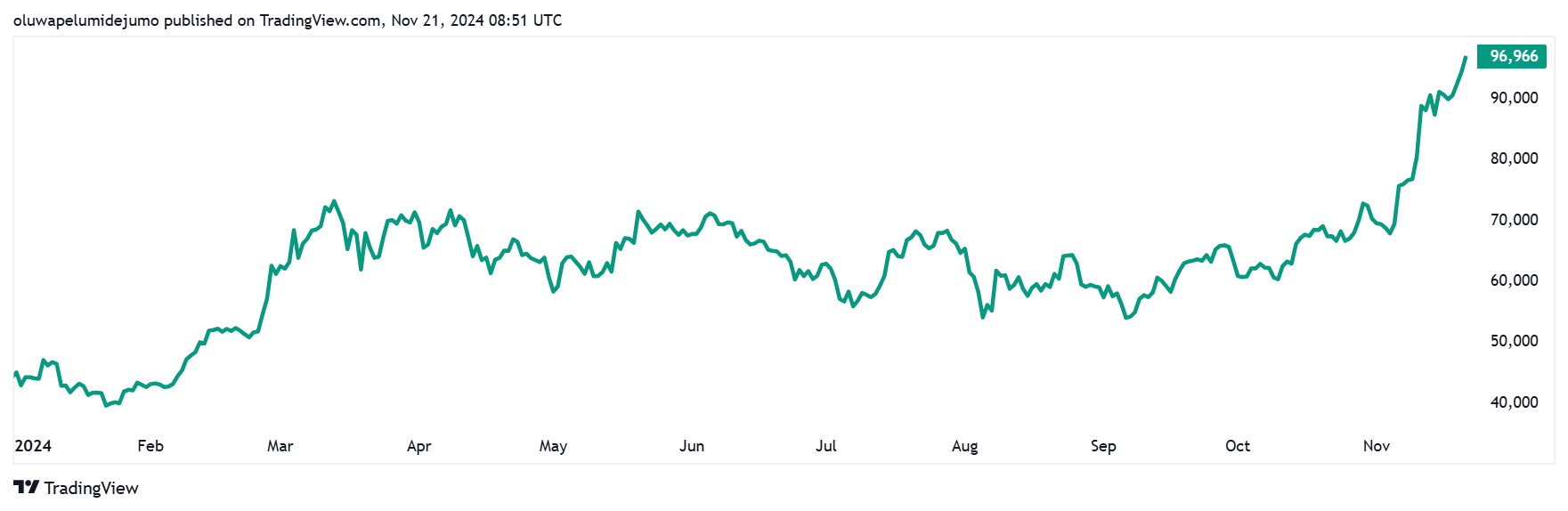

Bitcoin’s relentless rally has taken the main digital asset to new heights, surpassing $97,000 to succeed in a brand new all-time excessive of $97,862.

This surge, ignited by a broader wave of optimism following Donald Trump’s current political victory, has positioned Bitcoin simply inches from the extremely anticipated $100,000 mark. Reaching this milestone can be pivotal for the highest asset, additional cementing its standing within the broader monetary {industry} and pushing its market capitalization past the $2 trillion mark.

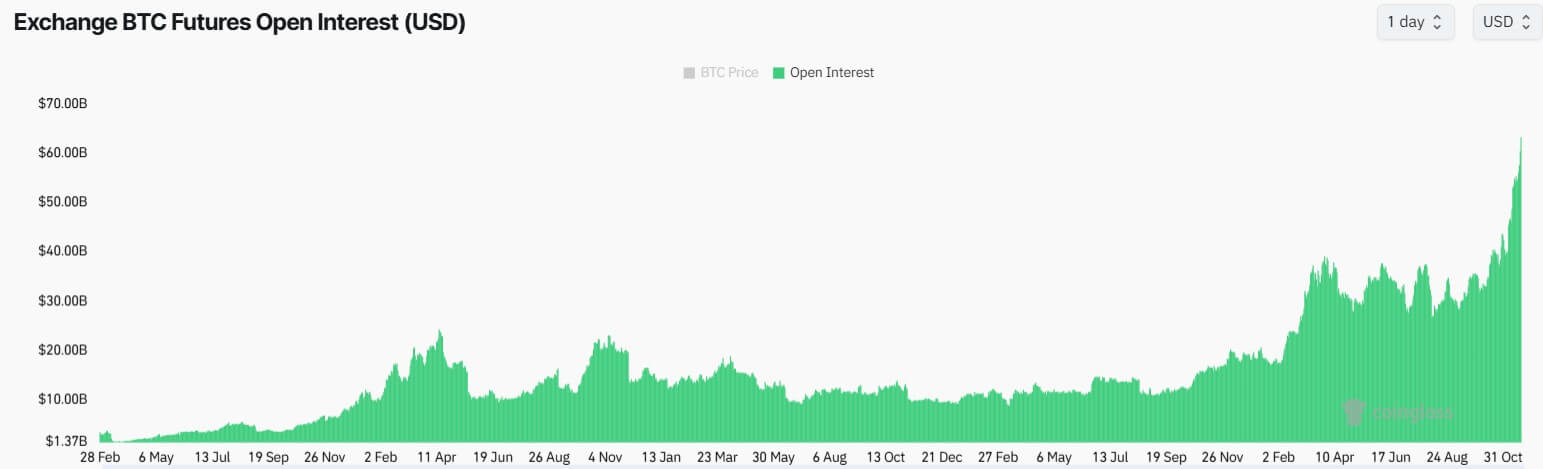

The derivatives market is taking part in a central function on this bull run. Based on Coinglass information, Bitcoin’s Open Curiosity has climbed to $63 billion, a historic excessive that marks a 147% enhance in market leverage in comparison with its 2021 peak of greater than $20 billion. At the moment, Bitcoin’s value hit an all-time excessive of round $69,000.

Nonetheless, the present market traits current dangers. The rising leverage in derivatives amplifies volatility, making the market extra vulnerable to sharp value swings.

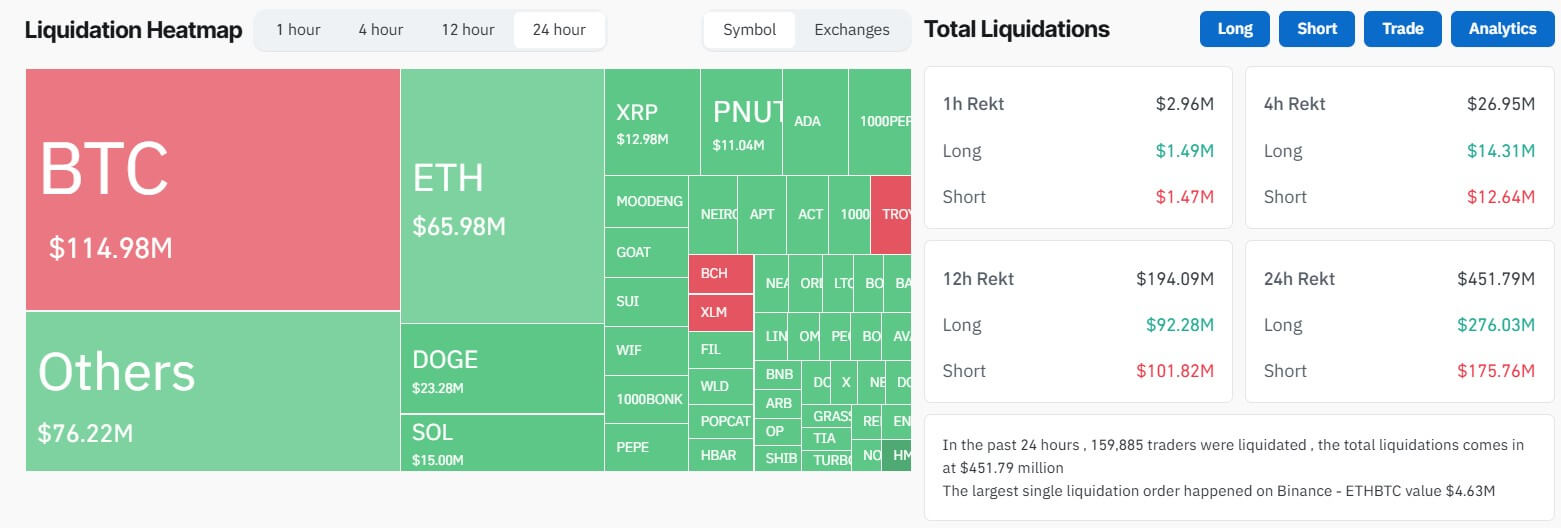

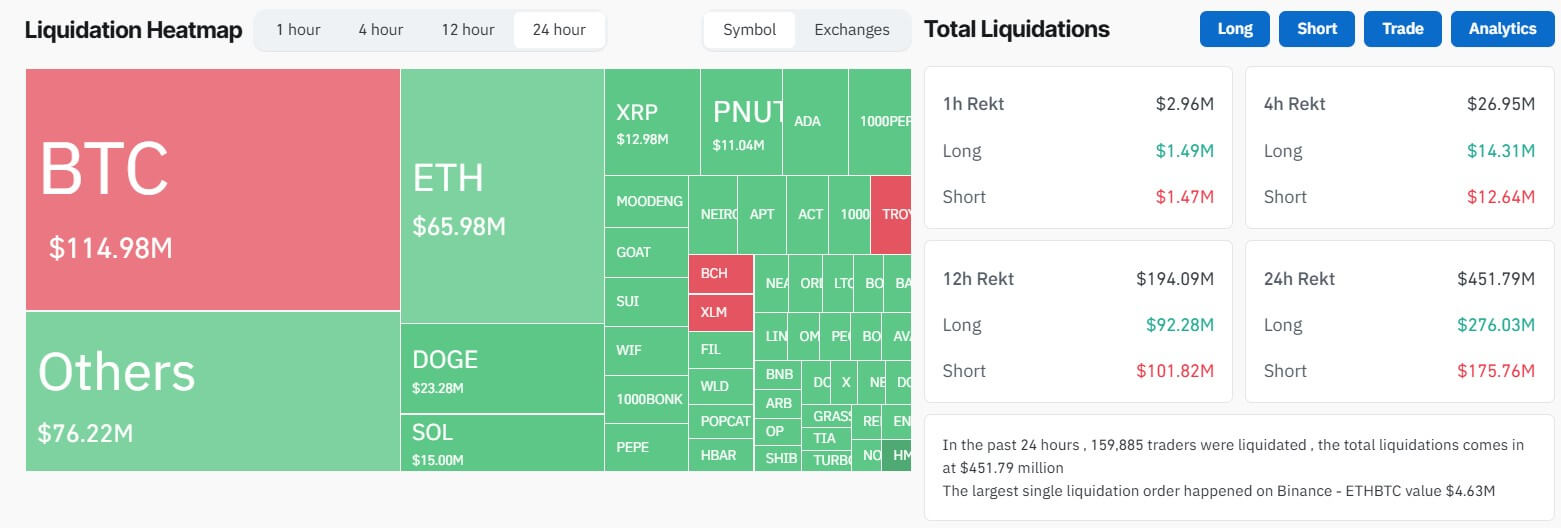

Already, Bitcoin’s value fluctuations have triggered industry-wide liquidations exceeding $450 million over the previous 24 hours. Of those, 60% got here from quick positions, indicating vital losses for merchants betting towards the rally.

As Bitcoin edges nearer to the six-figure milestone, market members ought to stay cautious amidst heightened volatility.