The value of Bitcoin picked up this week from the place it left off within the earlier week, forging successive all-time highs up to now seven-day span. Over the previous couple of days, the large query on everybody’s thoughts has been — when will the premier cryptocurrency surpass the $100,000 degree?

Whereas most buyers are frightened a couple of short-term goal, some market individuals are extra involved concerning the long-term prospects of the world’s largest cryptocurrency. Based on the most recent on-chain information, it seems that the worth of Bitcoin may see a shakeout ahead of anticipated.

Will The Rising Bullish Sentiment Maintain The Rally?

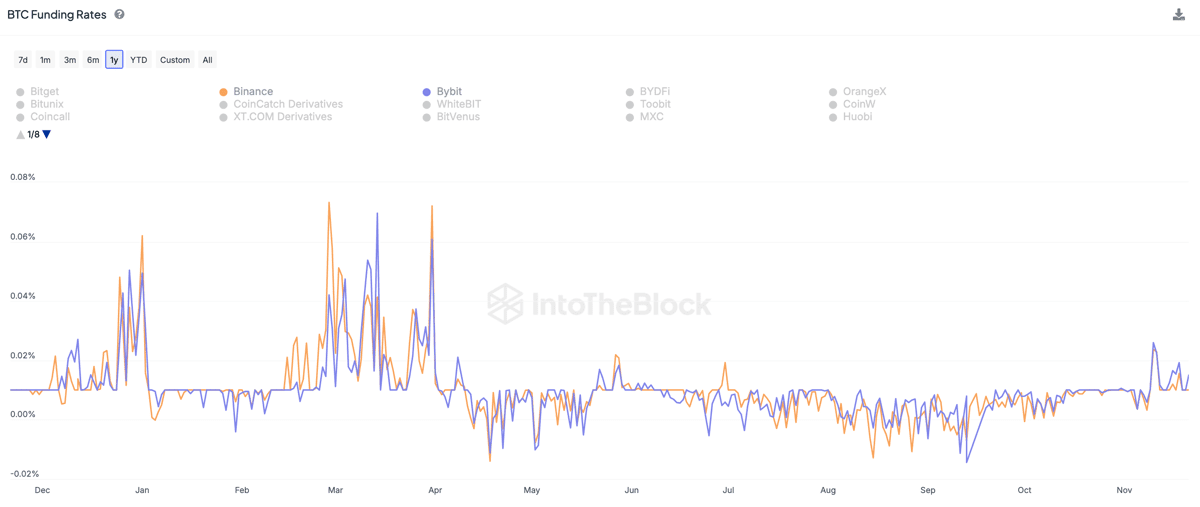

Based on market intelligence platform IntoTheBlock, the Bitcoin funding charges have witnessed a notable upswing in current days. The related indicator right here is the “funding fee” metric, which tracks the periodic payment exchanged between merchants within the derivatives (perpetual futures) market.

When the funding fee is excessive or optimistic, it implies that the lengthy merchants are paying merchants with brief positions. Sometimes, this path of the periodic fee suggests a powerful bullish sentiment out there.

Then again, a damaging worth of the funding fee metric implies that buyers with brief positions are paying merchants with purchase positions within the derivatives market. This development means that the market is shrouded by a bearish sentiment.

Information from IntoTheBlock reveals that the Bitcoin funding charges for perpetual swaps have elevated by greater than 10% — and as much as 20% on main buying and selling platforms. Nevertheless, the on-chain agency famous that this steady funding fee development may trace at speculative overheating, doubtlessly leading to market corrections.

Based on IntoTheBlock, one of many attainable catalysts of this bullish sentiment is the USA authorities’s method to crypto below Donald Trump. With the “strategic Bitcoin reserves” extra of a chance below the incoming US president, buyers are banking on Bitcoin surpassing a six-figure valuation.

As of this writing, the flagship cryptocurrency is valued at round $98,400, reflecting a 1% enhance up to now 24 hours.

Bitcoin Perpetual Futures Market Stays Restrained — What It Means

In a current publish on the X platform, Glassnode revealed that the Bitcoin perpetual futures market “stays restrained.” This means that a number of merchants are nonetheless approaching the market with warning regardless of the regular value climb of BTC in current weeks.

Information from Glassnode reveals that the Bitcoin funding charges are simply above 0.01%, which falls wanting the March 2024 degree (~0.07%) when the BTC value reached an area prime. Finally, this implies that there’s nonetheless room for development within the worth of the premier cryptocurrency.