Este artículo también está disponible en español.

Virtually 4 years in the past to the day, Bitcoin skilled a dramatic 17% plunge from $19,500 to $16,200 in 2020, an occasion that grew to become infamously generally known as the “Thanksgiving Day Bloodbath.” As the vacation approaches as soon as once more, market members are questioning whether or not historical past may repeat itself.

On Monday and Tuesday, Bitcoin’s worth underwent an 8% correction, dropping from $98,871 to a low of $90,791. This sudden downturn has sparked discussions amongst analysts if historical past might be repeating for the BTC worth.

Bitcoin ‘Thanksgiving Day Bloodbath’ 2024?

Alex Thorn, Head of Analysis at Galaxy Digital, took to X to attract parallels between the present market and the occasions of 2020. “Who remembers the Thanksgiving dump of 2020? Bitcoin dumped 17% between Wednesday, Nov 25, and Friday, Nov 27, 2020. BTCUSD later went on to greater than 3x over the following 5 months. Does historical past rhyme?”

A possible catalyst for the crash might be the worldwide M2 cash provide. At the moment, a chart illustrating the correlation between Bitcoin and world M2 is circulating on X.

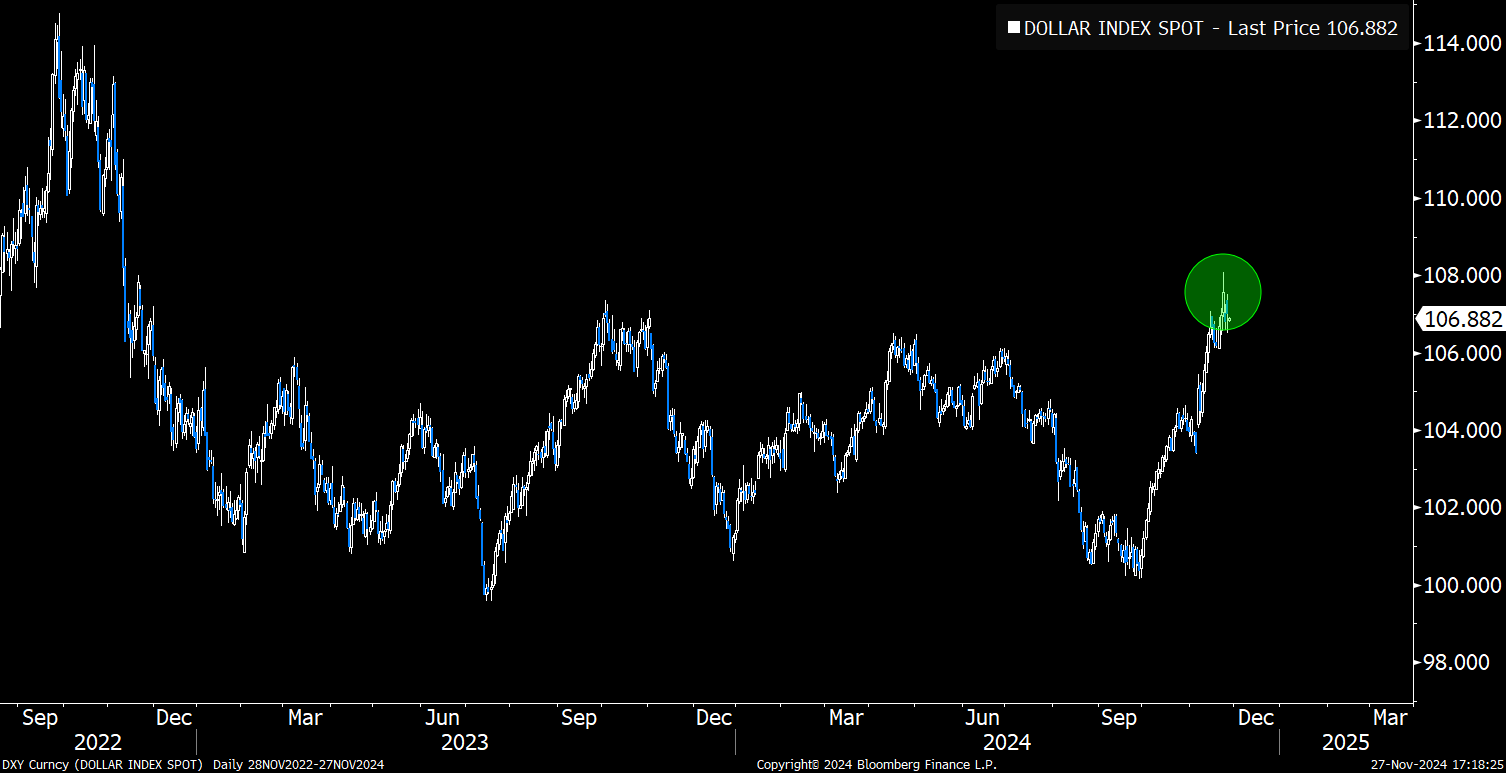

Joe Consorti, an analyst at Theya, noticed that since September 2023, “Bitcoin has intently tracked world M2 with a ~70-day lag.” Over the previous two months, world M2 has declined from $108.3 trillion to $104.7 trillion, pushed by elements equivalent to a strengthening US greenback—devaluing overseas currency-denominated M2 when transformed into {dollars}—and financial slowdowns dampening lending and deposit creation.

Associated Studying

Consorti cautions, “If it continues to comply with the present contraction in M2, a 20-25% correction might materialize, probably pulling bitcoin right down to roughly $73,000—not a worth prediction, however a stark reminder of Bitcoin’s tether to the worldwide cash provide.” Nonetheless, he additionally acknowledged that Bitcoin may defy this pattern, because it has previously, significantly “from 2022-2023 as a result of FTX collapse and curiosity within the area evaporating in consequence.”

He means that structural ETF inflows and company shopping for strain might assist Bitcoin resist the present M2 deflation. Consorti concludes, “Both approach, a correction at this level appears about proper. As talked about earlier than, these fast run-ups in Bitcoin’s worth all the time have pitstops alongside the best way, […] it’s very important to know the asset you maintain, the macro surroundings it exists in, and the forces driving it greater long-term. In the event you really perceive bitcoin, you don’t panic promote.”

Associated Studying

Regardless of the cautious outlook, some analysts imagine the dip could also be short-lived. Jamie Coutts, Chief Crypto Analyst at Actual Imaginative and prescient, factors out by way of X that “a Bitcoin bid has overshadowed tightening liquidity over the previous month.” Whereas acknowledging that Bitcoin seems “overstretched vs. world M2” and that his liquidity mannequin instructed warning, particularly with leverage, Coutts highlights potential coverage shifts that might favor threat belongings.

He references insights from economist Andreas Steno, indicating that the Federal Reserve is “in impact, discussing a put for USD liquidity—modifications to assist liquidity developments as early as December.” Coutts concludes: “DXY might have topped right here. The lag impact that Fintwit is concentrated on atm continues to be actual, however in the end, the Fed is waving the bull flag for threat belongings once more. Bullish 2025. Bullish BTC.”

At press time, BTC traded at $93,250.

Featured picture created with DALL.E, chart from TradingView.com