for normal company functions,” the corporate acknowledged in its press launch.

This $1.75 billion fundraiser for additional Bitcoin purchases has been introduced on the identical day MicroStrategy purchased $4.6 billion in BTC. One week previous to this, it additionally put barely over $2 billion into Bitcoin purchases.

This unequivocally makes MicroStrategy the world’s largest Bitcoin holder, persevering with its staunch Bitcoin-first coverage.

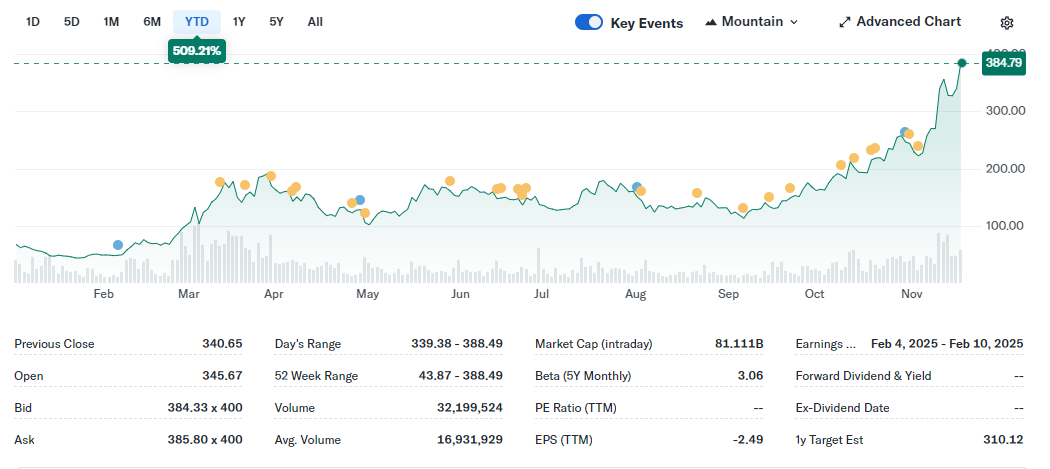

MicroStrategy’s inventory value has ballooned since adopting this coverage, outperforming Bitcoin with a 24-year excessive in October. Its inventory costs have elevated by over 460% in a yr and almost 75% this month alone.

The corporate’s worth is inexorably tied to the efficiency of Bitcoin, however they don’t at all times align immediately. In any occasion, MicroStrategy hit these highs earlier than Trump’s re-election, and the next bull market has despatched them hovering.

Among the precise particulars round this personal providing weren’t explicitly acknowledged within the press launch; for instance, the precise phrases of asset maturation and MicroStrategy’s proper to redeem the notes for money.

To that finish, Saylor additionally introduced a Webinar to debate the providing on Tuesday, November 19. It’s open to Certified Institutional Consumers, the identical group that may purchase the notes.

So long as the bull market continues, there’s no clear restrict to MicroStrategy’s Bitcoin urge for food. Nonetheless, there’s a restricted provide of bitcoins, and ETF issuers have already outpaced miners’ manufacturing ranges. These huge purchases should not sustainable endlessly, particularly with such a purchaser’s market, however Saylor will probably proceed so long as potential.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.