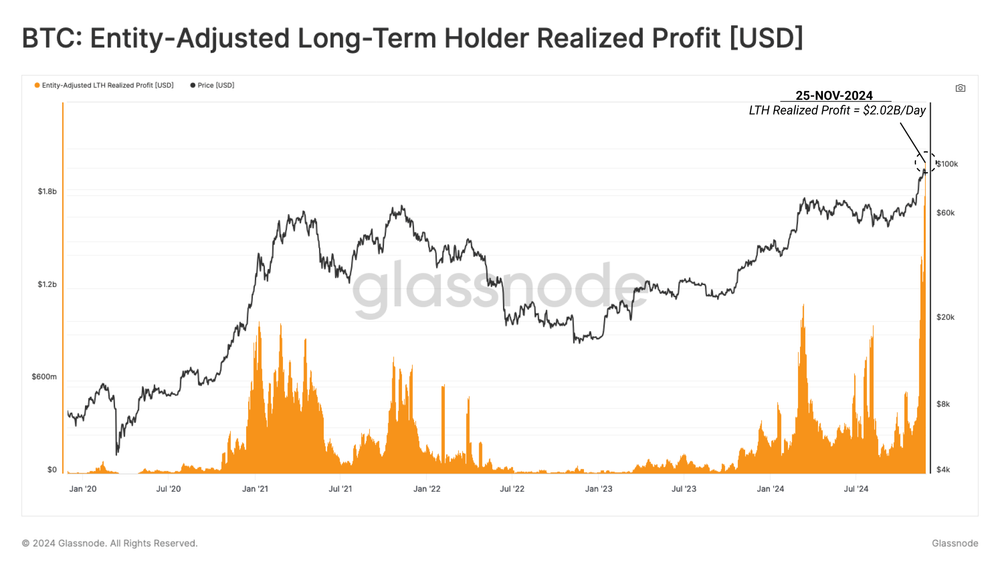

Lengthy-term Bitcoin holders have realized $2.02 billion in every day earnings, an unprecedented determine that highlights the depth of profit-taking exercise as the value of Bitcoin neared the $100,000 mark earlier this month.

In keeping with a Glassnode report, the figures surpasses a earlier file seen again in March of this 12 months and a “sturdy demand facet is required to totally take in this provide overhand, which can require a interval of re-accumulation to totally digest.”

Since September, long-term holders have offloaded greater than 507,000 BTC, with information suggesting that the majority long-term holder cash transcting are “more likely to have been acquired comparatively lately,” that means they’re “extra more likely to be 6 months outdated than 5 years outdated on common.”

The realized revenue information reveals a range of methods amongst Bitcoin holders. Buyers with modest share good points accounted for $10.1 billion in earnings throughout the 0%-20% vary, whereas high-return holders—these incomes over 300%—generated $10.7 billion.

These developments recommend contributors with decrease price bases promote smaller portions of Bitcoin however obtain comparable revenue volumes in greenback phrases. The report additionally highlights an aggressive promoting part, with the present price of LTH spending exceeding that of the March 2024 all-time excessive.

As CryptoGlobe reported, Bitcoin’s bull run this 12 months has seen on-chain exercise surge together with the flagship cryptocurrency’s worth, to the purpose the variety of every day lively addresses is now nearing 1 million after its first extended improve in three years.

In keeping with information from on-chain analytics agency IntoTheBlock, Bitcoin’s long-term exercise development has “decisively shifted” as on-chain exercise is seeing “important progress” amid BTC’s worth rise.

It’s price including {that a} every day lively tackle doesn’t essentially imply a every day lively person, as anybody can create as many Bitcoin addresses as they wish to, and specialists usually advocate the usage of varied addresses for privateness and safety functions.

The determine doubtless doesn’t signify a million lively customers, however it’s price noting that many use BTC inside cryptocurrency exchanges, whose addresses usually bundle the funds of assorted customers and find yourself representing the belongings of quite a few customers somewhat than these of a single entity.

On high of that, many spend money on cryptocurrency and retailer their funds in chilly pockets options that aren’t touched for years as long-term holders favor these options for the added advantages to safety.

Featured picture by way of Unsplash.