Observe Nikolaus On X Right here

Right this moment, MicroStrategy (MSTR) surpassed a $100 billion market cap to grow to be the 93rd largest publicly-traded firm within the U.S.

On the time of writing, MSTR has achieved extra buying and selling quantity than each inventory giants Tesla and Nvidia right this moment, and has conventional inventory merchants just like the Wall Road Bets group shedding their minds.

Wow $MSTR is probably the most traded inventory in America right this moment.. to finest $TSLA and $NVDA is loopy. It has been years since a inventory has traded greater than a type of two (it could have really been $GME to final do it). It is also about double $SPY! Wild instances.. pic.twitter.com/bUr8nycMX3

— Eric Balchunas (@EricBalchunas) November 20, 2024

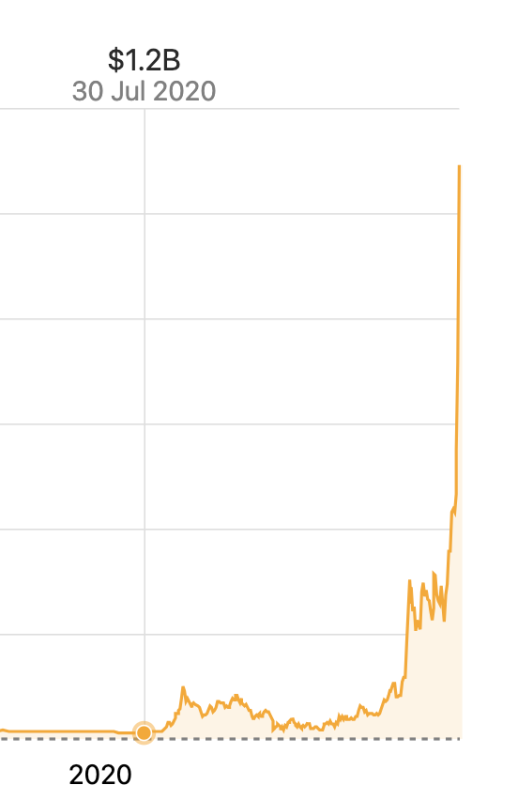

That is completely mindblowing contemplating MicroStrategy was a mere $1 billion firm when it first purchased bitcoin for its treasury about 4 and a half years in the past.

The large query I’m asking myself is, how and when does this finish? Assuming MSTR continues to pump till the height of this bull market, it is anybody’s guess on how excessive MSTR might go.

However how arduous will it crash within the bear market, contemplating it’s primarily a leveraged commerce on bitcoin? Dare I even recommend that this time could also be totally different, and that the draw back of the following bitcoin bear market gained’t be as brutal because the 70%+ corrections we’re traditionally used to seeing?

Even with the spot bitcoin ETFs, and the notion that the US might lead the cost of nation states shopping for up mass quantities of bitcoin, I’m nonetheless not satisfied that we don’t ultimately see a large downturn in bitcoin’s value. And I’m mentally getting ready for a standard bitcoin bear market to begin after this bull market finishes someday within the subsequent yr or so.

However again to MSTR — Michael Saylor has up to now confirmed that the Bitcoin for Companies technique works in beautiful style. Public corporations have been popping out of the woodwork this previous week saying that they’ve bought bitcoin for his or her stability sheet or plan to take action, and it appears this development will proceed because the CEO of Rumble requested his X viewers if he ought to add BTC to their stability sheet (nearly 94% of his 42,522 voters voted “sure”).

Lets put this in a ballot format…

Ought to Rumble add Bitcoin to its stability sheet?

— Chris Pavlovski (@chrispavlovski) November 19, 2024

Michael Saylor even provided to assist clarify how and why Rumble ought to undertake a company BTC technique.

Institutional bitcoin adoption is right here and it’s solely going to develop for the foreseeable future. As corporations determine the logic behind adopting bitcoin as a strategic reserve asset, the variety of publicly-traded corporations that undertake this technique goes to blow up.

Firms that add bitcoin to their stability sheet will rise above most different corporations — even prime large tech giants — when it comes to buying and selling quantity, as MicroStrategy has, till all corporations add bitcoin to their stability sheet. I attempt to put myself within the sneakers of a dealer, with information on Bitcoin and suppose to myself, “Why on earth would I purchase any firm’s inventory in the event that they don’t have bitcoin on their stability sheet?” I wouldn’t — it might be approach too boring.

Placing BTC on the stability sheet helps create volatility, and due to this fact alternative for inventory merchants, which is nice for the merchants, inventory value, and firm general. If you’re a publicly-traded firm, it’s a no brainer to undertake bitcoin as a treasury reserve asset.

This text is a Take. Opinions expressed are fully the creator’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.