Low-income households in america are turning crypto earnings into alternatives for homeownership, as revealed by a Nov. 26 report from the Workplace of Monetary Analysis (OFR), a US Treasury Division analysis arm.

Samuel Hughes, Francisco Ilabaca, Jacob Lockwood, and Kevin Zhao performed the examine primarily based on tax information. It gives an important have a look at how crypto is shaping monetary behaviors in economically susceptible communities.

Mortgage and auto-debts

The report famous the rise of “high-crypto” areas, outlined as zip codes the place over 6% of households reported crypto holdings in tax filings. These areas have seen a big uptick in mortgage and auto mortgage exercise, coinciding with substantial crypto market beneficial properties.

In these high-crypto areas, low-income households skilled a surge in mortgage exercise between 2020 and 2024. The variety of shoppers with mortgages grew by greater than 250%, whereas common mortgage balances jumped from $172,000 in 2020 to $443,000 in 2024, a rise of over 150%.

These figures counsel that crypto windfalls have enabled many households to safe bigger loans and enter the housing market.

The report said:

“For low-income households, common mortgage debt balances and mortgage-holding charges sharply elevated in zip codes with excessive crypto publicity. This means that low-income households could also be utilizing crypto beneficial properties to take out new mortgages and to take out bigger mortgages.”

The report additionally sheds mild on auto mortgage developments in these areas. Amongst low-income households, auto mortgage balances rose most sharply in high-crypto areas. Apparently, whereas delinquency charges elevated in low- and mid-crypto zip codes, they declined in high-crypto areas. This sample means that crypto earnings could also be serving to some households handle auto mortgage funds extra successfully.

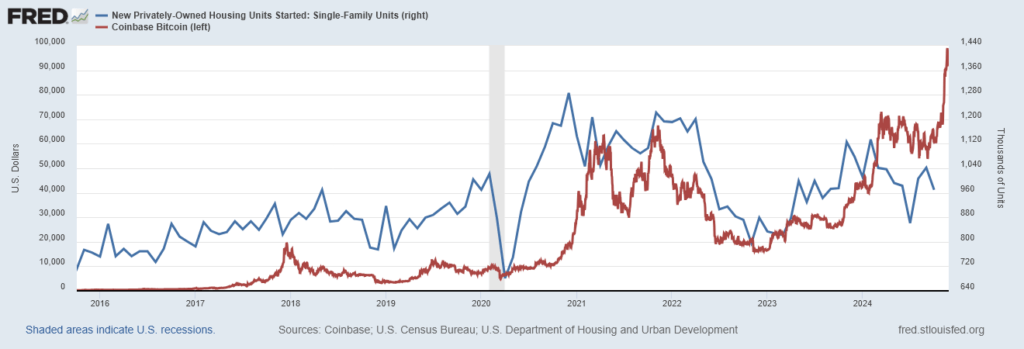

Because the 2008 banking disaster, which led to widespread defaults, single-family dwelling possession has by no means recovered. Nevertheless, since Bitcoin’s inception in 2009 figures have continued to rise. Whereas the correlation just isn’t indicative of causation, it’s attention-grabbing to notice that the 2021 bull run and subsequent bear market of 2022 additionally noticed will increase and declines in new single-family properties.

Dangers

Regardless of these optimistic developments, the researchers warn of potential dangers tied to rising debt and leverage amongst low-income households with vital crypto publicity.

Whereas delinquencies stay low general, financial downturns or a stoop within the crypto market may result in monetary instability. The focus of publicity in systemically essential establishments may amplify these dangers.

The researchers concluded:

“An essential takeaway for future monitoring is the elevated debt balances and leverage amongst low-income households with crypto publicity. Rising misery on this group may trigger future monetary stress, particularly if publicity to most of these high-leverage, high-risk shoppers is concentrated in systemically essential establishments.”