Metaplanet, a Japanese funding agency, has introduced plans to boost $62 million by issuing inventory acquisition rights to EVO Fund. The raised funds will likely be allotted to purchasing extra Bitcoin for its treasury administration.

The corporate careworn that it’ll proceed to keep up a Bitcoin-first technique.

Metaplanet outlined its technique in a press launch, confirming the issuance of its twelfth collection of Inventory Acquisition Rights. Beginning Dec. 16, 2024, the agency will allocate 29,000 models by way of a third-party allotment.

Every unit provides EVO Fund the best to buy 100 widespread shares, priced at 614 yen per unit, amounting to a complete of 17,806,000 yen.

“We’re prioritizing a Bitcoin-first, Bitcoin-only strategy to treasury administration. Now we have made it clear that we intend to make the most of debt and periodic inventory issuance to systematically enhance our Bitcoin holdings whereas decreasing publicity to a depreciating yen,” Metaplanet acknowledged within the press launch.

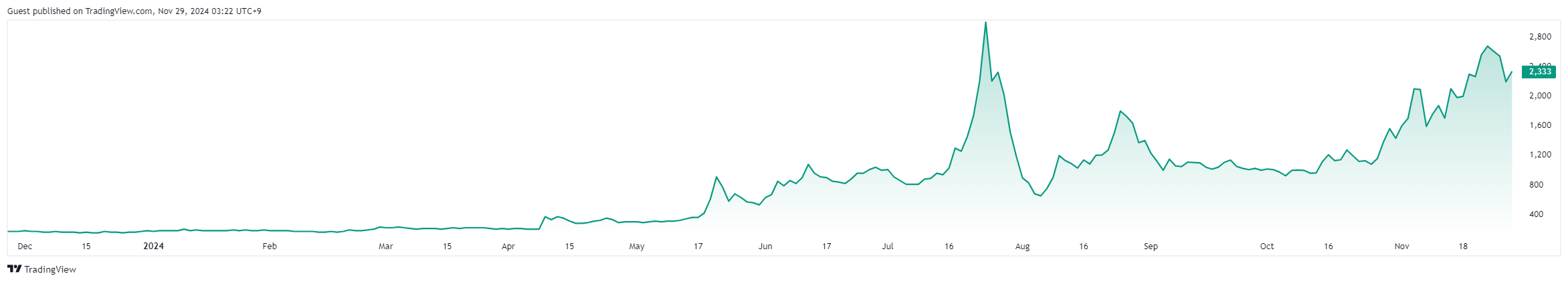

All through this yr, Metaplanet has been actively leveraging inventory acquisition rights to extend its Bitcoin holdings.

In October, the agency concluded its eleventh issuance, elevating 10 billion yen ($66 million), with a good portion allotted to additional Bitcoin purchases. The corporate’s shares surged over 1,000% in 2024.

Public Companies Proceed to Purchase Extra BTC

Publicly traded firms are more and more investing in Bitcoin. Yesterday, Chinese language public firm SOS Restricted additionally purchased $50 million price of BTC. Following the information, its inventory worth surged over 100%.

Additionally, MicroStrategy not too long ago acquired one other $5.4 billion price of BTC. This was its third spherical of Bitcoin buy in November alone. The corporate has spent over $16 billion on Bitcoin this yr, sustaining its standing as the most important institutional Bitcoin holder.

Just like different companies, MircoStrategy’s inventory efficiency has mirrored Bitcoin’s surge. Its shares have climbed 450% year-to-date, putting it among the many high 100 US public firms.

Different companies are additionally ramping up Bitcoin investments. Marathon Digital not too long ago raised $1 billion by way of a convertible senior notes providing, earmarking the vast majority of the funds for Bitcoin acquisitions.

Bitcoin’s worth efficiency continues to gasoline optimism. Regardless of reaching $99,000 within the present cycle, public companies stay assured in Bitcoin’s long-term potential.

The truth is, Pantera Capital not too long ago projected that Bitcoin might hit $740,000 by 2028, reinforcing the bullish sentiment throughout the business.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.