The FCA, a British monetary authority, launched statements and a roadmap for finalizing complete crypto laws by 2026. The FCA’s operations on this sector will considerably improve within the first half of 2025.

The FCA acknowledged the rising recognition of the crypto {industry} in Britain, however its monitor report of earlier laws has earned widespread scorn.

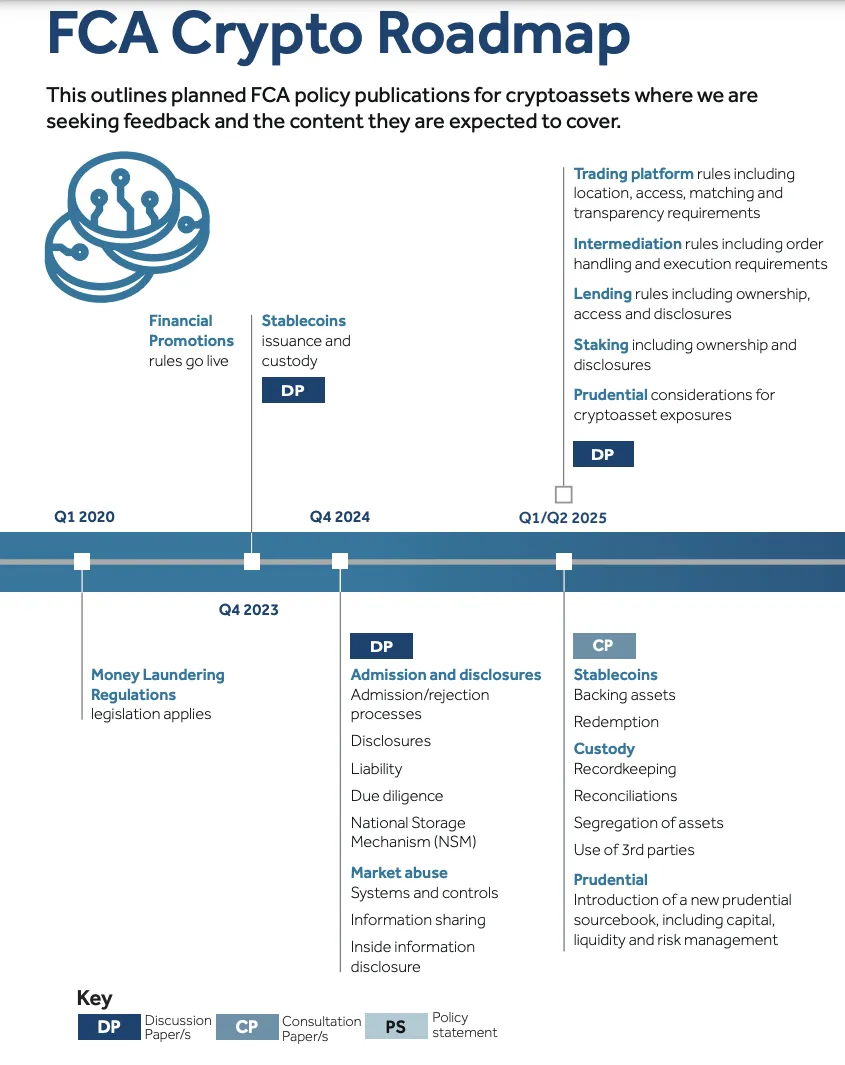

FCA Crypto Regulation Plans

The British Monetary Conduct Authority (FCA) introduced on Tuesday that it’s getting ready to finalize crypto regulation within the UK by Q1 2026. Focus areas embrace market abuse, buying and selling platforms, lending, and stablecoins.

The regulator additionally revealed a analysis exhibiting that crypto consciousness within the nation has elevated to 93%, whereas possession has risen to 12%. This means that extra UK adults at the moment are inquisitive about cryptocurrencies as an asset class or funding product.

Nevertheless, the FCA’s present regulatory insurance policies have already ruffled feathers within the {industry}. Final August, a survey of British crypto companies revealed rising skepticism to the FCA’s method. Earlier than his appointment to the place, FCA Chair Ashley Alder attacked the crypto sector, and he’s nonetheless employed within the function.

Nonetheless, the regulator has acknowledged the {industry}’s rising recognition. It claimed that 12% of British adults now personal digital belongings, and this quantity is rising.

Regulation is Nonetheless a Gray Space within the UK

In the newest Parliamentary election, the much less industry-friendly candidate gained. The Labour Social gathering has been recognized for its damaging stance towards crypto and favoritism in the direction of open banking.

Nonetheless, the shift within the US regulatory scene following Trump’s re-election appears to have influenced the UK’s resolution to re-think its insurance policies.

“Our analysis outcomes spotlight the necessity for clear regulation that helps a protected, aggressive, and sustainable crypto sector within the UK. We need to develop a sector that embraces innovation and is underpinned by market integrity and client belief,” claimed Matthew Lengthy, director of funds and digital belongings on the FCA.

In different phrases, these laws supply a number of hopeful prospects for customers and companies within the area. The FCA claimed that it consulted over 100 crypto organizations, together with exchanges, blockchain analytics companies, and different advocates.

A 2023 survey confirmed that 85% of exchanges fail present FCA requirements. The regulator could have to loosen them if it needs the British crypto sector to be aggressive.

Nevertheless, there are many bearish indicators that may’t be disregarded. Along with these {industry} professionals, the FCA additionally consulted varied regulators, together with the US SEC. Matthew Lengthy gave an interview with Bloomberg regarding these laws at this time, and his statements instantly mirror a pessimistic outlook:

“There aren’t any protections for investing in crypto. So, sadly, our message is ‘be ready to lose all of your cash,’ Lengthy claimed.

Total, crypto laws are nonetheless a gray space within the UK. The FCA beforehand launched strict guidelines in opposition to crypto promoting within the nation. This led to many main exchanges, equivalent to Binance, considerably lowering their operations within the nation.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.