Optimism (OP) worth has surged 43.40% within the final seven days, showcasing robust bullish momentum out there. The uptrend is supported by rising pattern power, with the ADX confirming rising momentum and EMA strains displaying a bullish setup.

Regardless of the rally, a declining pattern in each day energetic addresses suggests warning, as it could point out decreased community exercise and potential strain on OP’s worth. Whether or not OP can maintain this momentum to check resistance at $3 or face a deeper correction depends upon the power of purchaser curiosity within the coming days.

OP Present Uptrend Is Robust

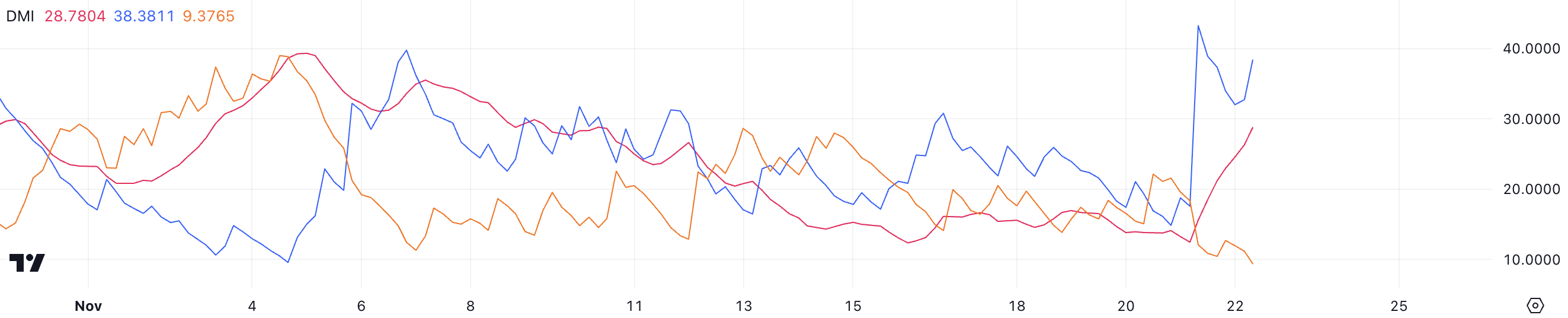

Optimism at the moment has an ADX of 28.7, a major surge from beneath 15 only a day in the past. The sharp rise in ADX signifies that the power of OP’s present pattern is growing quick, signaling rising momentum behind the value motion.

The ADX measures pattern power, with values above 25 indicating a robust pattern and beneath 20 suggesting a weak or nonexistent pattern. At 28.7, OP’s ADX confirms that its uptrend is gaining traction and will maintain additional upward momentum if this power persists.

The optimistic directional index (D+) is at 38.8, whereas the unfavorable directional index (D-) is at 9.37, displaying that bullish strain far outweighs bearish exercise. This huge hole between D+ and D- displays robust purchaser dominance, reinforcing the uptrend.

The mixture of a rising ADX and a excessive D+ means that OP’s worth might proceed climbing so long as market situations stay favorable and shopping for strain persists.

OP Each day Energetic Addresses Carry An Vital Sign

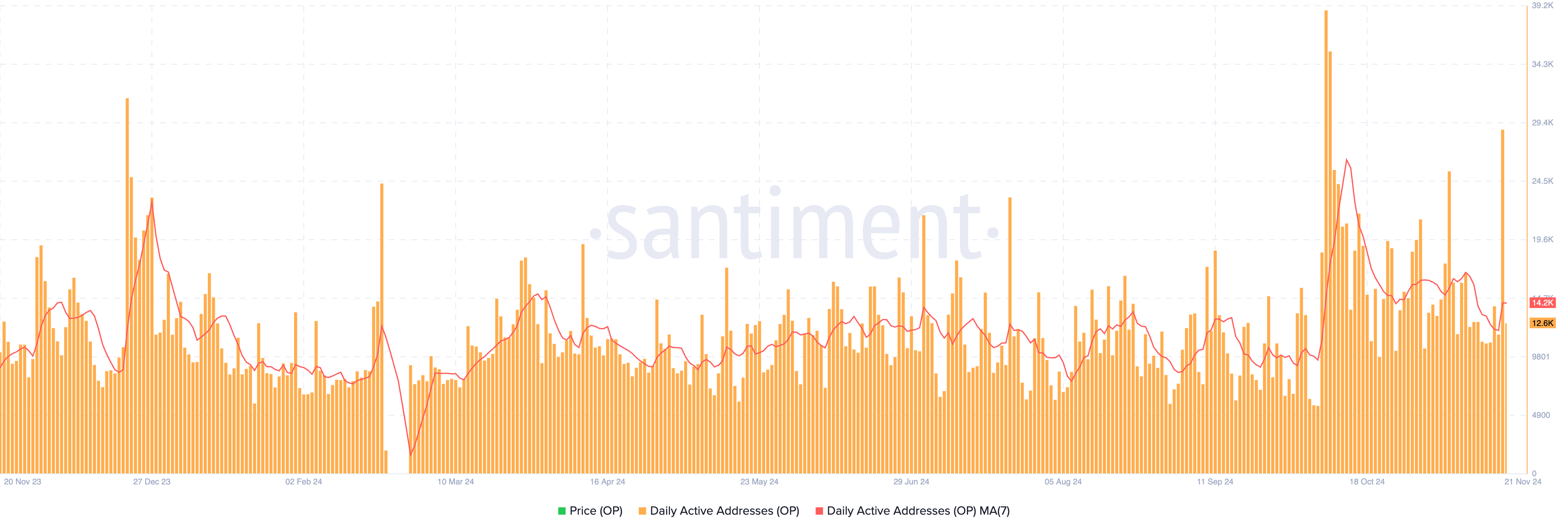

OP 7-day shifting common of each day energetic addresses was 14,200 as of November 21.

This metric displays the variety of distinctive pockets interactions with the community, which signifies continued robust exercise however is down from the yearly peak of 26,300 on October 13.

Each day energetic addresses are a vital metric as a result of they supply insights into community utilization and total demand. A reducing pattern on this metric could sign waning curiosity or decreased exercise on the community, which might translate into decrease shopping for strain for OP.

If the pattern continues to say no, it could exert downward strain on OP worth as market enthusiasm fades. Nonetheless, a reversal on this metric might reignite bullish sentiment and assist future worth progress.

Optimism Worth Prediction: Can OP Attain $3 In November?

If Optimism worth maintains its uptrend, it might check the subsequent resistance ranges at $2.55 and doubtlessly $3.04. Breaking above $3.04 might pave the way in which for OP worth to problem $3.41, its highest worth since April.

This bullish situation is supported by the EMA strains, which present a good setup with short-term strains positioned above the long-term ones, indicating robust momentum.

Nonetheless, if the pattern reverses, OP worth might face important downward strain, with the subsequent helps at $1.82 and $1.53.

If these ranges fail to carry, the value might drop additional to $1.06, representing a steep 51% correction.

Disclaimer

Consistent with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.