Este artículo también está disponible en español.

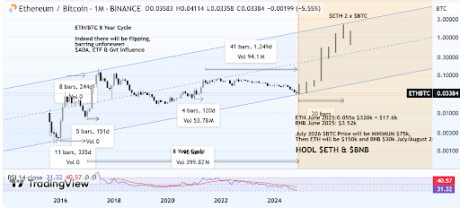

Current evaluation means that the Ethereum value could also be working on an 8-year cycle, diverging from Bitcoin’s established 4-year cycle. This could clarify the sheer underperformance of the Ethereum value in relation to the Bitcoin value for the reason that starting of the yr. Retaining this in thoughts, technical evaluation means that the Ethereum value nonetheless has an extended technique to go on this cycle, particularly if the Bitcoin value begins to bear a significant correction.

Understanding ETH/BTC’s 8-12 months Cycle

Technical evaluation of the ETH/BTC chart has identified an attention-grabbing cycle between each crypto heavyweights. Notably, the chart exhibits that the Ethereum value has been largely underperforming in opposition to the Bitcoin value for the previous few years, a development that has been additional exacerbated since July of this yr.

Associated Studying

In contrast to the Bitcoin value, which follows a well-documented 4-year cycle aligned with its halving occasions, the Ethereum value appears to chart a special path. Through the years, knowledge means that Ethereum is aligned with an 8-year cycle. This distinction explains why Ethereum and its ecosystem usually seem to lag behind Bitcoin throughout bull runs and bear markets. Curiously, this distinction has been very apparent within the present bull cycle, which has seen the Bitcoin value breaking into a number of new all-time highs whereas Ethereum continues to wrestle beneath $4,000.

Ethereum’s 8-year cycle signifies that because the Bitcoin value begins to succeed in a peak inside its personal cycle, Ethereum may very well be counterbalancing these actions. This performs into the notion of an altcoin season the place traders begin to take revenue on the Bitcoin value and begin investing within the altcoin market.

In response to an evaluation on the TradingView platform, the 4-year cycle of the Bitcoin value means that the main cryptocurrency would possibly plunge to the depth of its sinusodial path by 2026, in accordance with its Energy Legislation hall by 2026. However, this predicted Bitcoin value decline can be counteracted by a simultaneous Ethereum value surge that will push it to its highest level within the 8-year cycle by 2026.

Projected Peak For Ethereum Value In Mid-2026

Primarily based on the 8-year cycle principle, Ethereum’s value is anticipated to peak by mid-2026. This peak is anticipated to align with the trough of Bitcoin’s 4-year cycle, making a counterbalance between the 2 main cryptocurrencies. Throughout this era, Ethereum’s value is projected to climb to its highest ranges as Bitcoin enters a value correction section. Moreover, BNB is anticipated to behave as a stabilizing asset alongside Ethereum because the Bitcoin value declines.

Associated Studying

Value forecast means that the Ethereum value may attain $17,600 by June 2025, with BNB concurrently rising to $3,520. By July or August 2026, Ethereum is projected to succeed in $150,000, whereas BNB could climb to $30,000.

On the time of writing, Ethereum and BNB are buying and selling at $3,385 and $660, respectively. Bitcoin is buying and selling at $98,150.

Featured picture created with Dall.E, chart from Tradingview.com