Crypto trade antagonist Gary Gensler’s days as Securities and Trade Fee (SEC) Chair are numbered. Gensler’s final day might be on January 20, 2025 as Donald Trump takes workplace, as introduced final week, with the departure anticipated a technique or one other following Trump’s win.

The president-elect is poised to hammer dwelling certainly one of his hottest crypto guarantees made earlier this yr. A minimum of, that is what many within the trade are hoping for.

“I’ll hearth Gary Gensler on day one,” Trump declared at a Bitcoin convention in July, prompting thunderous applause from 1000’s in Nashville. “The day I take the oath of workplace, Joe Biden and Kamala Harris’ anti-crypto campaign might be over.”

Trump will not have to fireside Gensler, it seems, because the SEC chair is resigning as a substitute. And with Gensler now formally headed for the door, the names of a number of potential replacements are making the rounds forward of Trump’s inauguration on January 20.

That listing consists of Hester Peirce and Mark Uyeda, each SEC commissioners; Dan Gallagher, Robinhood’s chief counsel; former chairman of the U.S. Commodity Futures Buying and selling Fee, Chris Giancarlo; and former Binance.US CEO Brian Brooks. Some have already signaled that they do not need the job, nonetheless.

This is a take a look at the potential candidates and what they’ve stated about their curiosity within the function, if something.

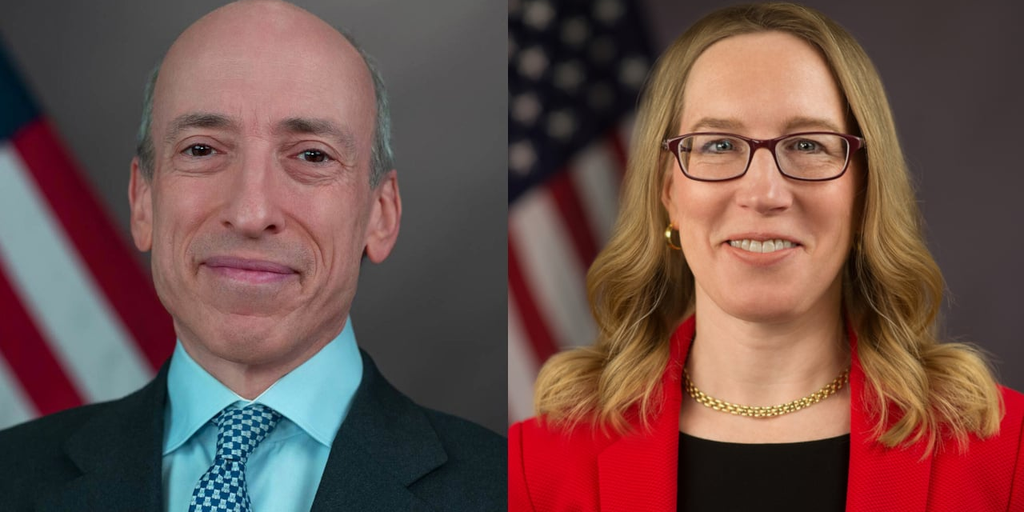

Hester Peirce

John Stark, an ardent crypto skeptic who as soon as served as an SEC enforcement legal professional, made the case for Peirce after Election Day.

“More often than not, they only resign as a result of they know {that a} new chair goes to be appointed,” Stark stated. “The president will then instantly appoint somebody to be performing chair, and that can often be the senior member of that occasion.”

Nicknamed “Crypto Mother” for her help of the trade, Peirce has disagreed with the SEC’s penchant for suing crypto corporations since she was appointed in 2018. Dissenting in opposition to an NFT-focused enforcement motion in September, she derided the SEC’s strategy as “misguided and overreaching,” creating many useless circumstances.

Peirce didn’t reply to a request for remark from Decrypt.

Mark Uyeda

Of the SEC’s 5 present commissioners, three belong to the Democratic Social gathering, together with Gensler. In the meantime, Peirce’s Republican colleague, Uyeda, who was appointed in 2022, can be being pitched as a possible contender.

“I’d give respectable odds to Uyeda,” Jake Chervinsky, chief authorized officer at Variant Fund, stated in a tweet after Election Day, including that he thinks Peirce doesn’t need the job. He caveated, nonetheless, “I count on Trump could desire to herald somebody new of his personal.”

Dan Gallagher

With Trump’s transition staff co-chaired by Cantor Fitzgerald Chairman and CEO Howard Lutnick, an out of doors decide to guide the SEC seems doable Fitzgerald views Wall Road as ripe for prime cupboard positions, POLITICO reported Wednesday.

Robinhood’s Chief Authorized Officer Gallagher could be a “pure selection,” based on one former SEC official who spoke with POLITICO. Previously serving as an SEC commissioner from 2011 to 2015, Gallagher testified earlier than Congress earlier this yr about digital asset regulation and a scarcity of “regulatory readability on the federal stage.”

After injecting over $119 million into federal elections this yr, some leaders of digital asset corporations are making calls of their very own for Gensler’s alternative. Ripple Labs CEO Brad Garlinghouse inspired Trump to nominate Gallagher as SEC chair on Wednesday, in addition to Brooks or Giancarlo.

“They’d be huge upgrades in rebuilding the rule of legislation (and repute) on the SEC,” Garlinghouse stated. “Hearth Gensler. Day 1, no delays.”

However there’s one downside: Gallagher says he would not need the gig. On November 22, Gallagher put out an announcement saying he “has made it clear that I don’t want to be thought-about for this place.”

Chris Giancarlo

Nicknamed “Crypto Dad” for his dedication to digital property as chairman of the U.S. Commodity Futures Buying and selling Fee (CFTC) from 2017 to 2019, Giancarlo now works as senior counsel and co-chair of Willkie’s Digital Works follow.

Whereas Giancarlo led the CFTC, bitcoin futures grew to become authorised on the Chicago Mercantile Trade. On the similar time, he cultivated a “Do No Hurt” strategy to the digital property trade, based on the conservative legislation group Federalist Society.

However like Gallagher, Giancarlo stated that he is not searching for the SEC Chair function, after beforehand choosing up for Gensler on the CFTC.

“I’ve made clear that I’ve already cleaned up an earlier Gary Gensler mess,” he wrote on Twitter (aka X). “[I] don’t need to need to do it once more.”

Brian Brooks

Brooks—who hasn’t but earned a paternalistic moniker from the digital property trade—most notably served as performing comptroller of the forex. Main the impartial arm of the U.S. Treasury Division, he was accountable for chartering, regulating, and supervising nationwide banks.

From 2018 to 2020, Brooks served as chief authorized officer for the crypto trade Coinbase. After departing Washington, he additionally served as CEO of Binance.US, leaving the American firm after 4 months on account of “variations over strategic course.”

Notably, Coinbase and Binance.US—alongside Binance and the trade’s co-founder and former CEO Changpeng Zhao—face ongoing SEC lawsuits, which allege each corporations breached its regulatory guidelines

However with a Trump-led change in SEC management, former SEC official Stark stated a shift within the company’s stance would virtually make sure.

“Does this imply that the SEC’s warfare on crypto is over?” he requested on Thursday. “I’d say ‘completely,’ with a powerful ‘sure.’”

Teresa Goody Guillén

Teresa Goody Guillén, who as soon as served as an SEC litigator, is presently a companion on the legislation agency BakerHostetler, the place she co-leads its blockchain staff. As somebody with years of presidency expertise and crypto-focused experience, Trump’s transition staff has not too long ago thought-about the lawyer as a possible successor to Gensler as SEC Chair, per CoinDesk.

In 2022, Goody Guillén informed Decrypt that the SEC’s framework for regulating digital property invitations confusion on the a part of market members. She stated there’s an actual want for extra sturdy steering, and that the trade could also be chilled amid aggressive enforcement actions.

Referencing Gensler and former SEC Chair Jay Clayton, Goody Guillén stated there’s added confusion within the trade in the case of statements made as a matter of non-public opinion by SEC leaders. For instance, SEC leaders had stated publicly on the time that Bitcoin is just not a safety, however the regulator hadn’t put that opinion forth as an official willpower.

Goody Guillén didn’t instantly reply to a request for remark from Decrypt.

Edited by Sebastian Sinclair and Andrew Hayward

Editor’s notice: This story was initially printed on November 7, 2024. It was final up to date with new particulars on November 24.

Each day Debrief Publication

Begin daily with the highest information tales proper now, plus authentic options, a podcast, movies and extra.