Helium (HNT) value is up roughly 150% this 12 months and its market capitalization lately reached the $1 billion market cap. The Chaikin Cash Stream (CMF) has turned optimistic at 0.15, signaling robust shopping for strain and supporting current value beneficial properties.

If the golden cross types as EMA traces recommend, HNT might check resistances at $6.5 and $7.2, however a reversal may result in assist ranges at $6 or as little as $5.28.

HNT CMF Is Now Optimistic

HNT CMF has surged to 0.15 from -0.06 in simply someday, signaling a major shift towards optimistic shopping for strain. The CMF, or Chaikin Cash Stream, measures the stream of capital into or out of an asset over a particular interval, with values above 0 indicating internet inflows (shopping for dominance) and values beneath 0 reflecting internet outflows (promoting strain).

This sharp rise highlights rising confidence amongst patrons, supporting HNT’s current 5% value enhance.

A CMF of 0.15 signifies robust bullish sentiment, suggesting that the present uptrend has stable backing from capital inflows. If the CMF continues rising, it might sign additional upward momentum for HNT, doubtlessly leading to further value beneficial properties.

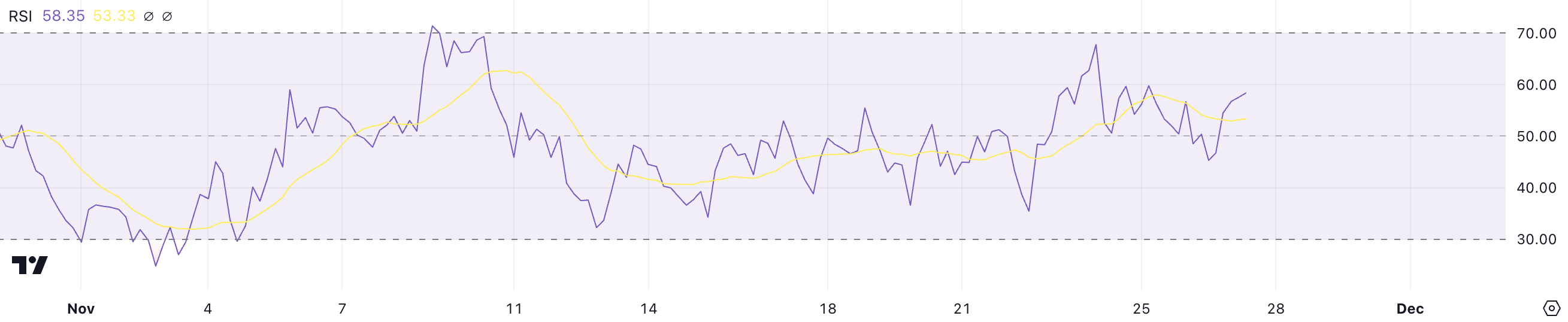

Helium RSI Exhibits Potential For Extra Worth Improve

Helium RSI has climbed to 58 from 46 in simply someday, reflecting rising bullish momentum. The RSI, or Relative Power Index, measures the velocity and magnitude of value modifications on a scale from 0 to 100.

Values above 70 sign overbought situations and a possible for a correction, whereas values beneath 30 point out oversold ranges, typically resulting in a rebound. An RSI of 58 means that HNT is in a wholesome uptrend with out approaching overbought territory but.

With the RSI nonetheless effectively beneath 70, HNT’s present uptrend has room to proceed earlier than hitting overbought ranges. This leaves area for additional value development as shopping for momentum builds.

If the RSI continues its upward development, HNT value might see further beneficial properties within the brief time period, supported by its present bullish sentiment.

HNT Worth Prediction: Can HNT Attain $7 Quickly?

HNT EMA traces present the potential formation of a golden cross, the place a short-term EMA crosses above a long-term EMA. This sample is a bullish sign, typically indicating the beginning of a sustained uptrend.

If the golden cross types and momentum continues, Helium value might break by means of the $6.5 resistance degree and doubtlessly climb to $7.2, reinforcing its bullish trajectory and the current $1 billion market cap milestone. This may additionally reinforce HNT within the high 10 rating amongst DePIN (Decentralized Bodily Infrastructure) cash.

Nonetheless, if the present uptrend weakens and reverses, HNT value could face essential assist ranges.

The value might first check $6, and if that fails, it’d drop to $5.57 and even $5.28.

Disclaimer

In keeping with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.