Coinbase, the most important US-based crypto trade, has introduced it should droop buying and selling for Wrapped Bitcoin (WBTC) on December 19, 2024, at roughly 12 p.m. ET.

The choice, revealed in a submit on X (previously Twitter), cites a routine evaluation of its listed property to make sure compliance with itemizing requirements.

Coinbase Sidesteps WBTC Amid cbBTC Increase

The suspension will apply to each Coinbase Alternate and Coinbase Prime. Though buying and selling will stop, WBTC holders will retain full entry to their funds and the flexibility to withdraw them at any time. In preparation for the transition, Coinbase has moved WBTC buying and selling to a limit-only mode, the place customers can place and cancel restrict orders whereas matches should still happen.

“Coinbase will droop buying and selling for WBTC (WBTC) on December 19, 2024, at or round 12 pm ET. Your WBTC funds will stay accessible to you, and you’ll proceed to have the flexibility to withdraw your funds at any time. We now have moved our WBTC order books to limit-only mode. Restrict orders may be positioned and canceled, and matches might happen,” Coinbase detailed.

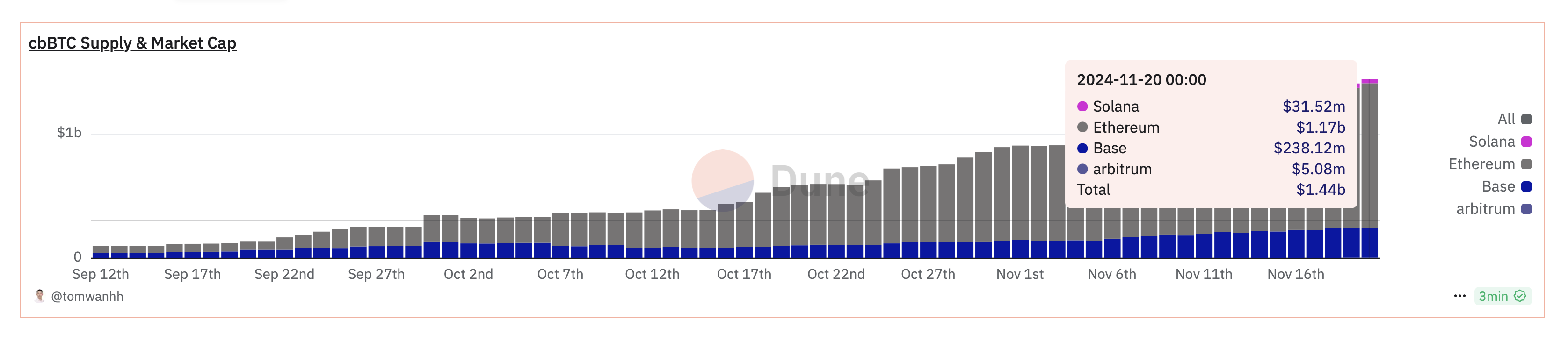

Coinbase’s transfer to droop WBTC comes amid the speedy success of its wrapped Bitcoin token, cbBTC. Lately, cbBTC surpassed a $1 billion market capitalization, reflecting rising adoption and belief throughout the crypto group. This milestone has additional cemented cbBTC’s place as a powerful competitor to WBTC within the decentralized finance (DeFi) area.

As of this writing, knowledge on Dune reveals that cbBTC market capitalization has elevated to $1.44 billion. CBTC’s native availability on networks like Solana, Ethereum, and Base has considerably expanded its accessibility, with Arbitrum being the most recent addition.

“cbBTC is dwell on Arbitrum. cbBTC is an ERC-20 token that’s backed 1:1 by Bitcoin (BTC) held by Coinbase. It’s natively obtainable on Arbitrum and securely accessible to extra customers throughout the Ethereum ecosystem,” Coinbase shared on Tuesday.

Moreover, outstanding DeFi protocol Aave is focusing on cbBTC for its Model 3 (V3) platform, enhancing its utility throughout the ecosystem. This rising momentum might have performed a key function in Coinbase’s determination to part out WBTC buying and selling.

WBTC Core Crew Urge Coinbase to Rethink

The staff behind Wrapped Bitcoin expressed remorse and shock at Coinbase’s determination. In an announcement on X, WBTC’s core staff emphasised its dedication to compliance, transparency, and decentralization.

“We remorse and are stunned by Coinbase’s determination to delist WBTC…We urge Coinbase to rethink this determination and proceed supporting WBTC buying and selling,” the staff mentioned.

The assertion outlined WBTC’s longstanding status for novel mechanisms, regulatory compliance, and decentralized governance. Highlighting its seamless integration with DeFi protocols, WBTC described itself as a vital liquidity resolution for Bitcoin customers. Urging Coinbase to rethink, WBTC reaffirmed its readiness to deal with any considerations or present further info to help its case.

In the meantime, Coinbase’s announcement has sparked combined reactions throughout the crypto group. Some customers criticized the trade, suggesting the choice displays an incapability to deal with competitors.

“Coinbase can’t deal with truthful competitors?? WBTC superior to cbBTC” mentioned Gally Sama in a submit.

However, others help the transfer, citing considerations over WBTC’s custody mannequin, with one person referencing BitGo’s latest adoption of a multi-jurisdictional custody system.

“You set custody within the fingers of a fraud. What did you assume was gonna occur?” the person expressed.

This critique aligns with rising fears about Justin Solar’s involvement in WBTC’s custody processes, as BeInCrypto reported not too long ago. Some customers have acted preemptively to keep away from potential dangers, with one commenter sharing their reservations.

“When Solar acquired on the multisig for WBTC, I despatched all my WBTC on OP to Coinbase and exchanged for true BTC that I withdrew to my {hardware} pockets… You gave me affirmation simply now that I made the suitable transfer,” they wrote.

The choice to droop WBTC buying and selling might mark a pivotal second within the competitors between wrapped Bitcoin options. Whereas cbBTC’s integration throughout a number of blockchain networks has gained momentum, skepticism surrounding WBTC’s custody mannequin and management has intensified.

Justin Solar has voiced criticism of Coinbase’s cbBTC technique, labeling it a setback for Bitcoin’s broader adoption. As the controversy continues, the business watches intently to see whether or not Coinbase’s cbBTC will solidify its dominance or if WBTC can regain its place as a number one wrapped Bitcoin resolution. Regardless, the shifting dynamics replicate the significance of transparency, governance, and group belief in shaping the way forward for DeFi.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.