Lengthy-term Bitcoin (BTC) holders have began taking income for the reason that cryptocurrency worth tried to succeed in $100,000. Consequently, Bitcoin’s worth has retraced to $93,000, affecting the worth of the broader crypto market capitalization.

Is Bitcoin’s worth rebounding? Brief-term traders could wish to know as this on-chain evaluation examines the probabilities.

Exercise Round Bitcoin Drops, Holders E-book Features

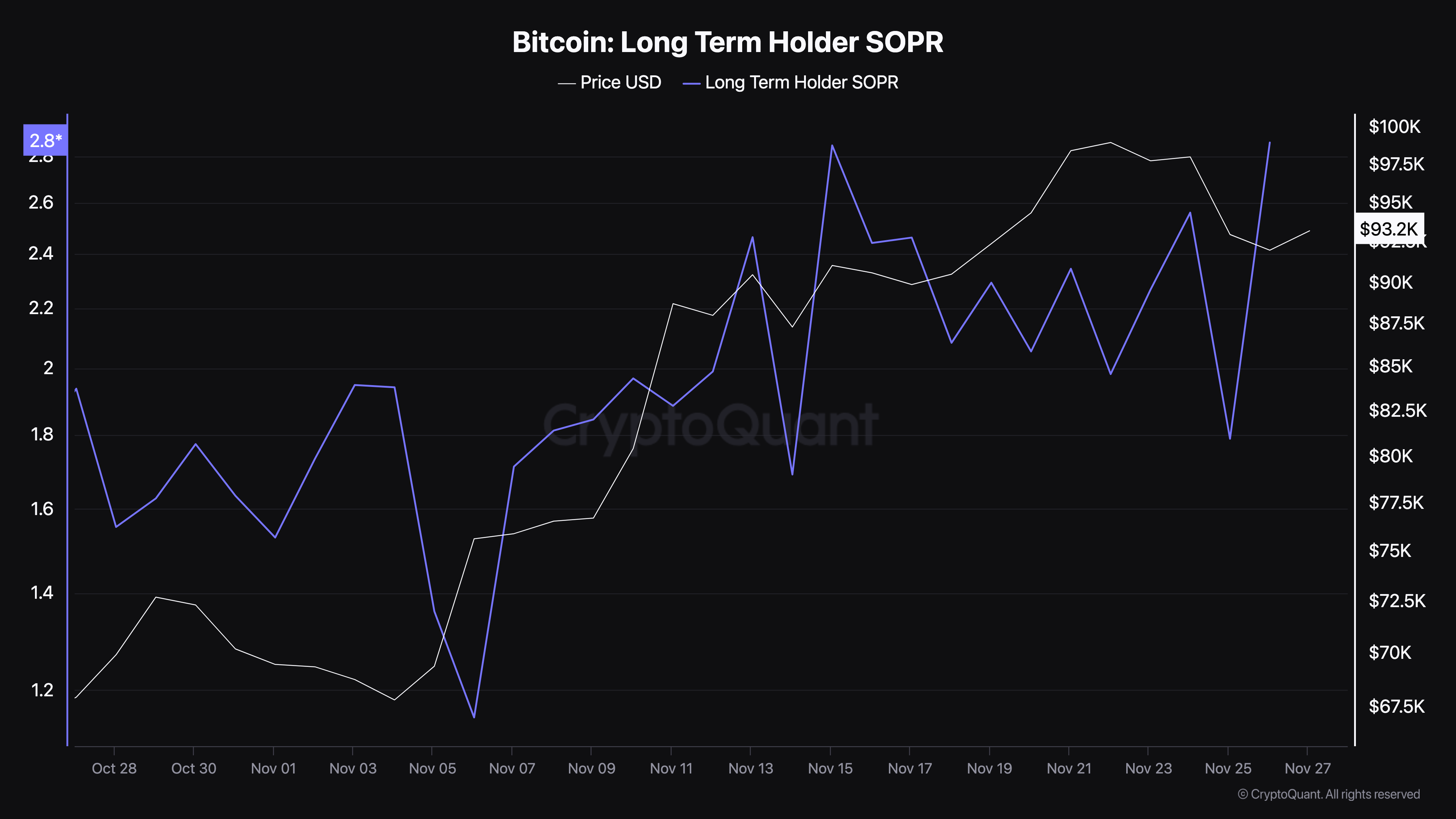

In response to CryptoQuant, Bitcoin’s long-term revenue output ratio has surged to 2.86. This ratio measures the exercise of long-term traders who’ve held the coin for greater than 155 days.

When the ratio is over 1, it signifies that these long-term Bitcoin holders are promoting at a revenue. Alternatively, if the revenue output ratio is lower than 1, it implies that holders are promoting at a loss. Because the studying is greater, it signifies that these holders are reserving income from the latest worth hike.

Apart from that, it’s noteworthy to say that this profit-taking is the very best holders have taken since August 30. Ought to this proceed, then BTC worth dangers falling beneath the $93,000 threshold.

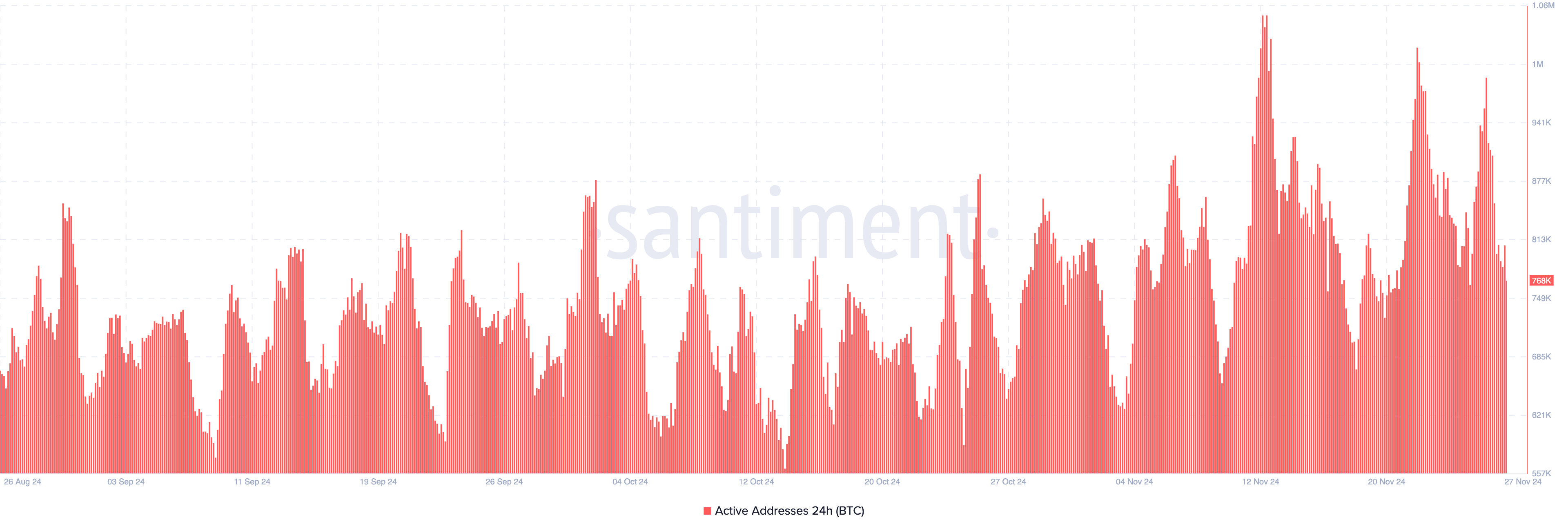

Past that, energetic addresses on the Bitcoin community have considerably decreased this week, which might spell bother for the cryptocurrency’s worth if the pattern persists. Lively addresses measure the variety of distinctive addresses concerned in transactions, reflecting person engagement with the blockchain.

When energetic addresses improve, it signifies rising community exercise and adoption. Conversely, a decline suggests decreased participation.

On November 26, Bitcoin’s energetic addresses have been almost 1 million, showcasing important traction. Nevertheless, as of this writing, the determine has dropped to 768,000, a noticeable decline. If energetic tackle exercise continues to wane, it might sign weakened market sentiment and will contribute to additional worth declines, as beforehand highlighted.

BTC Value Prediction: Time to Go Under $90,000?

On the each day chart, Bitcoin’s worth has fallen beneath the dotted strains of the Parabolic Cease and Reverse (SAR) indicator. This technical device identifies help and resistance ranges.

Dotted strains beneath the worth sign sturdy help, whereas strains above the worth counsel resistance that might result in a decline. Presently, Bitcoin faces the latter situation.

If this resistance persists, BTC might drop to $84,640. Nevertheless, if long-term holders scale back profit-taking, Bitcoin’s worth would possibly rise as a substitute, doubtlessly reaching $99,811.

Disclaimer

According to the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.