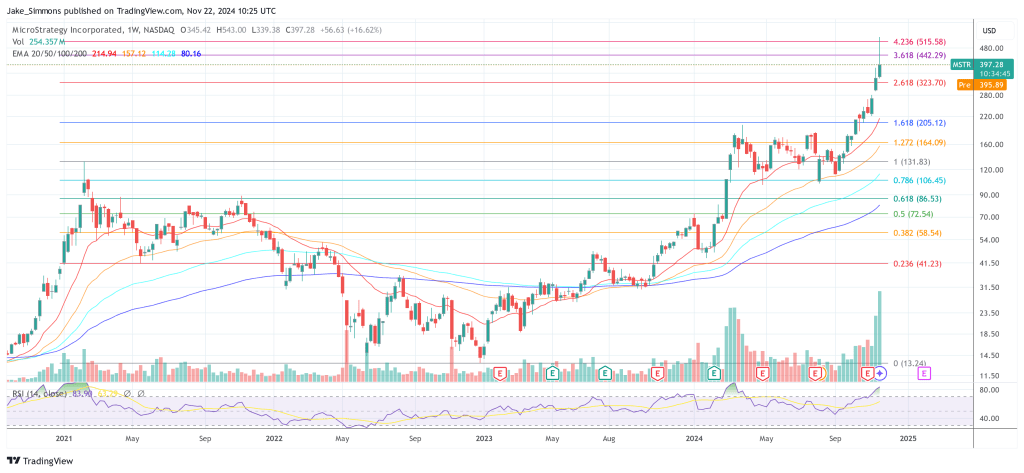

MicroStrategy Inc. (MSTR) skilled a pointy decline in its inventory worth yesterday, plummeting over 20% throughout intraday buying and selling earlier than closing down 16.2%. This important drop occurred at the same time as Bitcoin (BTC) surged to a brand new all-time excessive, simply shy of $100,000. Regardless of the setback, MSTR stays up a formidable 479% year-to-date.

The inventory’s tumble follows remarks from Andrew Left, founding father of Citron Analysis, who expressed issues about MicroStrategy’s valuation relative to Bitcoin fundamentals. “Now, with Bitcoin investing simpler than ever (ETFs, COIN, HOOD), MSTR’s quantity has fully indifferent from BTC fundamentals,” Left acknowledged. “Whereas Citron stays bullish on Bitcoin, we’ve hedged with a brief MSTR place. A lot respect to Michael Saylor, however even he should know MSTR is overheated.”

Is MicroStrategy Actually Overvalued?

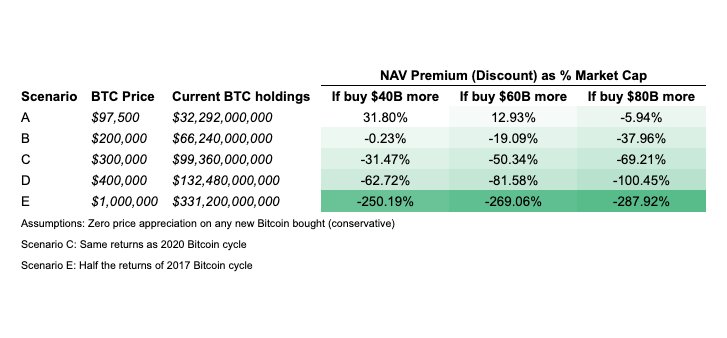

Contrasting Left’s bearish outlook, Charles Edwards, founder and CEO of crypto hedge fund Capriole Investments, provided a sturdy protection of MicroStrategy’s valuation. In an evaluation shared on X, Edwards argued that the corporate’s present market capitalization and premium to its Bitcoin web asset worth (NAV) are justified below sure circumstances.

“Everybody thinks MicroStrategy is overvalued. It’s not,” Edwards acknowledged. He steered that if the present Bitcoin cycle mirrors the earlier one—even below much less favorable circumstances—and if Saylor continues to aggressively purchase Bitcoin, then MicroStrategy has substantial development potential. “Saylor wants to purchase Bitcoin extra aggressively the broader their NAV premium is. The 21/21 plan received’t do anymore because the market has already priced it in,” he famous.

Edwards emphasised the size of current capital raises, highlighting that “Saylor’s raised $9.6 billion within the final 9 days alone.” He contended that with Bitcoin’s market capitalization poised to exceed $2 trillion, there’s a big viewers of bond merchants who can not straight entry Bitcoin resulting from funding mandates. “The US bond market is $50 trillion—greater than 25 instances the scale of Bitcoin. At the moment, MSTR is without doubt one of the solely automobiles that provides bond merchants publicity to Bitcoin,” Edwards defined. He added that MicroStrategy’s bond points are “continually oversubscribed,” displaying the robust demand for the MSTR inventory.

Addressing potential skepticism about his projections, Edwards clarified that his evaluation is predicated on particular assumptions. “In case you suppose Bitcoin goes to $200,000, and Saylor buys $40 billion extra Bitcoin, then it may be thought-about ‘pretty’ priced right now over the quick time period,” he mentioned. Nevertheless, he acknowledged that this situation requires Saylor to be “far more aggressive than at the moment deliberate” in buying Bitcoin and that “there are numerous dangers.”

Edwards additionally cautioned buyers in regards to the volatility of MicroStrategy’s NAV premium. “The NAV premia for MSTR fluctuates broadly and aggressively. Don’t anticipate it to be steady with Bitcoin,” he warned. He harassed that his evaluation is a “situation evaluation” and shouldn’t be used to foretell day by day returns, particularly with speculative Bitcoin worth targets like $1 million.

Concluding his insights, Edwards underscored the potential affect of MicroStrategy’s continued Bitcoin accumulation available on the market. “Saylor must hold busy over the subsequent yr to actively shut the premium by elevating much more capital, however supplied he does, there’s potential for MSTR fairness but,” he asserted. “Both approach, we have now a large Bitcoin purchaser available in the market that’s about to enter overdrive.”

At press time, MSTR traded at $395.89 pre-market.

Featured picture created with DALL.E, chart from TradingView.com