Cantor Fitzgerald, a outstanding US monetary companies agency, is increasing its alliance with Tether, a key participant within the digital asset business and the issuer of the world’s largest stablecoin.

In line with experiences, the agency has agreed to amass a 5% stake in Tether as a part of a broader collaboration that features Bitcoin-backed lending initiatives.

Tether Mints $13 Billion USDT as Cantor Fitzgerald Deepens Tie

The acquisition talks, reportedly finalized in 2023, valued the 5% stake at roughly $600 million. This partnership positions Tether to realize strategic benefits, notably as Cantor Fitzgerald’s CEO, Howard Lutnick, takes on his new position as Secretary of Commerce underneath President-elect Donald Trump.

Market observers counsel that the nomination raises the opportunity of enhanced regulatory help for Tether, which has confronted scrutiny over potential violations of sanctions and anti-money laundering rules—a declare the corporate has denied. Nonetheless, Lutnick has promised to step down from his positions at Cantor Senate affirmation.

Past the possession stake, Tether is predicted to help Cantor Fitzgerald’s Bitcoin lending program, a multi-billion-dollar initiative. This system goals to supply loans backed by Bitcoin, initially funded with $2 billion, with plans for vital future growth.

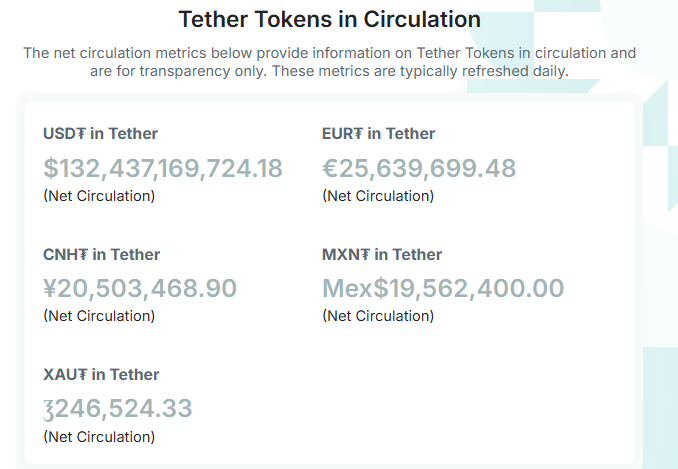

In the meantime, Cantor Fitzgerald is already a important accomplice for Tether, reportedly holding a good portion of the stablecoin issuer’s $134 billion reserves in US Treasury payments.

As Cantor Fitzgerald deepens its involvement with Tether, the agency has continued its aggressive token minting. On November 24, blockchain analytics platform Lookonchain reported that stablecoin firm minted a further $3 billion USDT, bringing the whole minted since November 8 to $13 billion. This growth has pushed the whole provide of USDT to roughly $132 billion.

The elevated USDT provide might mirror the rising demand for stablecoins, usually used to hedge market positions or facilitate crypto transactions with out changing to fiat. This liquidity inflow may cut back volatility and improve worth stability throughout the digital asset market.

This surge in USDT provide coincides with a broader market rally led by Bitcoin and different belongings akin to Dogecoin and Solana, signaling renewed investor confidence within the crypto ecosystem.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.