Since November 21, Bitcoin (BTC) has hovered close to the $100,000 mark however hasn’t hit it, with BeInCrypto attributing this to elevated realized income.

Latest knowledge reveals that profit-taking exercise has slowed. What does this imply for Bitcoin’s worth?

Bitcoin Holders Step Again from Reserving Good points

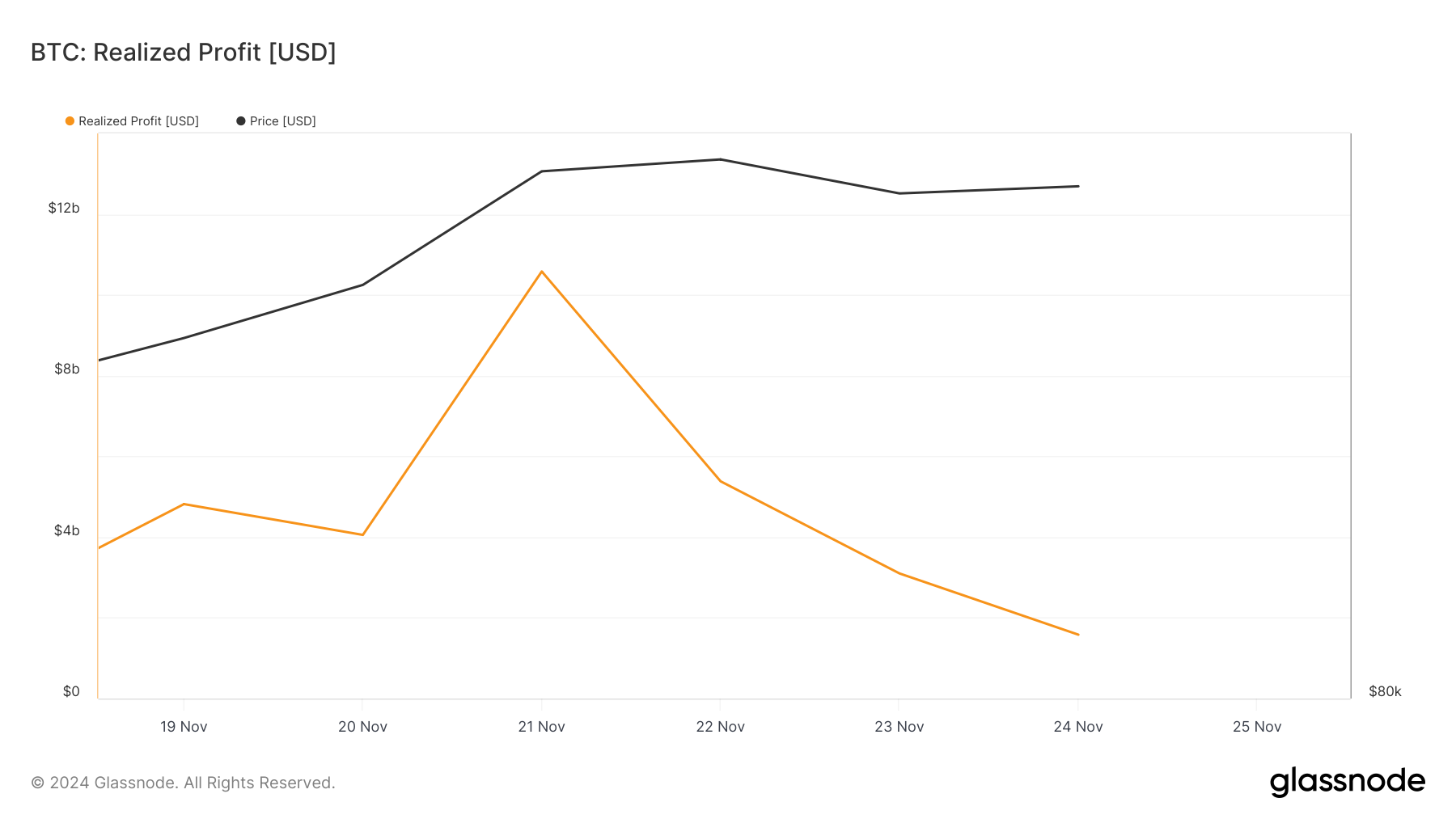

Knowledge from Glassnode reveals that Bitcoin realized income surged to $10.58 million on Thursday, November 21. Nonetheless, as of this writing, the worth has dropped to $1.58 million, a $9 million distinction.

Because the title implies, realized revenue is the worth of cash bought after their worth has elevated. Subsequently, when this metric rises, it turns into difficult for the cryptocurrency’s worth to proceed its rally.

Nonetheless, for the reason that realized revenue has dropped, most BTC holders have halted promoting in giant volumes. If this development continues, Bitcoin’s worth may bounce and doubtless rise to the $100,000 milestone.

This sentiment is additional supported by the Cash Holding Time metric, which tracks how lengthy a cryptocurrency has been held with out being transacted or bought.

When the Cash Holding Time decreases, it means holders of a specific crypto are promoting. If this continues, the development turns into bearish. Nonetheless, during the last seven days, BTC Cash Holding Time has elevated by 65%.

This increment reinforces the bias by the Bitcoin realized revenue that promoting stress has decreased. Apparently, IT Tech, an analyst on CryptoQuant, agrees with the thesis that Bitcoin would possibly proceed to climb.

“The inexperienced bars displaying STH promoting in revenue have but to achieve ranges seen in the course of the earlier $72,400 peak. This implies that profit-taking stress hasn’t peaked, leaving room for additional upward motion in worth,” IT Tech mentioned.

BTC Value Prediction: $102, 500 Appears Shut

On the day by day chart, BTC continues to commerce inside an ascending channel, suggesting that it has the potential to climb larger.

BeInCrypto additionally noticed that the Supetrend indicator has remained bullish. The Supertrend is a technical indicator used to identify the path by which an asset strikes.

If the crimson a part of the indicator is above the value, the development is downward, and the value can lower. Nonetheless, for the reason that inexperienced space is under the value, the worth would possibly rise above $99,780. If that have been the case, Bitcoin’s worth would possibly climb to $102,500.

Alternatively, if Bitcoin realized income surge once more, this may not occur. As a substitute, the worth may decline to $84,466.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.