BNB Value is simply 10% away from its earlier all-time excessive, surging 181.79% this 12 months because it continues to show robust market efficiency. Nevertheless, latest indicators, together with the ADX and Ichimoku Cloud, recommend that the present uptrend could also be dropping steam.

Whereas the bullish construction stays intact, with key resistances inside attain, momentum might want to strengthen for BNB to interrupt its earlier all-time excessive.

BNB Present Uptrend May Not Final

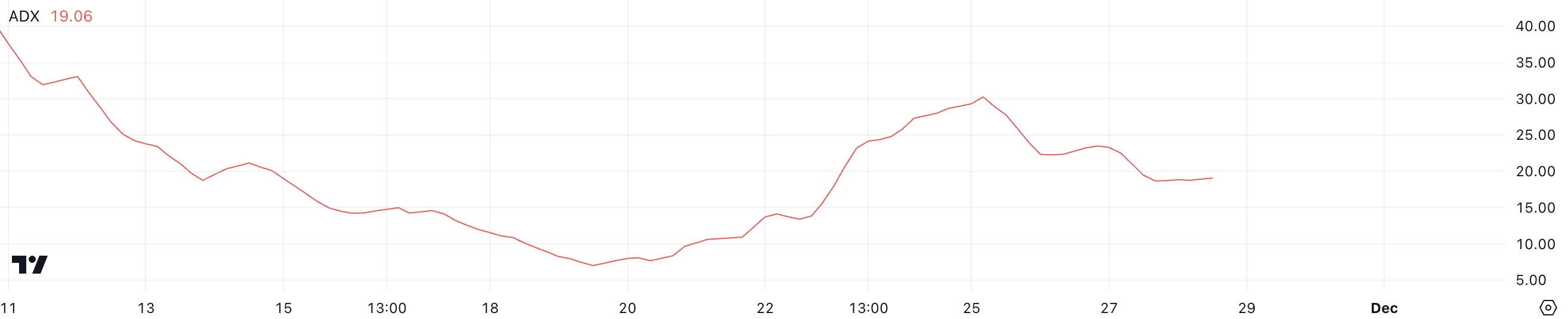

BNB ADX is at present at 19, down from over 30 simply two days in the past, signaling a weakening pattern. The ADX, or Common Directional Index, measures the energy of a pattern on a scale from 0 to 100 with out indicating its route.

Values above 25 recommend a powerful pattern, whereas values under 20 point out a weak or no pattern. The decline in ADX means that whereas BNB worth stays in an uptrend, the momentum driving it has considerably weakened.

With the ADX at 19, BNB present uptrend seems to lack the energy seen in latest days, indicating a possible section of consolidation or diminished shopping for stress.

For the uptrend to regain energy, the ADX would wish to rise above 25, confirming renewed momentum. Till then, BNB’s worth might transfer sideways or face elevated resistance in sustaining its bullish trajectory.

BNB Ichimoku Cloud Exhibits Blended Indicators

The Ichimoku Cloud chart for BNB at present exhibits a blended pattern. The worth is barely above the Kijun-Sen (orange line) and Tenkan-Sen (blue line), signaling some bullish momentum.

Nevertheless, the worth hovers close to the sting of the cloud (Senkou Span A and B), indicating the pattern just isn’t decisively robust but. The inexperienced cloud forward suggests some mid-term assist, however its comparatively flat nature alerts restricted momentum in both route.

For BNB worth to regain robust bullish momentum, it wants to interrupt additional above the Kijun-Sen and away from the cloud’s edge. If it fails to take action and drops again under the cloud, it may sign the start of a bearish pattern.

Conversely, sustaining its place above the cloud and seeing the Tenkan-Sen rise above the Kijun-Sen may reinforce a stronger uptrend.

BNB Value Prediction: Will BNB Rise Extra Than 10% And Attain A New All-Time Excessive?

BNB’s EMA traces at present show a bullish setup, with short-term EMAs positioned above long-term ones. This alignment suggests the uptrend stays intact for now, and if BNB worth regains momentum, it may break key resistances at $667 and $687.

A profitable breakout at these ranges may propel the worth towards its earlier all-time excessive of $719.84 and probably set new information. The EMAs proceed to assist bullish sentiment so long as the worth stays above them.

Nevertheless, indicators just like the ADX and Ichimoku Cloud recommend that the uptrend could also be dropping energy. If a downtrend emerges, BNB worth may retest vital assist ranges at $603 and even $593.

A drop under these helps may sign a deeper correction, undermining the present bullish construction.

Disclaimer

In keeping with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.