On Nov. 18, MicroStrategy unveiled plans to boost $1.75 billion by way of zero-coupon senior convertible notes to assist extra Bitcoin acquisitions and different enterprise initiatives.

These notes won’t accrue curiosity, goal institutional traders, and mature in 2029. They are often transformed into money, firm inventory, or a mixture of each. The corporate additionally plans to permit preliminary traders to buy an additional $250 million in notes inside three days of issuance.

This transfer might enable MicroStrategy so as to add greater than 19,000 BTC to its holdings if the highest asset worth stays round its present worth of $91,629. This potential acquisition would push MicroStrategy’s Bitcoin possession nearer to 2% of the asset’s mounted provide of 21 million cash.

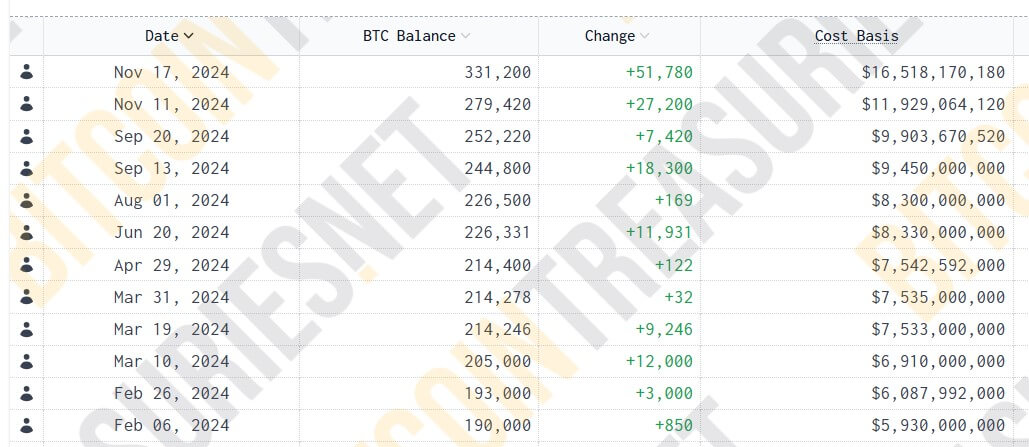

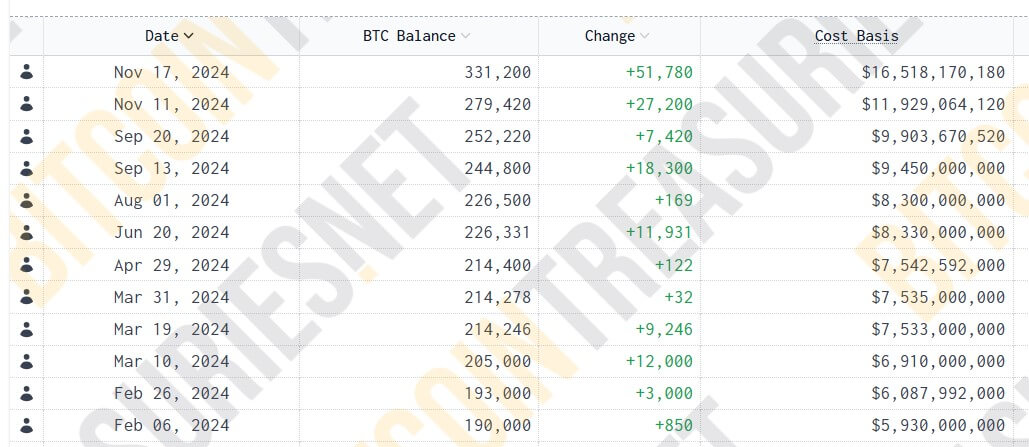

At the moment, the corporate owns 331,200 BTC, representing 1.58% of Bitcoin’s whole provide. These property had been bought at a complete value of $16.5 billion, averaging $49,875 per coin. At BTC’s present worth, they’re cumulatively value greater than $30 billion.

This 12 months, MicroStrategy has aggressively expanded its Bitcoin reserves. Its most up-to-date acquisition, made the earlier week, added 51,780 BTC for $4.6 billion, bringing the 12 months’s whole to 142,050 BTC.