The co-founders of market intelligence platform Glassnode say that when Bitcoin (BTC) hits the $100,000 milestone, buyers might begin taking earnings.

In a brand new thread, Glassnode founders Jan Happel and Yann Allemann – who go by the deal with “Negentropic” – inform their 63,200 subscribers on the social media platform X that the crypto king might dip after reaching six figures for the primary time if buyers begin taking earnings.

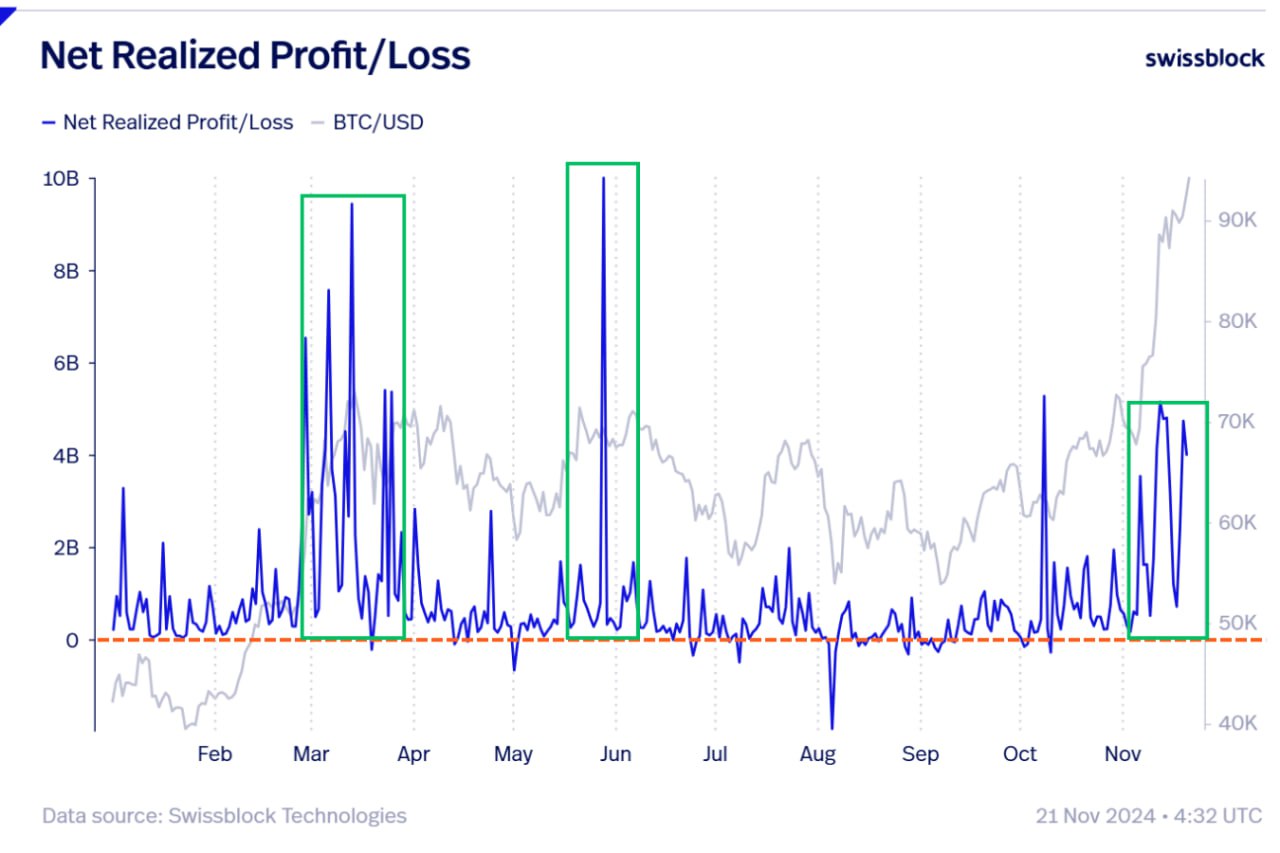

“Bitcoin hits $97,000 only a step away from the six-figure milestone! However beware – $100,000 might set off main profit-taking. Up to now, the sell-offs haven’t been as intense as in March, when Bitcoin hit its $73,000 all-time excessive, or throughout the $70,000 retest in late Could.

If we see a pointy uptick in profit-taking indicators, a worth correction turns into extra seemingly. Six-figure Bitcoin, right here we come!”

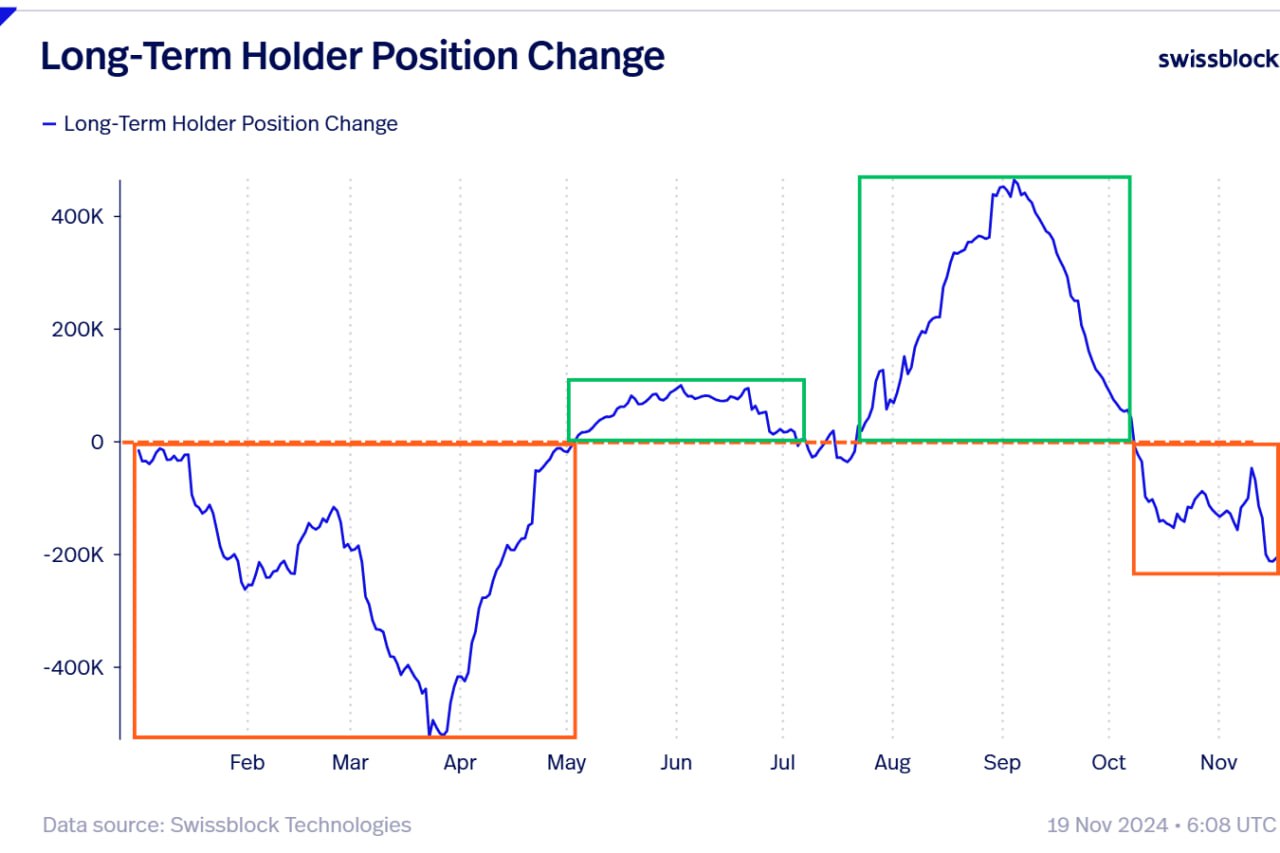

Negentropic goes on to notice that long-term holders of the highest crypto asset by market cap are likely to exit the market when BTC makes a bull run. Nonetheless, they are saying that their gross sales this time round have been a lot smaller comparatively.

“Since Bitcoin began climbing from $60,000 in October, long-term holders have been decreasing their positions. That is the most important promoting exercise in comparison with different market contributors throughout this run to new all-time highs. However don’t panic!

These gross sales are a lot smaller than the pre-halving exits seen earlier this 12 months (Jan-Could). Look how post-halving accumulation has been important. Sure, they’re promoting — however it’s no stampede.”

Bitcoin is buying and selling for $97,162 at time of writing, a 2.1% improve over the past 24 hours.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Worth Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses you might incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in affiliate internet marketing.

Featured Picture: Shutterstock/Design Tasks/Sensvector