Bitcoin has skilled a record-breaking bullish breakout, shattering all-time highs virtually each day over the previous three weeks. After a powerful rally, the worth is lower than 2% away from the $100,000 mark—a crucial psychological stage that might turn out to be a turning level for the complete crypto market. Buyers and analysts alike are intently watching this milestone, as breaking it might gasoline a brand new wave of market momentum and broader adoption.

On-chain knowledge shared by CryptoQuant CEO Ki Younger Ju means that Bitcoin’s present rally should have room to develop. Ju highlights that the market seems too early to name a bubble, as the general market cap has not risen considerably in comparison with cumulative on-chain capital inflows. This metric signifies that the worth motion is supported by actual demand reasonably than speculative hype, reinforcing confidence in Bitcoin’s sustained bullish trajectory.

With Bitcoin main the cost, its strategy to $100,000 may set the tone for the remainder of the crypto market. Whether or not it breaks via or faces resistance, the end result will possible affect market sentiment, providing a glimpse into what lies forward for the world’s largest cryptocurrency and the digital asset area as a complete.

Bitcoin Metrics Set Excessive Expectations

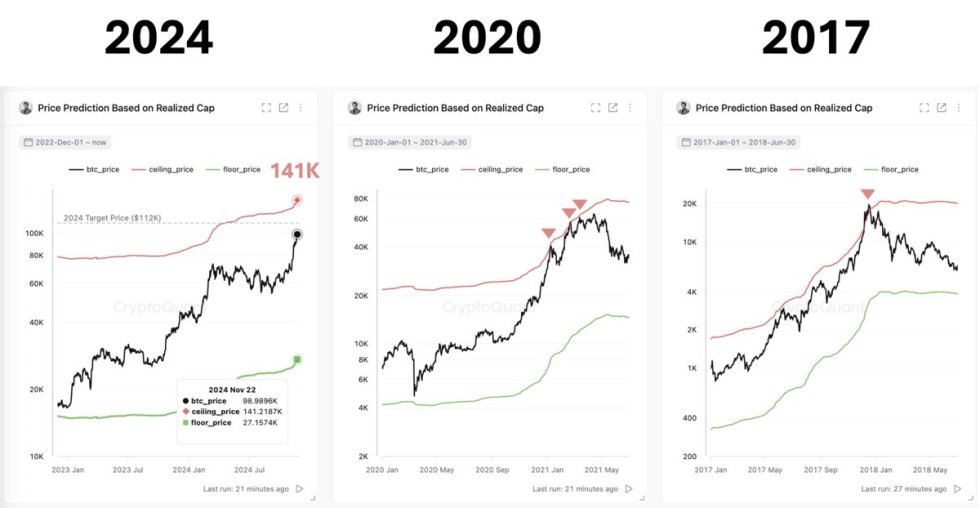

Bitcoin has been setting report highs, but it “struggles” to interrupt the crucial $100,000 barrier. Regardless of this, the general market sentiment stays bullish, with analysts predicting that the worth may proceed to rise. CryptoQuant CEO Ki Younger Ju has shared priceless insights on X, revealing that the Bitcoin cycle high may doubtlessly exceed $141,000.

Based on Ju’s evaluation, the present market dynamics recommend that BTC continues to be within the early levels of its bull market, making it untimely to name the rally a bubble. A key piece of information Ju highlights is the realized cap, which has been rising steadily daily. The realized cap, calculated by summing the worth of all BTC on the value at which they had been final moved on-chain, serves as an indicator of the full capital inflows into the BTC market.

Ju factors out that traditionally, Bitcoin’s market cap tends to exceed its realized cap throughout bull markets, with the market cap peaking as retail traders enter. Throughout bear markets, the market cap typically falls beneath the realized cap.

Because the realized cap continues to rise, it helps the argument for a continued upward trajectory in BTC’s value, with the potential to succeed in and even surpass $141,000 earlier than the market peaks. This evaluation reinforces that, regardless of Bitcoin’s close to battle to interrupt $100,000, the market nonetheless holds vital room for development earlier than a possible high is reached.

BTC Rising Demand Pushing Value Up

Bitcoin is on the verge of getting its highest weekly shut in historical past because it approaches the $100,000 mark, at present holding sturdy above $98,000. The worth motion has confirmed the bullish accumulation sample, a cup and deal with, that began forming in November 2021.

This sample means that BTC is constructing a robust base, and a confirmed breakout above $98,000 may set the stage for a surge previous the psychological $100,000 stage as early as Monday. A powerful shut right this moment may sign a continuation of the bullish pattern, with potential for additional upward momentum.

Nevertheless, there’s some warning across the potential for a weak breakout. If the worth struggles to carry above $100,000 after a breakout, it may set off a pullback, resulting in a correction earlier than the subsequent part of the rally.

A failure to maintain above $98,000 right this moment would additionally increase the danger of a short-term retrace, with help ranges beneath this mark turning into key in figuring out the power of the present rally. Regardless of the opportunity of a minor correction, the general market sentiment stays bullish, with many analysts anticipating continued beneficial properties if the $100,000 stage is damaged decisively.

Featured picture from Dall-E, chart from TradingView