Ripple (XRP) has surged 181.38% previously 30 days, demonstrating robust market momentum. After reaching $1.63, XRP is now consolidating, with its RSI at a impartial 53.2, signaling balanced market circumstances.

If bullish momentum builds, XRP might retest $1.63 and climb towards $1.70, its highest degree since 2018. Nonetheless, a downtrend would possibly push the worth right down to $1.27 and even $1.05.

XRP Is Presently In A Impartial Zone

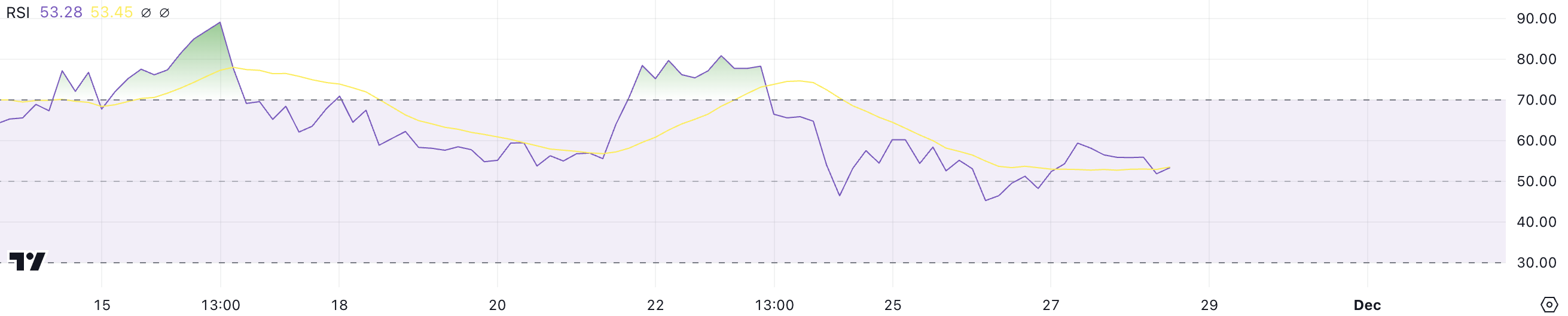

XRP RSI presently sits at 53.2, reflecting a impartial momentum after the latest value surge. The RSI, or Relative Energy Index, measures the pace and magnitude of value modifications on a scale from 0 to 100.

Values above 70 point out overbought circumstances, typically signaling a possible pullback, whereas values under 30 counsel oversold ranges, hinting at restoration potential. XRP RSI was above 70 between November 21 and 23, throughout its rally to $1.63, highlighting the overbought state at that peak.

At 53.2, XRP’s RSI signifies a cooling of bullish momentum however doesn’t sign a reversal but. This impartial degree means that the coin is consolidating after its latest beneficial properties, leaving room for additional upward motion if shopping for strain returns.

Nonetheless, if the RSI traits decrease, it might point out weakening sentiment, probably resulting in a pullback.

Ripple CMF Turned Adverse

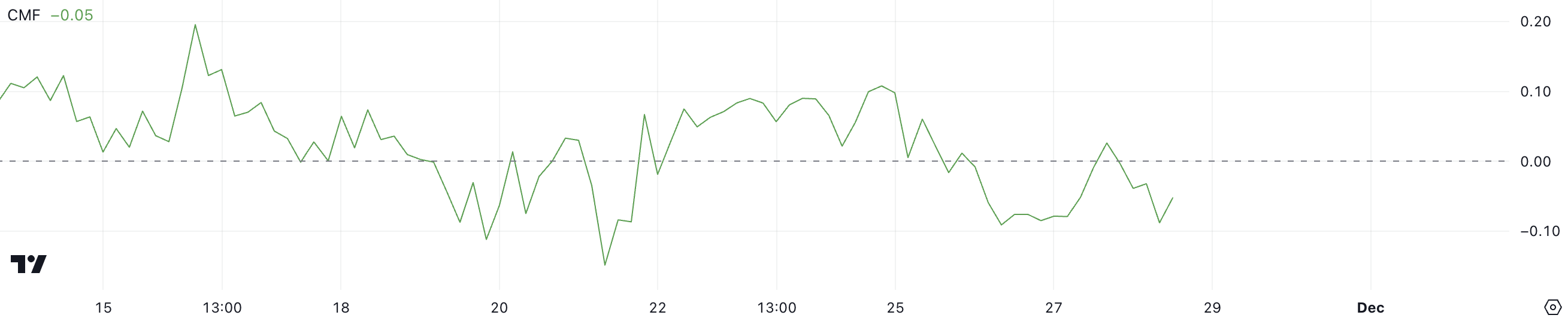

Ripple CMF is presently at -0.05, down from 0.10 when its value peaked at $1.63 per week in the past, reflecting lowered capital inflows. The CMF, or Chaikin Cash Stream, measures the volume-weighted circulation of capital into or out of an asset, with constructive values indicating shopping for strain and unfavourable values suggesting promoting dominance.

The drop to unfavourable territory indicators that promoting strain is beginning to outweigh shopping for exercise, though not but considerably.

At -0.05, XRP’s CMF signifies slight bearish sentiment however stays above the -0.15 degree seen on November 21. This means that whereas promoting strain is growing, it isn’t as intense as throughout earlier corrections.

If the CMF traits additional downward, it might sign extra promoting and a possible XRP value decline.

Ripple Value Prediction: Can It Go Again to 2018 Ranges?

XRP EMA strains stay bullish, with short-term strains positioned above long-term ones, signaling an ongoing uptrend. Nonetheless, the narrowing hole between the strains suggests weakening bullish momentum, indicating a potential development reversal.

If a downtrend emerges, Ripple value might take a look at the robust help at $1.27. If that degree fails to carry, the worth might drop additional to $1.05, reflecting a extra important correction.

However, if shopping for strain strengthens and a brand new uptrend varieties, XRP value might retest its latest excessive of $1.63. Breaking this degree might push the worth to $1.70, marking its highest worth since 2018.

Disclaimer

According to the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.