Este artículo también está disponible en español.

The crypto market witnessed a big milestone final week as funding merchandise recorded roughly $3.13 billion in web inflows globally, primarily pushed by US spot Bitcoin exchange-traded funds (ETFs), in line with information from CoinShares.

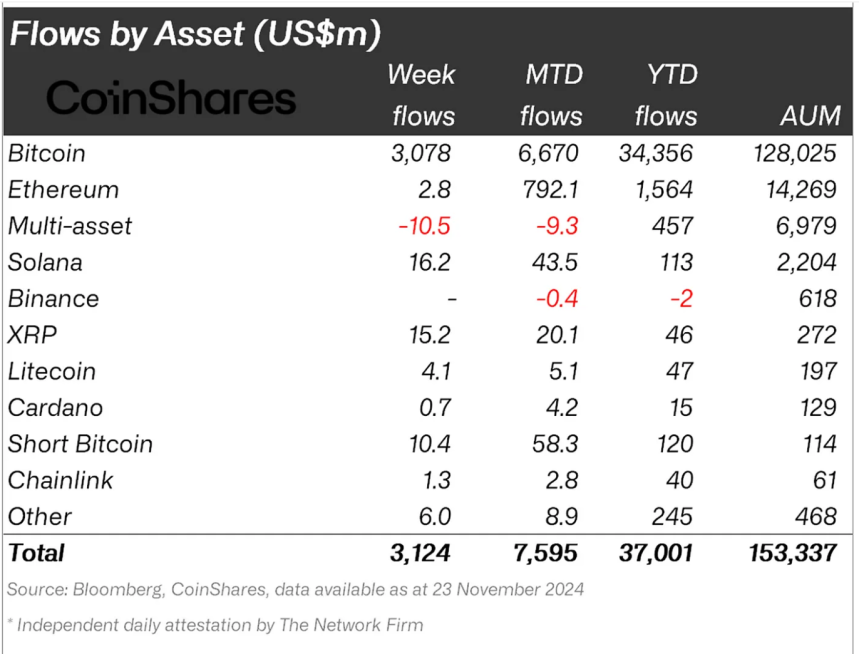

This surge highlights rising institutional curiosity and confidence within the crypto market, with Bitcoin main the cost. CoinShares reveals that the year-to-date web inflows into crypto funds have reached $37 billion, whereas whole belongings below administration (AUM) soared to a brand new excessive of $153 billion.

Associated Studying

Bitcoin Takes The Lead, Altcoins Present Progress

The latest inflows mark the seventh consecutive week of optimistic actions for international crypto funding merchandise managed by main corporations similar to BlackRock, Constancy, Grayscale, and ProShares.

A considerable portion of final week’s inflows, roughly $2.05 billion, originated from BlackRock’s IBIT product, underlining the dominance of US-based funds within the international house. These inflows outpaced the first-year debut of US gold ETFs, which attracted solely $309 million.

Bitcoin-based funds have been on the forefront of the inflows, contributing $3 billion of the weekly whole. This influx coincided with Bitcoin’s continued worth rally, drawing extra curiosity from institutional and retail traders.

Nevertheless, the upper costs additionally spurred a notable $10 million influx into short-Bitcoin merchandise, bringing the month-to-month determine for these merchandise to $58 million — the very best since August 2022.

Whereas Bitcoin dominated, altcoins additionally attracted vital funding. Solana emerged because the second-most common asset amongst institutional traders, with web weekly inflows of $16 million, surpassing Ethereum’s $2.8 million.

Different altcoin-based funds additionally noticed notable inflows, with XRP, Litecoin, and Chainlink attracting $15 million, $4.1 million, and $1.3 million, respectively. These inflows counsel rising confidence within the broader altcoin market, pushed by worth rallies and rising adoption.

World Crypto Inflows And Regional Tendencies

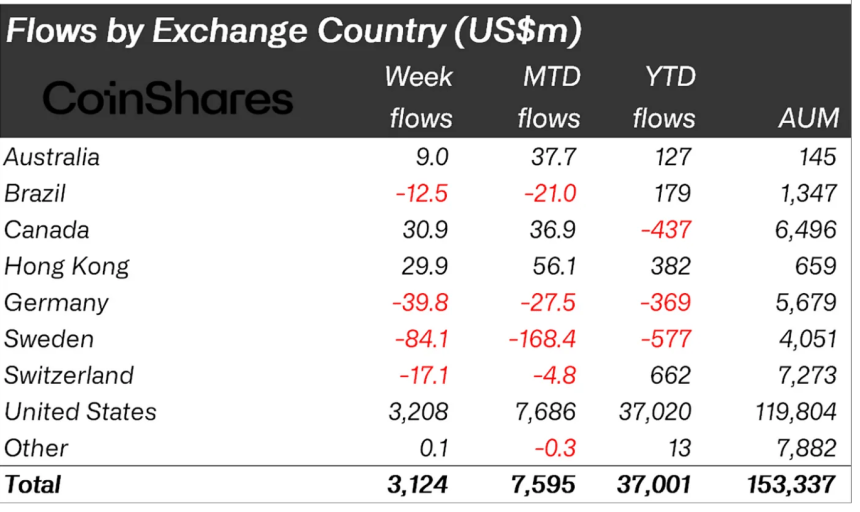

US-based funds’ dominance was evident in regional fund flows, accounting for $3.2 billion in web weekly inflows.

Nevertheless, this was barely “offset” by outflows from European markets, together with $84 million, $40 million, and $17 million from crypto funding merchandise in Sweden, Germany, and Switzerland, respectively.

Regardless of these regional outflows, the general pattern stays bullish, pushed largely by institutional participation within the US market.

Notably, CoinShares’s steady inflows mirror a mix of things, together with the market’s optimistic sentiment concerning the bull run and the rising acceptance of crypto as a legit asset class.

Associated Studying

The launch of spot Bitcoin ETFs has been a pivotal growth. It gives institutional traders with a regulated avenue to realize publicity to digital belongings.

In consequence, the cryptocurrency market is witnessing a shift towards mainstream adoption, additional supported by robust worth efficiency and constant inflows throughout varied funding merchandise.

Featured picture created with DALL-E, Chart from TradingView