Stellar (XLM), which surged over 100% up to now week, has now witnessed a pointy decline in Open Curiosity. This drop in XLM Open Curiosity signifies waning enthusiasm amongst derivatives merchants, probably indicating a weakening within the latest rally’s momentum.

Though holders could stay optimistic, on-chain evaluation means that XLM’s worth might face a big correction if the present market situation doesn’t change.

Stellar Market Dominance Fizzles

On November 24, XLM Open Curiosity climbed above $339 million, which was an all-time excessive. As reported earlier, this large curiosity within the altcoin is linked to the surge in Ripple (XRP) worth.

Nevertheless, as of this writing, the OI, as it’s generally abbreviated, has fallen to $209 million. This drop signifies that merchants have closed beforehand open contracts price $130 million. Unsurprisingly, this decline coincided with XLM’s worth lower, which precipitated it to lose 10% of its worth within the final 24 hours.

From a worth perspective, the drop in OI means shopping for strain within the derivatives market has decreased. Therefore, if the OI worth continues to say no, then XLM’s worth is prone to fall beneath $0.45.

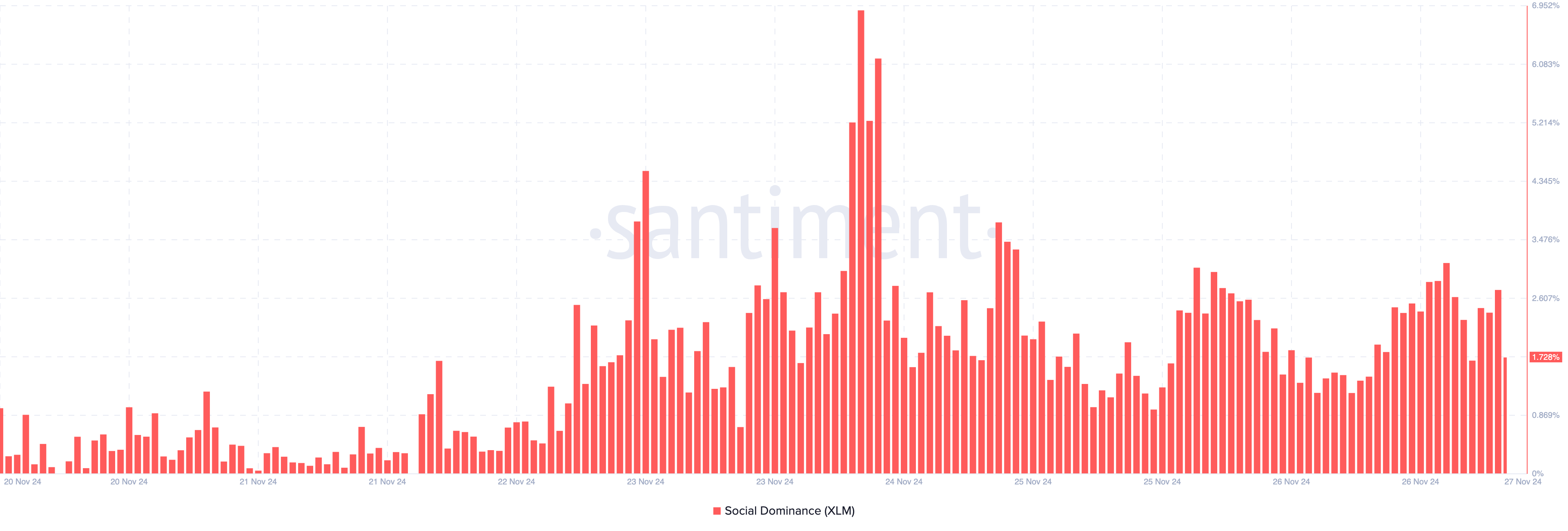

One other bearish sign for Stellar is its declining social dominance. This metric evaluates the proportion of discussions a few cryptocurrency in comparison with the highest 100 belongings. When social dominance rises, it sometimes signifies heightened market curiosity and demand. Conversely, a decline suggests diminishing consideration and probably decrease demand.

Just a few days in the past, XLM’s social dominance was at 3.13%. Nevertheless, it has dropped considerably to 1.73%, implying that market contributors are shifting their focus to different belongings. If this development persists, it might result in additional worth drops for XLM.

XLM Worth Prediction: Push Again to $0.28 Probably

If the declining OI and social dominance proceed, XLM could battle to maintain its latest good points. On the every day chart, the Cash Circulation Index (MFI) studying has dropped. The MFI measures shopping for and promoting strain and tells if an asset is overbought or oversold.

When the studying is above 80.00, it’s overbought. However when it’s beneath 20.00, it’s oversold. As seen beneath, the MFI hit the overbought zone earlier earlier than it retraced. Contemplating the present situation, XLM’s worth might decline to $0.28.

Nevertheless, a break beneath the $0.22 assist stage might push the value all the way down to $0.17. On the flip aspect, if shopping for strain will increase within the derivatives and spot market, this may not occur. As a substitute, XLM might rally to $0.64.

Disclaimer

In keeping with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.